I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 12, 2025

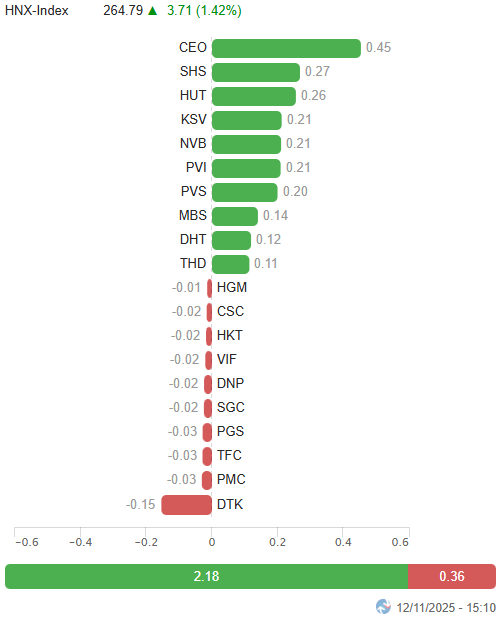

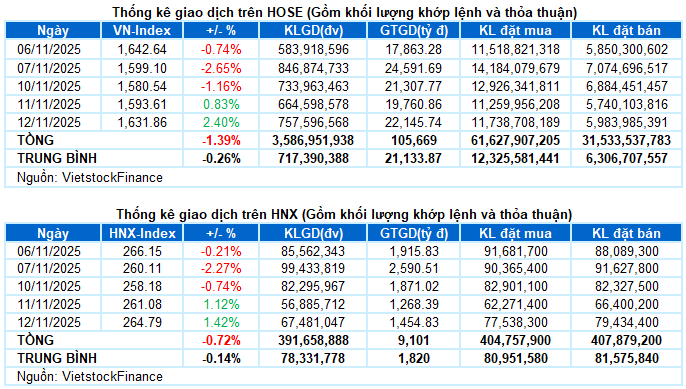

– Key indices surged during the November 12 trading session. Specifically, the VN-Index rose by 2.4%, reaching 1,631.86 points, while the HNX-Index increased by 1.42%, closing at 264.79 points.

– Trading volume on the HOSE floor rose by 14.5%, exceeding 682 million units. The HNX floor recorded nearly 66 million matched units, a 22.5% increase compared to the previous session.

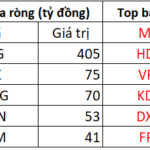

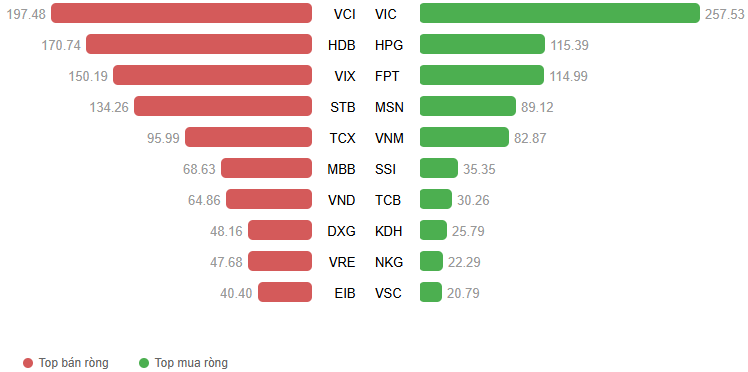

– Foreign investors net sold over VND 387 billion on the HOSE and nearly VND 78 billion on the HNX.

