Last week, the VN-Index dropped by 40.55 points to close at 1,599.1 points. Market liquidity continued to weaken, with total trading value across the market reaching VND 126.38 trillion, an 8% decrease compared to the previous week. Similarly, the HNX-Index ended the week at 260.11 points, down 5.74 points from the prior week. However, total trading value for the week increased by nearly 20% to VND 12.267 trillion.

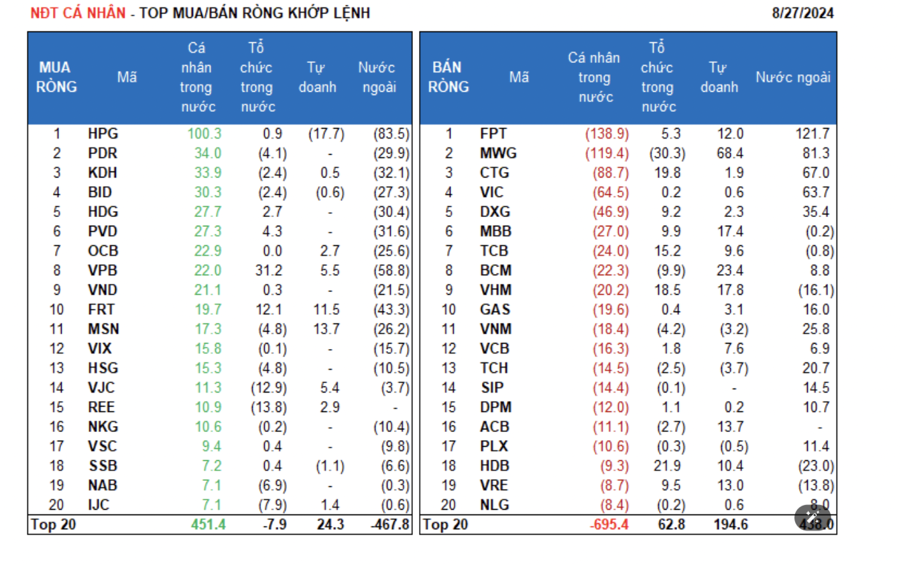

On the HoSE, foreign investors net sold 91.4 million units, with a net selling value of over VND 2.134 trillion. On the HNX, foreign investors net bought 0.68 million units, with a net buying value of over VND 67 billion.

On Upcom, foreign investors net sold for five consecutive sessions, totaling nearly 2.5 million units with a selling value of over VND 476 billion. Overall, during the trading week from November 3-7, foreign investors net sold over 93.2 million units across the market, with a total net selling value of nearly VND 2.544 trillion.

Over VND 319 billion in cash

Hoa Binh Construction Group Joint Stock Company (stock code: HBC) recently submitted a report on the payment status of principal and interest on bonds to the Hanoi Stock Exchange (HNX) and bondholders.

Hoa Binh Construction delayed the payment of over VND 12 billion in principal for the bond series HBCH2225002.

Specifically, according to the plan, on October 31, Hoa Binh Construction was scheduled to pay over VND 12 billion in principal for the bond series HBCH2225002. However, due to insufficient funds, the company was unable to make this payment. The company is currently negotiating with investors regarding the repayment of the bond debt.

The bond series HBCH2225002 has a total value of nearly VND 95 billion, issued on October 31, 2022, with a 3-year term and maturity on October 31, 2025. Previously, from April 2023 to June 2025, HBC had repeatedly repurchased a portion of this bond series before maturity. Most recently, on June 30, the company repurchased VND 11.7 billion, reducing the outstanding value to VND 12.4 billion.

Notably, as of September 30, HBC held over VND 319 billion in cash, but its total debt reached VND 4.012 trillion, equivalent to 204% of equity. This includes VND 3.521 trillion in short-term debt and over VND 490 billion in long-term debt.

In Q3 2025, HBC recorded net revenue of over VND 1.1 trillion, a 15% increase year-on-year. The company attributed this growth primarily to the construction activities of the parent company, while revenue from other activities (land leasing, goods sales, real estate) at subsidiaries declined.

HBC’s financial revenue saw a significant increase of nearly VND 230 billion, thanks to the recognition of VND 228 billion in late payment interest as per a court ruling. Additionally, the court ruling helped HBC generate nearly VND 31 billion in other profits from the liquidation and sale of fixed assets. As a result, HBC’s net profit in Q3 2025 reached nearly VND 182 billion, 23 times higher than the same period last year.

For the first nine months of the year, HBC’s after-tax profit totaled over VND 238 billion, a 72% decrease year-on-year due to modest results in the first half. As of September 30, HBC’s total assets stood at VND 15.9 trillion, a 3% increase from the beginning of the year.

Traphaco

Appoints New CEO

Traphaco Joint Stock Company (stock code: TRA) announced the appointment of Ms. Dao Thuy Ha as its new CEO. Previously, on November 5, Traphaco issued a decision to relieve Mr. Tran Tuc Ma of his duties as CEO, following his resignation.

Ms. Dao Thuy Ha – the new CEO of Traphaco.

Ms. Dao Thuy Ha, 50, succeeds Mr. Ma. Previously, she served as Deputy CEO of Sales and Marketing at Traphaco. Her appointment took effect on November 10.

Ms. Ha joined Traphaco in 1996 and has spent 30 years with the company, gaining experience in various areas such as market planning, research and development, marketing, and new product development.

Van Phat Hung Joint Stock Company (stock code: VPH) continued its senior management changes in the first 11 months of 2025. The company appointed Mr. Chau Quang Dat as Deputy CEO. Mr. Dat did not hold any position prior to this appointment.

In terms of personnel, during the first seven months of 2025, Van Phat Hung made several changes, including relieving Ms. Tran Thanh Phuong Trang of her duties as a Board of Directors member, relieving Mr. Phung Dien Trong of his duties as Deputy CEO, and relieving Ms. Tran Thanh Phuong Trang of her duties as a member of the Audit Committee. Mr. Truong Thanh Nhan was appointed as her replacement.