The State Securities Commission has approved Mobile World Investment Corporation (MWG) to repurchase 10 million treasury shares, equivalent to 0.7% of the total outstanding shares.

The transaction will take place from November 19 to December 18 via direct order matching on the stock exchange, with a maximum purchase price of VND 200,000 per share. The company plans to buy 3-10% of the registered volume per session, approximately 300,000 to 1 million shares daily.

According to the shareholder notice, MWG sets the minimum purchase price at VND 10,000 and the maximum at VND 200,000 per share, calculated as “reference price plus 50% of the stock’s price fluctuation range.”

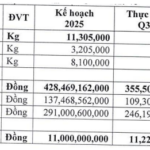

At the ceiling price, the total transaction value could reach VND 2 trillion, funded from retained earnings of over VND 12,582 billion by the end of 2024.

Companies and insiders actively buy back shares amid market downturn

This move signals the company’s effort to support its share price and reinforce confidence in its intrinsic value during a volatile market period. On November 11, MWG shares traded at around VND 77,000. Upon completion, the company’s charter capital will decrease, while shareholder ownership ratios will increase due to reduced outstanding shares.

MWG isn’t alone; multiple listed company executives have recently registered to purchase shares to bolster market confidence. Khải Hoàn Land Chairman Nguyễn Khải Hoàn acquired 13.58 million KHG shares from his spouse between October 24 and November 7, increasing his stake to 34.99% from 31.97%.

Earlier, EDX Group’s Chairman announced plans to purchase 4 million DCS shares between November 10-28, reflecting a broader trend of executives increasing holdings to demonstrate long-term commitment to investors.

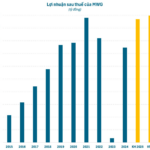

The Iron Fists of Nguyen Duc Tai

Following a period of quantitative growth, MWG has undergone a robust restructuring over the past two years and is now entering a new phase of growth driven by its enhanced “quality.” This momentum is fueled by the strategic and impactful initiatives led by Mr. Nguyễn Đức Tài.