Source: BSC Research

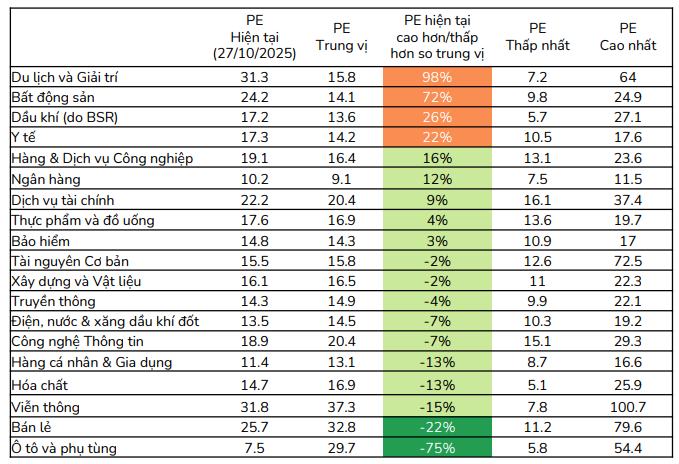

In a recent update, BIDV Securities (BSC Research) highlights that 8 out of 19 sectors are currently trading below their 2-year median P/E ratios. This comes as the VN-Index has surged over 30% year-to-date, underscoring a clear divergence in investment flows for 2025. However, BSC notes that current valuations are based on cumulative earnings up to June 2025.

Sectors commanding higher valuations, such as Real Estate, Financial Services, Banking, Retail, and Energy, have demonstrated robust growth in the first nine months of the year and are expected to maintain momentum in 2026.

Source: BSC Research

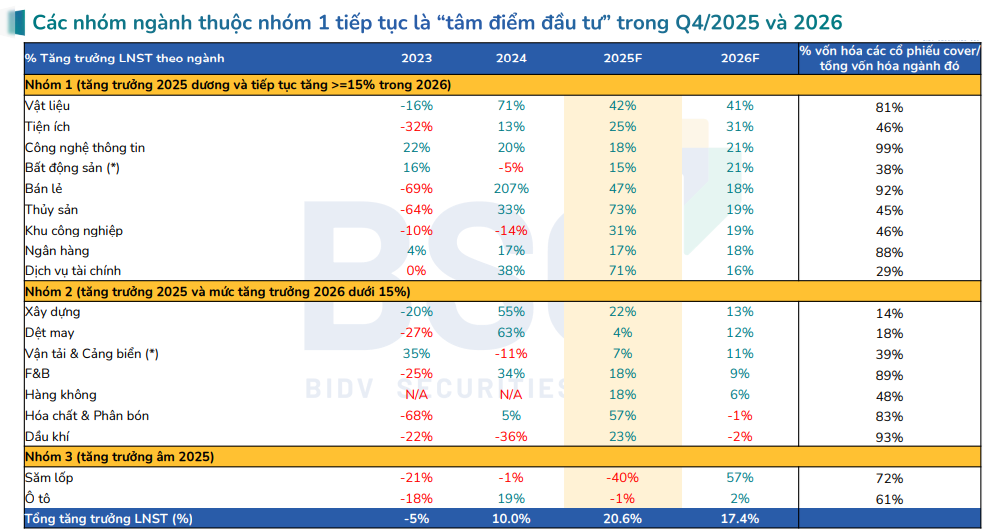

As of October 27, 2025, 582 out of 1,644 companies (27.3% of market capitalization) reported a 44% year-on-year increase in Q3 net profits. With 2025 profit growth forecasts revised upward to 20.6% and 2026 projections at 17.4%, BSC believes current valuations still offer room for growth in Q4 2025 and beyond.

