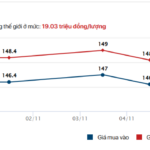

On Sunday, November 9th, the price of SJC gold bars was listed by major companies such as SJC, PNJ, and DOJI at 146.4 million VND per tael for buying and 148.4 million VND per tael for selling, remaining stable compared to the previous weekend.

This was a surprising development for gold bar prices, following two consecutive weeks of decline. Despite moving sideways last week, gold bar prices still dropped by approximately 6.2 million VND from their peak.

Meanwhile, prices for gold rings and 99.99% gold jewelry continued to fall. Companies like SJC traded gold rings around 143.3 – 145.8 million VND per tael (buy – sell), a further decrease of about 300,000 VND compared to the previous weekend. Gold ring prices have seen three consecutive weeks of decline.

Domestic gold prices have fluctuated in recent days due to global market influences. In the international market, gold closed the week’s trading at $4,000 per ounce, slightly lower than the previous week.

Compared to the historical peak of $4,380 per ounce, the precious metal has lost approximately $380 (equivalent to about 12 million VND).

Investors forecast gold prices to rise further next week

Kitco’s survey on gold price trends for the upcoming week revealed an interesting contrast: while analysts predict sideways movement and increased unpredictability, investors remain more optimistic.

Specifically, among 21 Wall Street analysts surveyed, 32% believe gold prices will continue to rise, while 59% predict a decline, and 9% expect prices to remain stable. The number of analysts forecasting higher gold prices highlights the metal’s unpredictability after a series of increases since the beginning of the year, culminating in a peak in mid-October.

Currently, gold prices have moved sideways for several days and have yet to surpass the $4,000 per ounce mark.

In contrast, a Main Street online survey of 123 investors showed greater optimism about gold’s upward trend. Specifically, 56% of respondents expect gold prices to rise again, only 17% predict a decline, and the remaining 27% anticipate stable prices.

| Increase (%) | Decrease (%) | Stable (%) | |

|---|---|---|---|

| Wall Street Analysts | 32 | 59 | 9 |

| Main Street Investors | 56 | 17 | 27 |

Speaking to Kitco, Alex Kuptsikevich, Market Analyst at FxPro, noted that the upward trend has been disrupted after two weeks of consecutive sell-offs. Gold prices have hovered around $4,000 per ounce for the past 10 days, ending the week nearly unchanged from the opening level. However, whenever gold prices approach $3,900 per ounce, buying interest emerges, pushing the metal back up. Investors continue to view gold as a safe-haven asset for the medium to long term.

Currently, the global gold price converted at the listed exchange rate is approximately 127.1 million VND per tael.

Gold Ring and Gold Bar Prices Surge by Up to 2 Million VND per Tael on November 11th

At the close of today’s trading session, Bao Tin Minh Chau is offering wedding ring gold at 152.3 million VND per tael, while gold bars have reached a selling price of 152 million VND per tael.

Gold Prices Surge: SJC and Ring Gold Witness Unexpected Spike by November 6th Close

As the sun dipped low on the evening of November 6th, domestic gold prices surged dramatically, mirroring the global gold market’s rebound above the $4,000 per ounce threshold.