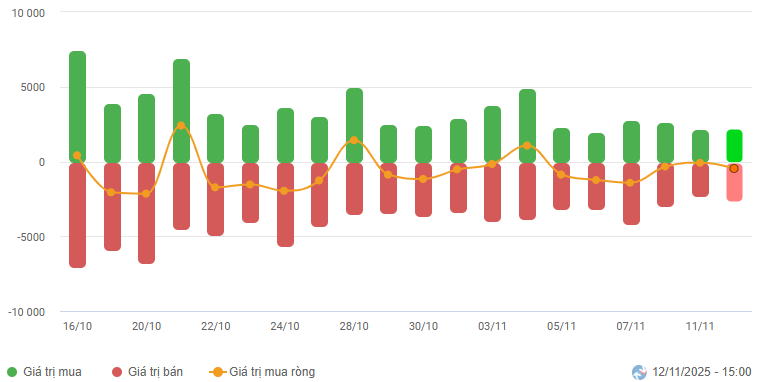

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

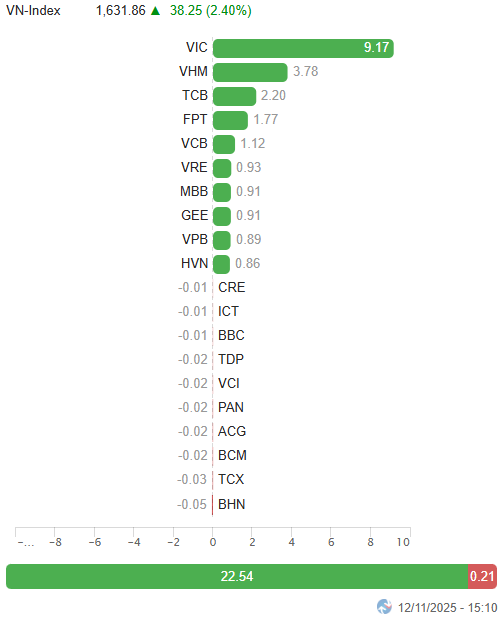

– The market continued its robust recovery during the November 12 session. After a tug-of-war around the 1,600-point mark in the first half of the morning session, the VN-Index gradually strengthened as investor sentiment stabilized. Despite low liquidity, market breadth improved significantly, with green dominating most key sectors. In the afternoon session, the uptrend expanded further, led by large-cap stocks. The VN-Index surged by over 38 points from the previous session, closing at 1,631.86 points.

– In terms of impact, VIC was the primary driver, contributing 9.17 points to the VN-Index. Following closely were VHM, TCB, and FPT, adding a combined 7.75 points. Meanwhile, the total impact of the 10 most negative stocks only deducted 0.2 points from the index, highlighting overwhelming buying pressure across the board.

Top Stocks Influencing the Index. Unit: Points

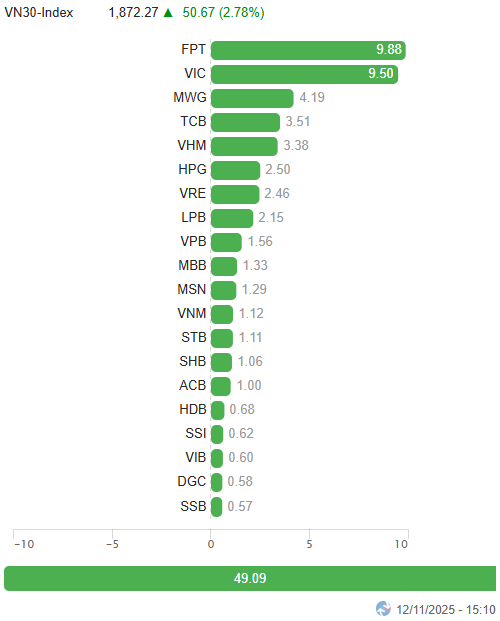

– The VN30-Index soared by 50.67 points, or 2.78%, reaching 1,872.27 points. Buyers dominated with 29 out of 30 stocks rising, led by VRE and VIC with impressive gains of over 5%. The only stock in the red was BCM, down a slight 0.1%.

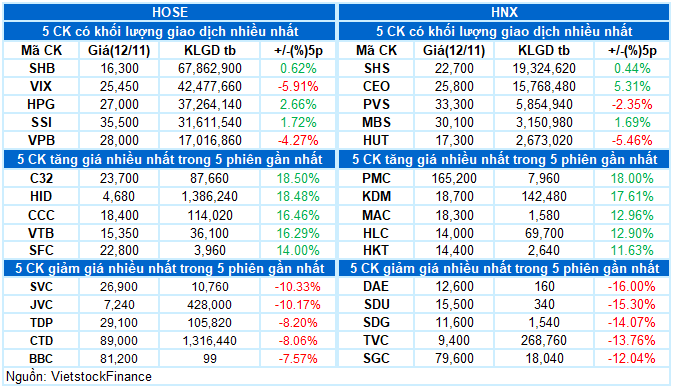

Green dominated all sectors. Information technology saw the most significant gains, primarily driven by FPT (+4.68%), CMG (+2.39%), VEC (+8.07%), DLG (+2.33%), and HPT (+4.58%).

