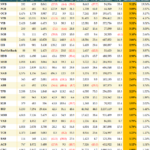

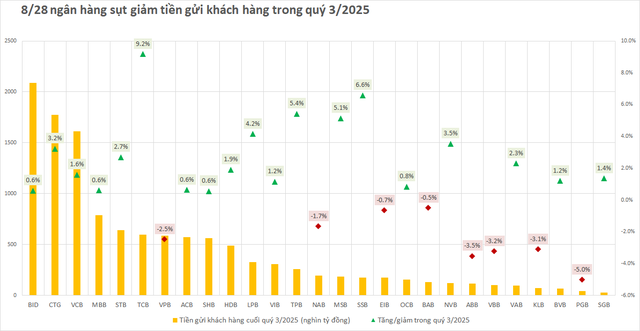

Notably, 8 out of 27 banks recorded a decline in deposits during Q3. In contrast, all 27 banks had shown positive growth in Q2/2025.

The banks experiencing deposit reductions include: ABBank, BacABank, Eximbank, Kienlongbank, NamABank, PGBank, VietBank, and VPBank.

Among these, VPBank saw a significant drop of nearly VND 15 trillion in customer deposits in Q3, falling to approximately VND 586 trillion. Previously, in the first six months of 2025, VPBank led the system in deposit growth, adding over VND 115 trillion, equivalent to a 24% increase.

Other banks like Eximbank, Kienlongbank, NamABank, and PGBank also experienced deposit declines, but these were minor, ranging from VND 1 to 3 trillion.

Conversely, several banks continued to see robust deposit growth in Q3/2025, led by VietinBank, Techcombank, and LPBank, among others.

Specifically, VietinBank attracted an additional VND 55.5 trillion in deposits in Q3/2025, reaching over VND 1.77 quadrillion. In the first nine months, customer deposits at this bank increased by more than VND 169 trillion, the highest in the system. Deposit growth in nine months reached 10.5%.

Techcombank also impressed in Q3 by attracting over VND 50 trillion in deposits. Earlier, customer deposits at this bank had decreased by over VND 1.8 trillion in Q1/2025 but rebounded by nearly VND 13.5 trillion in Q2/2025.

Vietcombank ranked third in deposit growth in Q3/2025, adding over VND 25 trillion. By the end of September 2025, deposits at Vietcombank reached over VND 1.6 quadrillion.

Other banks that added more than VND 10 trillion in deposits in Q3/2025 include: BIDV (over VND 12 trillion), LPBank (over VND 13 trillion), SeABank (nearly VND 11 trillion), Sacombank (nearly VND 17 trillion), and TPBank (over VND 13 trillion).

By the end of September 2025, BIDV remained the bank with the highest deposits in the system, at over VND 2 quadrillion. VietinBank and Vietcombank ranked second and third, with customer deposits of over VND 1.77 quadrillion and VND 1.61 quadrillion, respectively.

Amid signs of slowing deposit growth, many banks began raising deposit interest rates from the start of Q4/2025 to boost capital mobilization.

According to MBS Securities, out of 18 monitored banks, six adjusted their deposit rates in October. LPBank currently offers the highest 12-month deposit rate at 6.1%/year. The rising deposit interest rates in early Q4 reflect increasing capital mobilization needs to meet growing credit demand, which typically peaks toward year-end due to seasonal trends.

According to the State Bank of Vietnam, as of October 30, the credit balance of the entire system had increased by approximately 15% compared to the end of 2024 and is expected to rise further to 19-20% by year-end. As of late October, the average 3-month deposit interest rate for private commercial banks was 4.1%. The average 12-month deposit interest rate for private commercial banks increased to 5.34%, while state-owned commercial banks maintained a stable rate of 4.7%. Consequently, the average 12-month deposit interest rate for commercial banks rose by 15 basis points since the beginning of the year, reaching 5% by the end of October.

MB CEO Pham Nhu Anh: Many FDI Enterprises Opt to Borrow in Vietnam Instead of Their Home Countries Due to Lower Interest Rates

The CEO of MB highlighted that this serves as a prime example of how interest rates in Vietnam have reached historically low levels. In the short term, rates may edge up slightly, but the increase will be minimal. Even with a rise of 0.5-1%, borrowing costs remain remarkably affordable compared to previous periods and global standards.