FTSE Russell has released a report detailing its plan to reclassify Vietnam from a frontier market to a secondary emerging market, effective from September 2026.

The organization stated that an interim review in March 2026 will ensure the market infrastructure meets international standards, particularly in expanding access for global investment funds. The reclassification will occur in phases, with Vietnamese stocks exiting the FTSE Frontier Index and joining the FTSE Global Equity Index Series (GEIS).

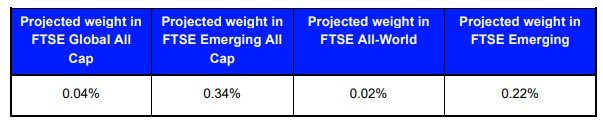

The FTSE Russell report also outlines the weighting of Vietnamese stocks in the indices post-upgrade. Specifically, Vietnam will represent 0.04% in the FTSE Global All Cap, 0.02% in the FTSE All-World, 0.34% in the FTSE Emerging All Cap, and 0.22% in the FTSE Emerging Index. Tracking indices have been established to simulate the impact before the official reclassification.

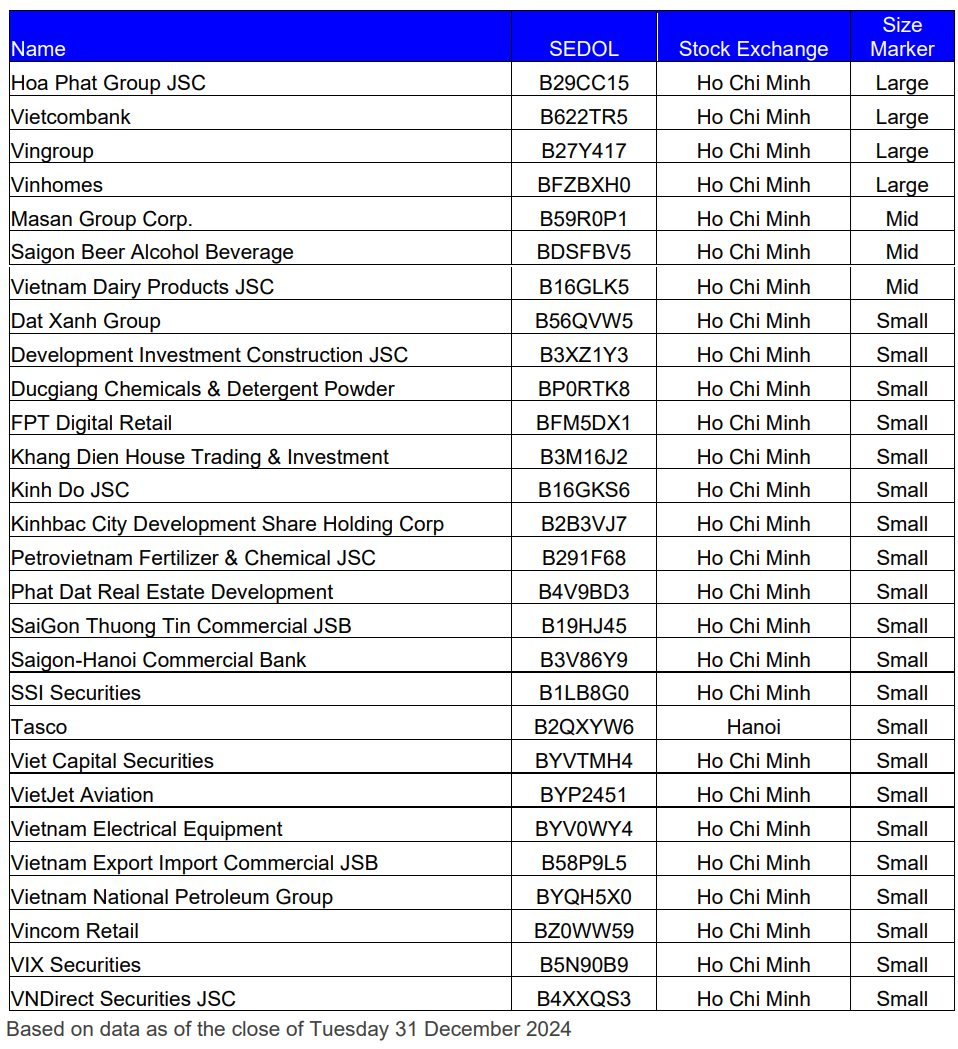

FTSE Russell has identified a list of Vietnamese stocks potentially eligible for inclusion in the FTSE Global All Cap Index, including HPG, VCB, VIC, VHM, MSN, SAB, VNM, DXG, DIG, DGC, FRT, KDH, KDC, KBC, DPM, PDR, STB, SHB, SSI, HUT, VCI, VJC, GEX, EIB, PLX, VRE, VIX, VND.

This list is based on data as of December 31, 2024, and may be subject to change by the official announcement date. The final list will be published before the FTSE GEIS semi-annual review in September 2026. The inclusion of Vietnamese stocks is expected to occur in multiple phases. Detailed implementation stages will be announced in March 2026, following consultations with the FTSE Russell Advisory Committees, market participants, and final approval by the FTSE Russell Index Governance Committee.

From September 2026, Vietnam will be categorized under the “Asia Pacific ex Japan ex China” region in reviews. Liquidity, size, and compliance with global standards will continue to be monitored during the transition period.

FTSE Russell emphasized that this reclassification marks a significant milestone, elevating Vietnam’s position on the global financial map and paving the way for increased institutional investment flows from FTSE Russell’s global index-tracking funds into the Vietnamese stock market.

Great News on Wages for Millions of Workers Starting Next Year

The government has mandated an increase in the regional minimum wage, ranging from 250,000 to 350,000 VND per month, effective January 1, 2026.

FTSE Russell Unveils 28 Vietnamese Stocks Targeted for Inclusion Upon Vietnam’s Upgrade

FTSE Russell has announced its plan to upgrade Vietnam’s stock market from “Frontier Market” to “Secondary Emerging Market” within the FTSE Global Equity Index Series (GEIS). This reclassification is expected to take effect during the September 2026 semi-annual review.