Real estate and industrial sectors also made strong impressions, with numerous stocks surging over 3%, including VIC, VRE, VHM, KDH, PDR, VPI, CEO, KHG, HDC, HVN, GEX, BMP, PC1, CTD, and TV2. Notably, NVL, GEE, CII, and VSC hit their upper limits.

Additionally, the financial sector spread positive sentiment across the market, with active trading in stocks like VIX (+4.52%), SHB (+3.16%), SSI (+1.87%), STB (+1.91%), VPB (+1.82%), HDB (+1.35%), TCB (+4.01%), MBB (+2.16%), VND (+2.58%), SHS (+2.25%), and TPB (+2.37%).

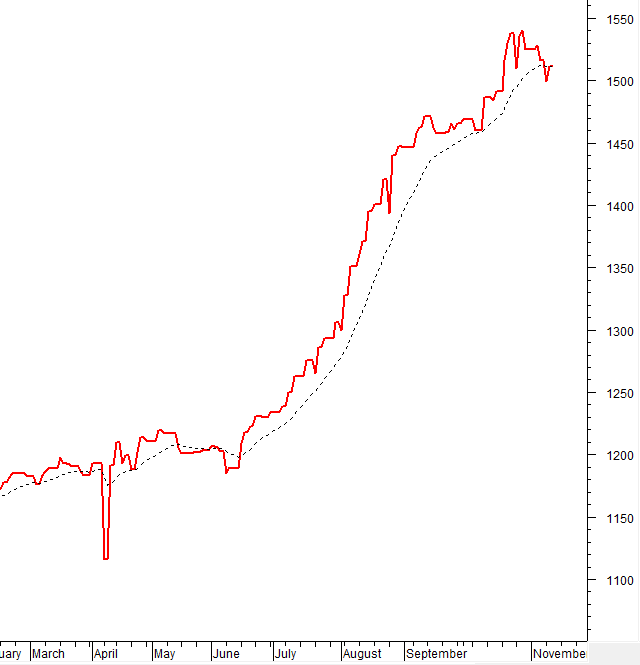

The VN-Index surged above the 100-day SMA. The Stochastic Oscillator indicator may signal a buy in the oversold region. If this signal appears in upcoming sessions alongside trading volume exceeding the 20-day average, the index’s recovery prospects will be strengthened.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator May Signal a Buy

The VN-Index surged above the 100-day SMA.

The Stochastic Oscillator indicator may signal a buy in the oversold region. If this signal appears in upcoming sessions alongside trading volume exceeding the 20-day average, the index’s recovery prospects will be strengthened.

HNX-Index – Crossed Above the 100-day SMA

The HNX-Index recovered strongly for the second consecutive session, crossing above the 100-day SMA. However, liquidity remains a short-term concern.

The MACD indicator is narrowing its gap with the Signal line. If a buy signal reappears, the index’s outlook will become more positive.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Capital Flow: Foreign investors continued to net sell in the November 12, 2025 session. If foreign investors maintain this action in upcoming sessions, market volatility may occur.

III. MARKET STATISTICS ON NOVEMBER 12, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 16:27 November 12, 2025

Foreign Investors Ease Sell-Off, Counter-Trend with Over 400 Billion VND Buy-In on Blue-Chip Stock in November 10th Session

Foreign investors net sold approximately VND 300 billion, a notable cooling-off compared to the previous sessions marked by massive sell-offs worth thousands of billions of dong.

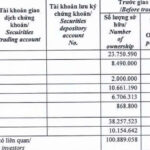

Dragon Capital Successfully Acquires Over 2.5 Million DXG Shares

Dragon Capital has successfully acquired over 2.5 million shares of DXG, elevating its ownership stake in Dat Xanh Group to 10.1510%.