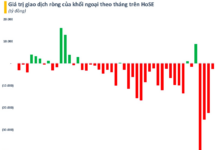

Following a significant decline in the previous session, the market rebounded during the November 11th session, opening with a gain on low liquidity. Buying interest returned to large-cap stocks, driving the VN-Index up by 13.07 points (+0.83%) to close at 1,593.61. Foreign trading remained a negative factor, with net selling of VND 76 billion, although the selling pressure eased compared to previous sessions.

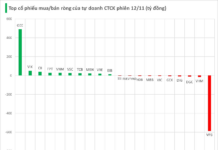

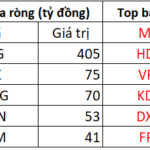

Securities firms’ proprietary trading desks net bought VND 466 billion on HOSE.

Specifically, HPG saw the strongest net buying at VND 214 billion, followed by MSN (VND 208 billion), VSC (VND 156 billion), TCB (VND 92 billion), CII (VND 81 billion), VHM (VND 43 billion), MWG (VND 42 billion), KBC (VND 12 billion), VNM (VND 8 billion), and VRE (VND 6 billion) – all actively net bought by securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in FPT, with a value of -VND 66 billion, followed by HHS (-VND 61 billion), VIC (-VND 59 billion), DGC (-VND 47 billion), and VPB (-VND 35 billion). Other stocks also recorded notable net selling, including LPB (-VND 28 billion), ACB (-VND 18 billion), VJC (-VND 14 billion), RYG (-VND 12 billion), and HDB (-VND 11 billion).

Market Pulse 12/11: Green Wave Sweeps In, VN-Index Recaptures 1,630 Mark

At the close of trading, the VN-Index surged by 38.25 points (+2.4%), reaching 1,631.86 points, while the HNX-Index climbed 3.71 points (+1.42%) to 264.79 points. Market breadth was overwhelmingly positive, with 361 advancing stocks versus 323 declining ones. Similarly, the VN30 basket saw a near-complete dominance of green, with 29 gainers and only 1 loser.

Vietstock Daily November 13, 2025: Recovery Momentum Continues

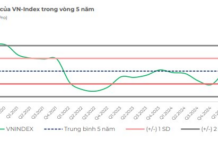

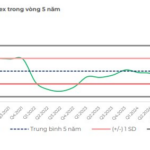

The VN-Index has surged, decisively breaking above its 100-day SMA. The Stochastic Oscillator is poised to generate a buy signal from oversold territory. Should this signal materialize in upcoming sessions, accompanied by trading volume surpassing the 20-day average, the index’s recovery prospects would be significantly strengthened.

Foreign Investors Ease Sell-Off, Counter-Trend with Over 400 Billion VND Buy-In on Blue-Chip Stock in November 10th Session

Foreign investors net sold approximately VND 300 billion, a notable cooling-off compared to the previous sessions marked by massive sell-offs worth thousands of billions of dong.