Vietnam’s stock market experienced a turbulent trading session, with a wave of selling pressure at the end of the day causing numerous stock groups to plummet, dragging the index down significantly. The VN30 group saw 28 out of 30 stocks decline, including one that hit the floor, while FPT and GAS stood out as rare gainers.

Closing the session on November 7th, the VN-Index dropped by 43.54 points (-2.65%), falling below the 1,600 mark to 1,599. This marked the first time in 88 days that the VN-Index dipped under 1,600. The 2.65% decline made Vietnam’s stock market the biggest loser in Asia.

Notably, the market’s sharp decline occurred amidst weak liquidity, with the trading value on HoSE reaching a mere VND 23,560 billion. This reflects investors’ heightened caution at the moment.

In reality, the VN-Index had enjoyed a prolonged uptrend, becoming one of the world’s hottest markets since the beginning of 2025. However, since August, it has entered a period of adjustment and accumulation.

According to many analysts, the significant volatility is primarily driven by domestic individual investors, accompanied by an increase in “hot money” in accounts. With investors leveraging heavily, margin debt reached a record high by the end of Q3, causing investor sentiment to fluctuate with every market shake. Even slightly negative macro or policy news can trigger substantial selling pressure.

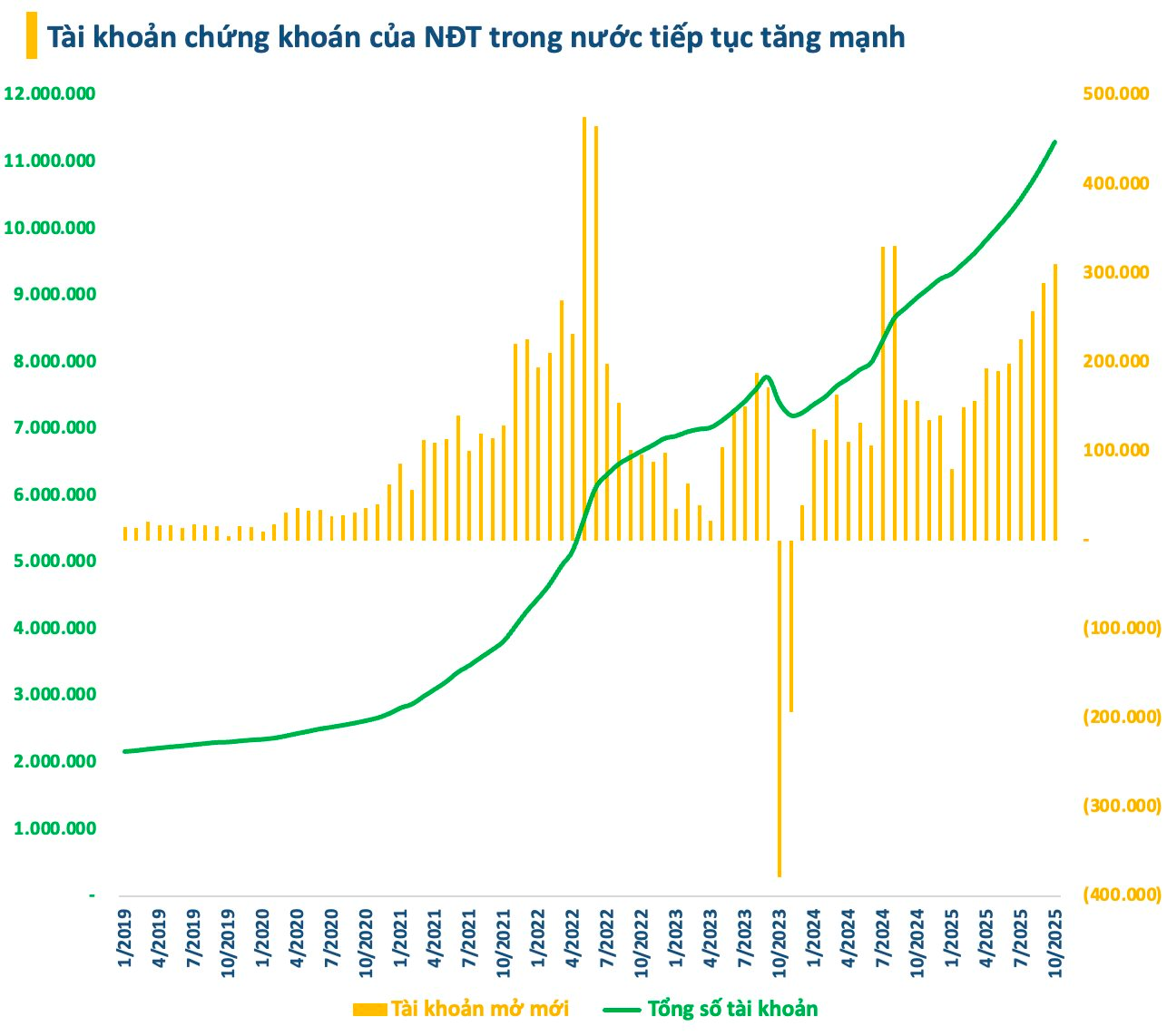

Contrary to the bleak liquidity situation, individual investors continue to show strong interest in the market, with new account openings consistently setting records.

According to the latest data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by over 310,000 in October 2025, marking the fifth consecutive month of growth. This is the strongest increase in the past 14 months. The majority of new accounts were opened by individuals, while only 155 new accounts were opened by organizations.

Year-to-date, the number of domestic securities accounts has increased by over 2 million. As of the end of October 2025, individual investors held a total of nearly 11.3 million accounts, equivalent to approximately 11% of the population, thus achieving the 2030 target ahead of schedule.

Despite the market’s current strong adjustments and unpredictable short-term volatility, Vietnam’s stock market is still viewed positively in the medium to long term. A stable macro foundation, controlled inflation, expectations of global interest rate cuts, and the return of foreign capital are creating room for market recovery.

Additionally, FTSE Russell’s upgrade of Vietnam’s market status and supportive policies from the Ministry of Finance and the State Securities Commission are seen as signals bolstering investor confidence in the coming period.

In the context of deep market discounts, many experts believe that several sectors and stocks have reached attractive price levels, presenting new investment opportunities.

The latest report from BIDV Securities (BSC Research) indicates that 8 out of 19 tracked sectors are currently trading below their 2-year median P/E ratios. This is notable given that the VN-Index has risen over 30% since the beginning of the year, highlighting a clear divergence in “investment flow direction” in 2025. However, BSC notes that current valuations are based on cumulative earnings up to the end of June 2025.

According to BSC, sectors that remain investment focal points in the final quarter of 2025 and into 2026 are those with positive profit growth in 2025 and expected growth of 15% or more in 2026. These include materials, utilities, information technology, real estate, retail, seafood, industrial zones, banking, and financial services.

What’s Happening with Vietnam’s Stock Market?

The past three months of steady gains were completely erased, sending the VN-Index tumbling to its lowest point since mid-August.

Haiphong Emerges as a Magnet for Investment Capital

Billions in infrastructure and capital investment are propelling Hai Phong’s rapid growth, fueling the rise of meticulously planned residential projects. These developments prioritize eco-conscious design, aiming to establish Hai Phong as a leading green, smart, and sustainable urban center, now a focal point of the real estate market.