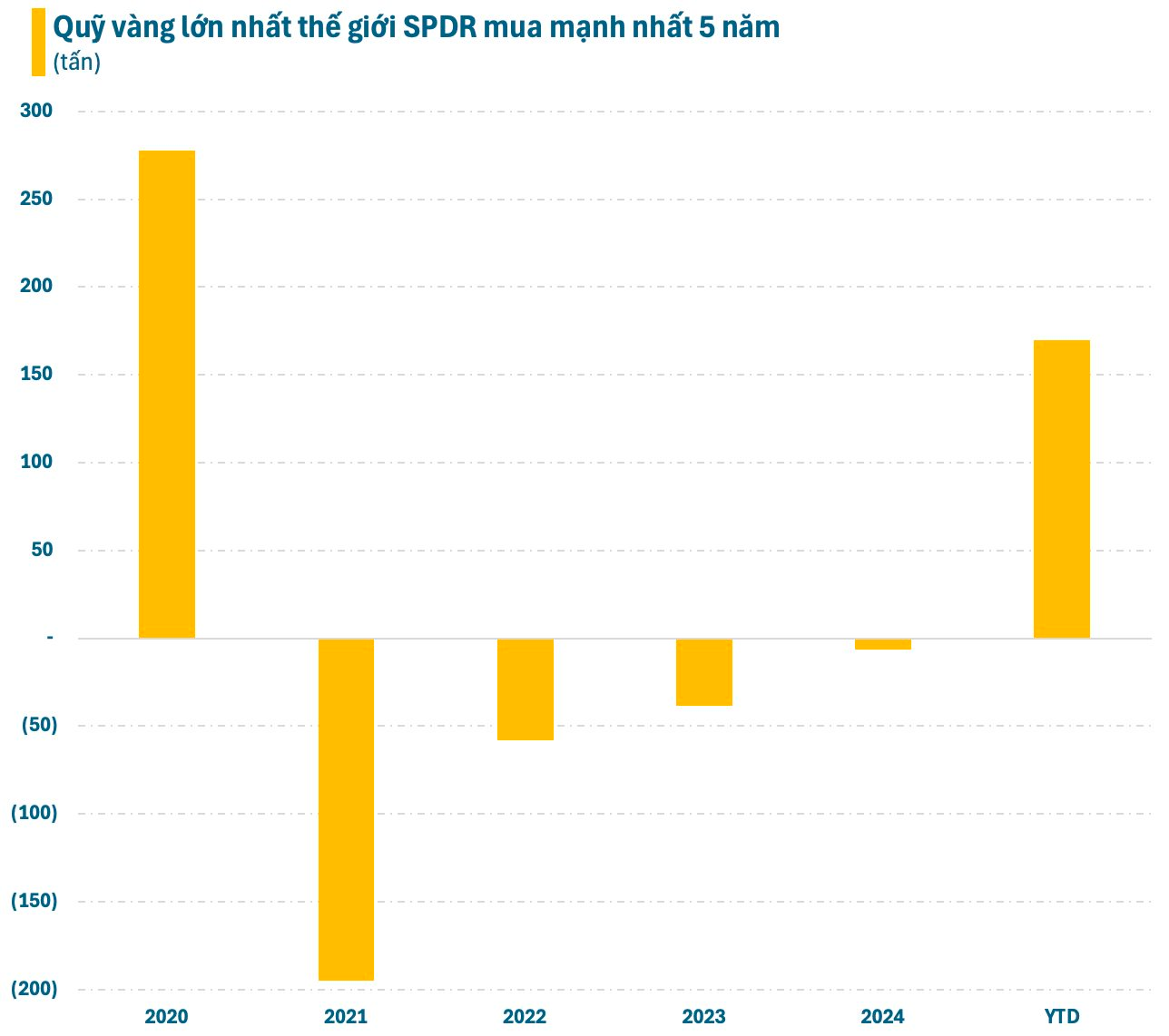

According to recent data, the world’s largest gold ETF, SPDR Gold Shares, has added 170 tons of gold (approximately $10 billion) since the beginning of 2025, marking the strongest inflow since 2020. This surge reverses the previous four years of net outflows, reflecting investors’ renewed confidence in gold as a “safe haven” amidst global uncertainties.

Source: Muavangbac.vn

Managed by State Street Global Advisors, SPDR is the largest physical gold ETF globally, with assets under management nearing $140 billion as of November 11. The fund currently holds over 1,042 tons of gold. This “gold rush” is driven by a combination of macroeconomic factors and market sentiment.

First, persistent inflation in the U.S. and Europe, though down from its 2022 peak, remains at 2.5-3%—above the Fed’s and most central banks’ targets. Gold, as a traditional hedge against inflation, has become a top choice for institutional investors.

Second, escalating geopolitical tensions have heightened demand for safe-haven assets. The trade war initiated by President Donald Trump and the uncertainty surrounding the U.S. economic outlook have further fueled global investor anxiety, making gold ETFs like SPDR a focal point for capital inflows.

Third, central bank actions play a crucial role. According to Goldman Sachs, countries like China, India, and Turkey have collectively purchased over 500 tons of gold in 2025 to diversify reserves and reduce USD dependency. This trend has a ripple effect, encouraging private capital to flow into ETFs like SPDR. Notably, the Harvard Endowment Fund invested $101.5 million in SPDR during Q3, marking its first significant gold bet.

The continuous buying by central banks and gold funds has been a key driver of gold prices. Since the start of the year, gold prices have soared 55%, from $2,300/ounce to over $4,000/ounce in October—an all-time high. Strong inflows into SPDR have supported prices by creating direct physical demand. Conversely, rising prices improve fund performance, attracting more investors.

Looking ahead, Shaokai Fan, Global Central Bank Director at the World Gold Council (WGC), predicts that gold accumulation through ETFs will accelerate globally in Q4, potentially surpassing previous records. This trend is expected to persist due to positive factors supporting further gold accumulation. Demand for gold bars and coins remains steady despite higher prices. The WGC maintains its positive outlook, with additional upside potential based on favorable prospects for China and India.

“Expanding demand is another positive factor for gold prices. Gold demand is expected to remain robust, driven by increased investment flows into both ETFs and physical gold. Central bank purchases continue to be a key driver of gold demand,” Fan noted.

Today’s Gold Price (Nov 9): Surprising Developments in Gold Bullion

Compared to its historical peak of $4,380 per ounce, the precious metal has declined by approximately $380, equivalent to roughly 12 million Vietnamese dong.