Lã Ngọc Đan Chinh and Lã Ngọc Đan Thanh, daughters of Mr. Lã Văn Trường Sơn, CEO of HTL, and Mrs. Nguyễn Thị Kiều Diễm, Chairwoman of the Board, have registered to sell 362,000 and 284,000 shares, respectively. These sales represent 3.02% and 2.37% of HTL‘s capital. The transactions are expected to take place between November 13 and December 12 through negotiated agreements, with the purpose of “financial investment.”

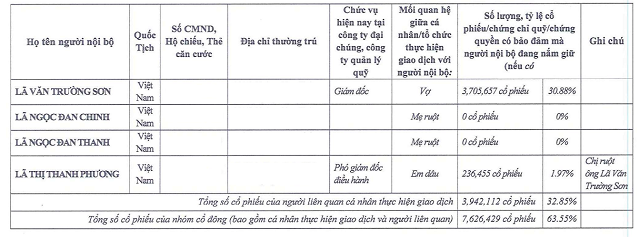

Conversely, Mrs. Nguyễn Thị Kiều Diễm has registered to purchase the exact number of shares her daughters are selling, totaling approximately 646,000 shares. If completed, her ownership in HTL will increase by 5.39%, reaching 30.7%. Following the transactions, the family leadership group will still hold a combined 63.5% of HTL‘s capital. Among them, Mrs. Lã Thị Thanh Phương, Mr. Sơn’s sister and Deputy CEO of HTL, owns 1.97% of the capital.

The shares the two daughters intend to sell were acquired in late 2024, also through negotiated agreements. At that time, HTL shares were surging, reaching approximately 28,000 VND per share, more than triple the price at the beginning of the year.

Mrs. Nguyễn Thị Kiều Diễm (left) and Mrs. Lã Thị Thanh Phương at HTL‘s 2023 Annual General Meeting – Photo: HTL

|

HTL was established in 1998 in Ho Chi Minh City, initially as a trading company for Soosan and Tadano cranes. Later, the company shifted its focus to specialized vehicles and environmental trucks, becoming an official distributor of Hino Motors Vietnam, distributing domestically assembled and imported Hino trucks. The founding shareholders included Mrs. Nguyễn Thị Kiều Diễm, Mr. Lã Văn Trường Sơn, and Mrs. Lã Thị Thanh Phương, all of whom later held key leadership positions at HTL.

A major turning point came in 2007 when the automotive division of Japan’s Sumitomo Corporation acquired a 25.5% stake, becoming a strategic shareholder. This propelled HTL into a period of robust growth. Notably, the government’s vehicle weight control policy between 2014 and 2015 boosted demand for heavy-duty and specialized trucks, driving HTL‘s revenue to a peak of nearly 1.7 trillion VND in 2015, seven times higher than in 2012. Net profit for the same year also reached a record high of 135 billion VND.

During this prosperous phase, Chairatchakarn Company (Bangkok, Thailand), one of the largest Hino distributors in Thailand, also became a strategic shareholder by continuously increasing its stake in HTL, at one point reaching 27.6%.

However, after this peak, the truck market began to stagnate. From 2016, HTL faced increasing competition from brands in China, Japan, and South Korea. Revenue and profits declined sharply, causing the share price to plummet from around 50,000 VND per share (adjusted) to below par value by early 2019, remaining stagnant for years.

While HTL shares were trading at low levels, Sumitomo gradually divested, exiting the shareholder list. These shares were acquired by Mr. Lã Văn Trường Sơn, CEO of HTL. In 2023, he increased his ownership from 16.8% to 23.8%, and further to 30.8% in early 2024, when shares were still around 10,000 VND per share.

The increased ownership by Mr. Sơn and the founding shareholders marked a “revival” phase for HTL shares. By late 2024, the share price surged again, reaching 32,000 VND per share at one point, a 300% increase in just one year.

| HTL share price traded near par value for an extended period |

The Chairman’s family continues to hold controlling interest in HTL post-transaction. Source: HTL

|

– 11:28 11/11/2025