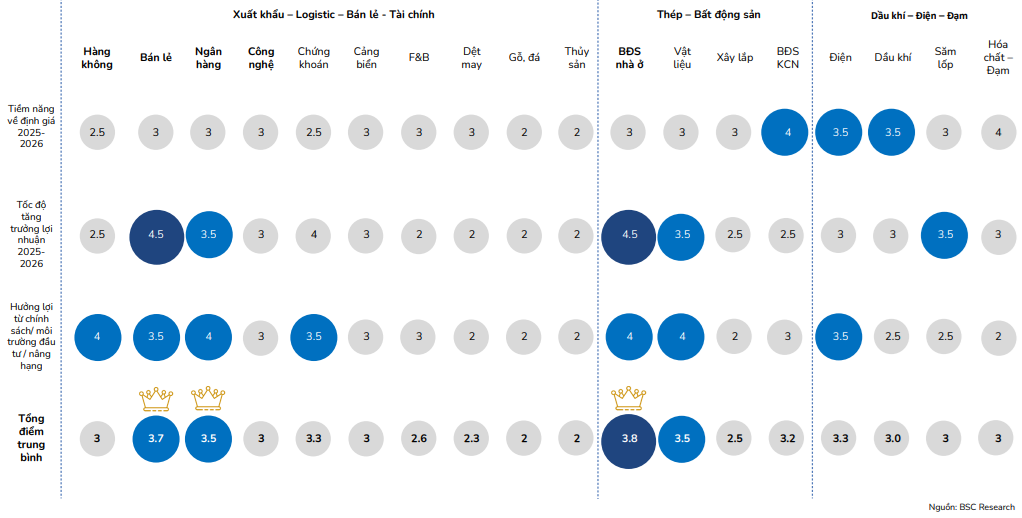

BSC identifies key sectors for investment in Q4 2025 and 2026 as those with positive profit growth in 2025 and expected growth of at least 15% in 2026. These include Materials, Utilities, IT, Real Estate, Retail, Seafood, Industrial Zones, Banking, and Financial Services.

Source: BSC Research

Looking ahead to 2026, BSC emphasizes that the effectiveness of policies promoting private sector growth will be pivotal. A shift in policy philosophy aims to create proactive development, institutionalize trust, and focus on key areas. Public investment will be a cornerstone, with accelerated project implementation directly benefiting the residential real estate sector. Demand-supply dynamics are expected to rebound, favoring practical housing solutions over tourism-oriented or speculative land projects. Positive profit growth and valuation potential are driven by (1) record-high launch prices and (2) faster-than-expected project execution.

Source: BSC Research

The construction materials sector is also poised to benefit. Domestically, most building materials have shown recovery signs, expected to continue in H2 2025. Exports have bottomed out, but BSC advises monitoring input costs for steel, cement, and plastics, which may decline in 2026 due to oversupply and Chinese policies. Investors are encouraged to focus on leading companies with strong domestic market share and reasonable valuations.

BSC forecasts strong growth for the construction sector in 2026. Infrastructure construction will thrive, driven by (1) accelerated public investment in the final cycle year and (2) key projects nearing completion, boosting profit margins. For residential construction, large backlogs ensure stable revenue for 2-3 years, with margins improving as the real estate market warms up.

Additionally, the government’s focus on science, technology, and innovation—highlighted in Resolution 57-NQ/TW—allocates at least 15% of the state budget to digital infrastructure, digital transformation, AI, high-tech workforce, and cybersecurity. This opens opportunities for private technology firms in Vietnam.

Priority sectors from H2 2025 to 2026

BSC also highlights sectors poised to benefit indirectly from public investment, including Aviation, F&B, Retail, Securities, and Banking.

Stock Market Week 03-07/11/2025: VN-Index Plunges Below 1,600 Points – Is the Downtrend Far from Over?

The VN-Index plummeted sharply, shattering its August 2025 lows and breaching the psychological 1,600-point threshold in the final session of the week, extending its losing streak into the fourth consecutive week. Short-term risks are escalating amid weak liquidity and a lack of clear market catalysts.

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.

A Major Force Returns to Scoop Up Vietnamese Stocks Amid Sharp Decline in Late Week Session on November 7th

Proprietary trading desks at securities companies collectively net-purchased VND 35 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.