On the afternoon of November 11, 2025, in Melbourne, the State Securities Commission of Vietnam (SSC) delegation held a meeting with representatives from Vanguard Global Investment Fund—one of the world’s largest asset management firms, currently managing nearly USD 13 trillion. The discussion focused on opportunities for collaboration, development, and attracting foreign investment into Vietnam’s stock market.

Representing Vanguard Global Investment Fund were Mr. James Chatfield, Head of Asia-Pacific Trading and Senior Portfolio Management Director, along with research experts and transaction implementation specialists for Vanguard’s operations in Vietnam.

During the meeting, Vanguard representatives commended the SSC’s efforts in reforming and enhancing the legal framework and investment environment, particularly new policies aimed at facilitating international investors.

Vanguard also outlined its investment plans in Vietnam following the market’s upgrade, including opening trading and indirect capital accounts. The Fund emphasized that adhering to the new regulatory procedures will serve as a critical test, providing global investors with firsthand experience of Vietnam’s investment climate.

The meeting underscored the SSC’s commitment to modernizing the stock market, enhancing transparency, and fostering a secure, professional, and sustainable investment environment to meet international investor expectations.

Earlier on November 11, 2025, in Melbourne, Australia, Mrs. Vu Thi Chan Phuong, Chairwoman of the SSC, met with Mr. Joseph Longo, Chairman of the Australian Securities and Investments Commission (ASIC). This meeting was part of the SSC delegation’s agenda in Australia from November 10–14, 2025, to attend ASIC’s 2025 Annual Conference, “Australia in a Dynamic World,” which addressed topics such as the future of capital markets, digital technology, administrative streamlining, and ASIC’s enforcement priorities.

Also in attendance were ASIC Board members, unit leaders, and representatives from the SSC’s leadership.

Overview of the meeting. Photo: TTTT

At the meeting, Mr. Joseph Longo congratulated Vietnam’s stock market on its upgrade from frontier to emerging status, hailing it as a significant milestone in the market’s development.

Mr. Longo noted that ASIC has consistently supported the SSC in market reforms and capacity building since August 2024, when the two agencies signed a Memorandum of Understanding. Their collaborative efforts have included conferences, seminars, and training programs on sustainable finance, corporate governance, inspection, supervision, and fraud prevention via social media.

SSC Chairwoman Vu Thi Chan Phuong and ASIC Chairman Joseph Longo pose for a photo. Photo: TTTT

Chairwoman Vu Thi Chan Phuong acknowledged the practical impact of the two agencies’ cooperation on Vietnam’s stock market development.

Looking ahead, she expressed hope for continued collaboration in inspection, supervision, enforcement, capital mobilization, corporate bond issuance, fund industry growth, and new product development. She also proposed joint training initiatives to strengthen corporate governance for listed companies.

Additionally, Chairwoman Phuong highlighted Vietnam’s Government Resolution No. 05/2025/NQ-CP on piloting a cryptocurrency trading market. She requested ASIC share its experience in managing Australia’s crypto asset market, which will inform Vietnam’s implementation efforts.

In response, Mr. Joseph Longo provided insights into Australia’s crypto asset regulation and affirmed ASIC’s readiness to share expertise in the proposed areas.

The meeting concluded successfully, with both leaders updating each other on their respective market developments and discussing mutual interests, paving the way for more effective future collaborations.

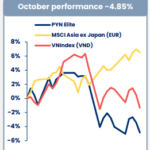

No Reason to Be Pessimistic: Current Price Levels Are More Than Reasonable, Says Mr. La Giang Trung

According to experts, if we assume the market cannot worsen beyond the “tariff” bottom seen in April, the current price range is exceptionally reasonable for any investor.