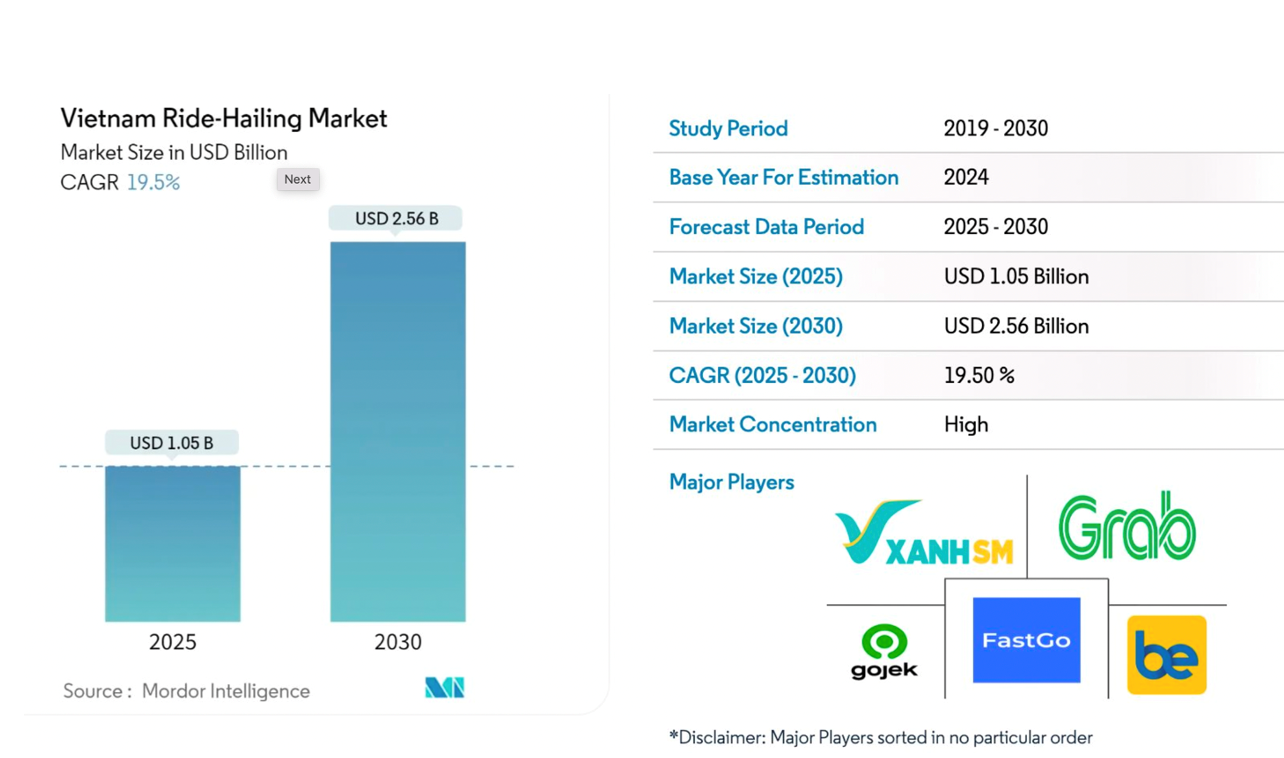

The latest report from Mordor Intelligence reveals that Vietnam’s ride-hailing market is projected to reach USD 1.05 billion by 2025 and is expected to grow to USD 2.56 billion by 2030, with a CAGR of 19.5% during the forecast period 2025-2030.

According to Mordor Intelligence, this market growth is driven by Vietnam’s rapid digital transformation, fueled by urbanization and increasing technology adoption.

Be Group Announces Company-Wide Profitability

In a recent surprise announcement, Be Group revealed that it has achieved positive EBITDA profitability across the entire company. This result is based on consistent positive profits in the first three quarters of 2025. The company’s cumulative profit remains positive as of November, with a stable upward trend. Be Group did not disclose specific profit margins or figures.

Be Group, a homegrown Vietnamese platform, currently offers 12 services in Vietnam, including beBike, beCar, beTaxi, beDelivery, beFood, beGiúpviệc, travel tickets (air, train, bus), insurance, and telecom services.

With its profitability announcement, Be Group stated it is reinvesting in its driver and helper partners. The company will provide scholarships of up to VND 4 million to eligible student drivers active from November 1 to December 31, 2025.

Be Group also launched its first monthly reward program for new student drivers: complete 25–30 trips/week to earn up to VND 720,000 in the first month, stackable with existing programs like uniform subsidies, multi-trip bonuses, and holiday rewards.

Additionally, after a trial period starting in October 2025, Be Group introduced its 24/7 Comprehensive Accident Insurance: premiums from VND 25,000/week, maximum accumulation of VND 1.25 million over 50 weeks, with coverage up to VND 1 billion.

