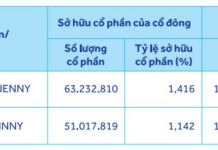

Recently, the foreign fund group Dragon Capital released a report detailing changes in ownership among related foreign investors who are major shareholders, holding 5% or more of the shares in Dat Xanh Group JSC (Stock Code: DXG, HoSE).

On November 4, 2025, Dragon Capital, through four of its member funds, collectively purchased over 2.5 million DXG shares.

Specifically, Hanoi Investments Holdings Limited acquired 630,000 shares, Norges Bank purchased 1.08 million shares, Samsung Vietnam Securities Master Investment Trust [Equity] bought 108,000 shares, and Vietnam Enterprise Investments Limited secured 720,000 shares.

Source: DXG

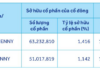

Following the transaction, Dragon Capital increased its DXG shareholdings from nearly 100.9 million shares to over 103.4 million shares, raising its ownership stake from 9.9019% to 10.1510% of Dat Xanh Group’s capital.

Based on the closing price of DXG shares on November 4, 2025, at VND 20,150 per share, it is estimated that Dragon Capital spent over VND 51 billion to successfully acquire the aforementioned shares.

Regarding business performance, according to the consolidated financial report for Q3/2025, Dat Xanh Group recorded net revenue of over VND 1,068 billion, a 5.4% increase compared to the same period last year. However, after deducting the cost of goods sold, gross profit reached over VND 469.6 billion, a 7.6% decrease.

During the period, the company also generated VND 41.6 billion in financial revenue, 3.2 times higher than the same period last year. Conversely, financial expenses decreased from VND 104.8 billion to VND 62.3 billion.

Additionally, selling expenses rose from VND 166.3 billion to over VND 243.8 billion, and administrative expenses reached VND 122.4 billion, a 16.9% increase year-over-year.

As a result, after deducting taxes and fees, Dat Xanh Group reported a net profit of nearly VND 163.6 billion, 2.2 times higher than the same period last year.

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.

Market Pressures Mount: What Lies Ahead for Stocks Next Week?

Last week, the VN-Index fell below the 1,600-point mark amid mounting pressure from a strengthening USD/VND exchange rate and heavy net selling by foreign investors. Despite positive macroeconomic data and third-quarter corporate earnings, analysts predict that the stock market may shift toward a consolidation phase next week, testing the support range of 1,550–1,580 points in the short term.

Market Warrants Week 10-14/11/2025: Fiery Momentum Mirrors Underlying Market

At the close of trading on November 7, 2025, the market saw 27 stocks rise, 250 fall, and 24 remain unchanged. Foreign investors continued their net selling streak, with a total net sell-off of 874.33 million VND.