Saigon Beer-Alcohol-Beverage Corporation (Sabeco, stock code: SAB) has announced that January 13, 2026, will be the final registration date for shareholders to receive an interim cash dividend for 2025, at a rate of 20% (2,000 VND per share).

The dividend payment is scheduled for February 12, 2026. With nearly 1.3 billion shares outstanding, Sabeco will allocate approximately 2.57 trillion VND for this dividend distribution.

In the current shareholder structure, the parent company, Vietnam Beverage, a subsidiary of ThaiBev owned by Thai billionaire Charoen Sirivadhanabhakdi, will receive nearly 1.375 trillion VND in dividends, holding 53.59% of the capital. The State Capital Investment Corporation (SCIC), holding 36% of the capital, will also receive over 920 billion VND.

Sabeco is one of the few companies maintaining a generous dividend policy over the past decade. Since 2016, the company has consistently paid cash dividends, regardless of market fluctuations or the COVID-19 crisis. Annual dividends have ranged from 3,000 to 5,000 VND per share.

Most recently, in late July, Sabeco paid the second installment of the 2024 dividend at a rate of 30%, bringing the total cash dividend for 2024 to 50%, equivalent to over 6.4 trillion VND.

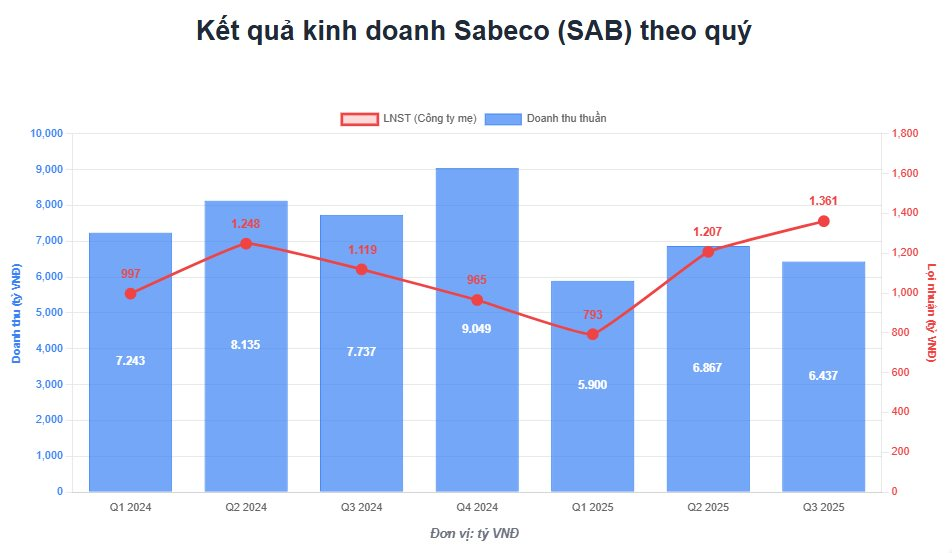

In Q3 2025, Sabeco’s net revenue reached 6.437 trillion VND, a 16% decrease compared to the same period in 2024. However, the parent company’s net profit after tax grew by nearly 22%, reaching 1.361 trillion VND—the highest quarterly profit in the last 13 quarters.

This profit growth stems from highly effective cost control. Despite declining revenue, the cost of goods sold in the quarter decreased by 25% (to 4.050 trillion VND), driving a 5% increase in gross profit to 2.386 trillion VND.

For the first nine months of 2025, Sabeco recorded net revenue of 19.052 trillion VND, a 17% decrease compared to the same period in 2024. The parent company’s net profit remained stable at 3.361 trillion VND, a slight 0.1% decrease year-on-year, achieving 71% of the annual profit target.

As of September 30, 2025, Sabeco’s total assets stood at 31.335 trillion VND. Inventory was recorded at 1.744 trillion VND, a 12% decrease from the beginning of the year, primarily due to reduced raw material and finished product inventory.

Cash, cash equivalents, and bank deposits remained at a very high level, accounting for 64% of total assets, with a value of 20.027 trillion VND. Interest income from deposits in the first nine months totaled 741 billion VND, averaging over 2.7 billion VND daily.

Petrosetco Surges Following PVN’s Announcement to Auction Entire Stake at Starting Price of 36,500 VND/Share

Petrovietnam is set to auction its entire 23.21% stake in Petrosetco (HOSE: PET), a leading integrated oil and gas services company, with a starting price of VND 36,500 per share. This move, valuing the entire lot at nearly VND 910 billion, immediately sent PET shares surging to their upper limit on the morning of November 10th, despite the market price still trailing 12% below Petrovietnam’s offering price.

HDBank Poised to Surpass 2025 Business Plan Targets

At the Q3/2025 Investor Conference held on November 10, 2025, the leadership of Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) expressed unwavering confidence in their ability to accelerate growth in Q4, aiming to surpass the full-year 2025 profit targets.