Local Players Rise to Challenge

Meanwhile, Grab is gradually losing its dominant position in Vietnam to local competitors.

According to Grab’s 2024 annual report, the company generated USD 228 million in revenue in Vietnam in 2024, a nearly 23% increase from USD 185 million in 2023. However, this growth rate is significantly lower than the 70% increase from USD 108 million in 2022 to USD 185 million in 2023, indicating a clear slowdown in Grab’s growth in Vietnam compared to other Southeast Asian markets.

Vietnam’s contribution to Grab’s regional revenue remains modest at 8.15% in 2024, significantly lower than its major markets. Grab Malaysia leads the region with USD 816 million, followed by Indonesia (USD 643 million), Singapore (USD 578 million), and the Philippines (USD 265 million). Smaller markets like Cambodia and Myanmar contributed less than USD 15 million.

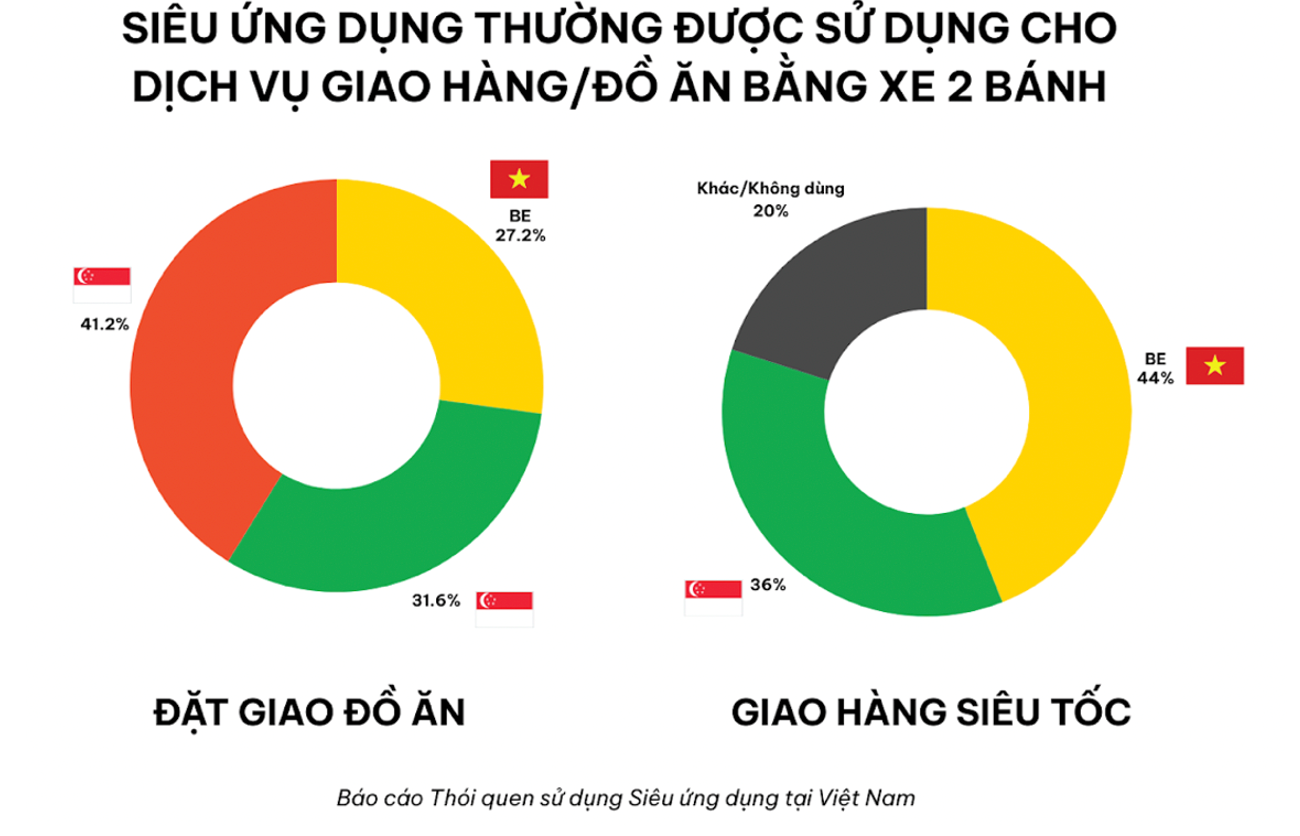

In food delivery, Grab also lags behind Be. According to Cimigo’s May 2025 report on Vietnamese super-app usage, three of the top eight services are in the two-wheeler category: ride-hailing, delivery, and food delivery—areas where Be leads the domestic market with steady growth since achieving positive gross profit in August 2022.