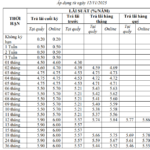

KienlongBank Savings Interest Rates

KienlongBank has officially adjusted its deposit interest rates as of November 11, after nearly 8 months of maintaining the same rate schedule. The bank increased the interest rate for 1-4 month deposits by 0.2% per annum and the 6-7 month term deposits by the same margin. Notably, KienlongBank reduced the interest rate for 8-9 month deposits by 0.1% per annum while keeping other terms unchanged. These adjustments apply to both individual and corporate customers.

According to the updated online savings interest rate table, individual customers with 1-5 month deposits enjoy a rate of 3.9% per annum. The 6-month term currently stands at 5.3% per annum, while the 8-9 month term has dropped to 5.1% per annum. The 10-11 month terms remain at 5.3% per annum, with the highest rate of 5.5% per annum for 12-month deposits. Longer terms, from 13 to 36 months, are listed at 5.45% per annum.

For corporate customers, KienlongBank’s online deposit rates are 0.1-0.3% per annum lower than those for individuals. Specifically, 1-5 month terms offer 3.7% per annum; 6 months at 5.2% per annum; 7 months at 5.3% per annum; 8 months at 5.0% per annum; 9 months at 4.9% per annum; 10-11 months at 5.0% per annum; 12 months at 5.2% per annum; 13-15 months at 5.05% per annum; and 17-36 months at 5.15% per annum.

LPBank Savings Interest Rates

LPBank has also adjusted its online deposit interest rates for individual customers as of November 10. Specifically, 1-5 month terms increased by 0.3% per annum; 6-11 month terms by 0.2% per annum; and 18-60 month terms by 0.1% per annum, while 12-16 month terms remain unchanged.

After the adjustment, LPBank’s online interest rates for end-of-term payments are 3.9% per annum for 1-month deposits; 4.0% per annum for 2-month deposits; 4.2% per annum for 3-5 month deposits; 5.3% per annum for 6-11 month deposits; 5.4% per annum for 12-16 month deposits; and a peak rate of 5.5% per annum for 18-60 month deposits.

Techcombank Savings Interest Rates

Techcombank recently announced its new online deposit interest rates for individual customers. The 1-2 month term increased by 0.2% per annum to 3.95% per annum; the 3-month term rose by 0.3% per annum to 4.75% per annum, the maximum allowed for deposits under 6 months. The 4-5 month term was adjusted upward by 0.4% per annum to 4.35% per annum. Terms from 12 to 36 months also saw a uniform increase of 0.2% per annum, with the latest 12-month rate reaching 5.75% per annum and 13-36 month terms at 5.25% per annum.

The bank maintained the interest rates for 6-11 month deposits, with 6-month terms at 5.45% per annum and 7-11 month terms at 4.95% per annum. This marks the second consecutive rate increase in just a few days, following the late October adjustment when Techcombank raised rates by 0.3% per annum for 1-2 and 6-36 month terms, and by 0.2% per annum for 3-5 month terms.

BaoViet Bank Savings Interest Rates

BaoViet Bank has also increased its deposit interest rates after more than 7 months of stability. According to the latest online rate schedule, the 1-month term rose by 0.5% per annum to 4.0% per annum; the 2-month term surged by 0.6% per annum to 4.2% per annum. Meanwhile, the 3, 4, and 5-month terms each increased by 0.1% per annum, now listed at 4.45% per annum, 4.5% per annum, and 4.6% per annum, respectively.

BaoViet Bank maintained rates for 6-36 month terms, with 6-8 month terms at 5.45% per annum; 9-11 month terms at 5.5% per annum; 12-month terms at 5.8% per annum; and the highest rate of 5.9% per annum for 13-36 month terms.

PVcombank Savings Interest Rates

PVcombank joined the November rate adjustments, marking its first change in over a year (since August 2024). The bank uniformly increased rates by 0.5% per annum across all terms from 1 to 36 months. With this increase, the highest deposit rate reaches 6.3% per annum for 15-36 month online deposits, currently the market’s highest.

Specifically, the 1-month term rose to 3.80% per annum; 2 months to 3.90% per annum; 3 months to 4.10% per annum; 4 months to 4.20% per annum; 5 months to 4.30% per annum; 6 months to 5.00% per annum; 7-11 months to 5.20% per annum; 12 months to 5.60% per annum; and 13 months to 5.80% per annum.

VPBank Savings Interest Rates

VPBank adjusted its over-the-counter deposit rates at the beginning of November. Currently, over-the-counter savings rates range from 4.2% to 5.4% per annum. Compared to October, VPBank’s direct deposit rates are as follows: 1-month terms increased by 0.3% to 4.2% per annum; 3-month terms by 0.3% to 4.2% per annum; 6-11 month terms by 0.3% to 5.1% per annum; terms over 12 months by 0.3% to 5.3% per annum; and 24-36 month terms by 0.3% to 5.4% per annum.

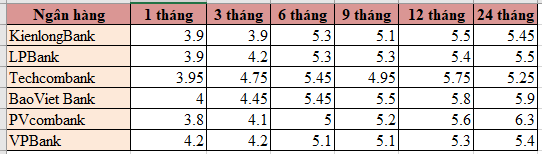

Summary table of savings interest rates from select banks.

Techcombank Earns High Credit Ratings from Both Fitch and S&P Global

On November 10, 2025, Fitch Ratings assigned Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) its inaugural credit rating with a “Positive” outlook. Concurrently, Fitch announced a Viability Rating (VR) and Government Support Rating (GSR) of ‘bb-‘, while also recognizing a ‘bb’ score for “Capital and Liquidity.”

White Night: A Royal Russian Musical Extravaganza Exclusively for Techcombank Private Clients

Over two enchanting evenings on November 1st and 2nd, music enthusiasts in the capital were treated to the quintessential sounds of Russian classical music. The St. Petersburg Symphony Orchestra delivered a captivating performance, showcasing the distinctive ‘Leningrad sound’ as part of the ‘White Night’ concert series.

Techcombank’s Marketing Director to Engage in Dialogue at Asia’s Leading Brand Forum

On November 7th, Singapore will host the “Asia Brand 2025” forum, organized by Brand Finance, a leading global authority in brand valuation. Themed ‘The Brand Frontier: Asia’s Rise to Global Dominance,’ this prestigious event will bring together Asia’s top brands, influential policymakers, and businesses shaping the future of the region’s economy.