The year 2025 marks a historic milestone for Vietnam’s stock market with its upgrade. The market’s robust growth and surging liquidity have enabled securities companies to expand their capital and assets, while also intensifying their core operations to achieve unprecedented profits.

Fierce Capital Increase Competition

In the financial sector, particularly in securities, capital is a critical factor for survival. The evolving stock market demands greater capital capacity from securities companies. In recent times, these firms have taken significant steps to enhance this crucial metric.

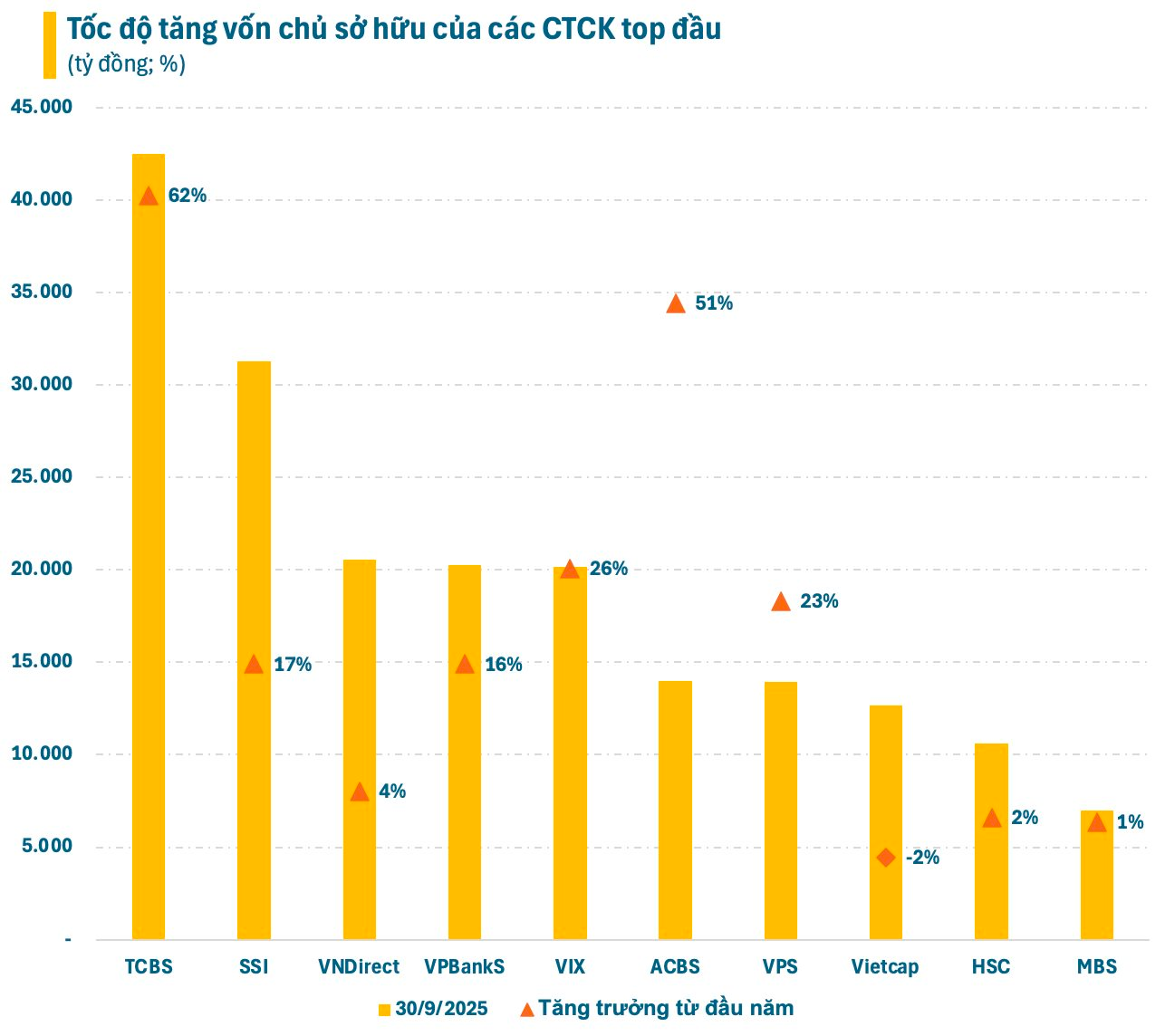

By the end of Q3 2025, the total equity capital of securities companies reached 308 trillion VND, a 43 trillion VND increase compared to the end of 2024, marking an all-time high. Among these, the top five securities companies—TCBS, SSI, VNDirect, VPBankS, and VIX—each boast equity capital exceeding 20 trillion VND. The race for capital in the securities industry has never been more intense.

TCBS has emerged as the industry leader in equity capital, surpassing 40 trillion VND, a first for any securities company. Since the beginning of the year, TCBS’s equity capital has grown by 62%, the highest among the top securities firms. This growth is primarily driven by increased chartered capital and accumulated profits.

Lending Activities Surge, Record-High Outstanding Loans

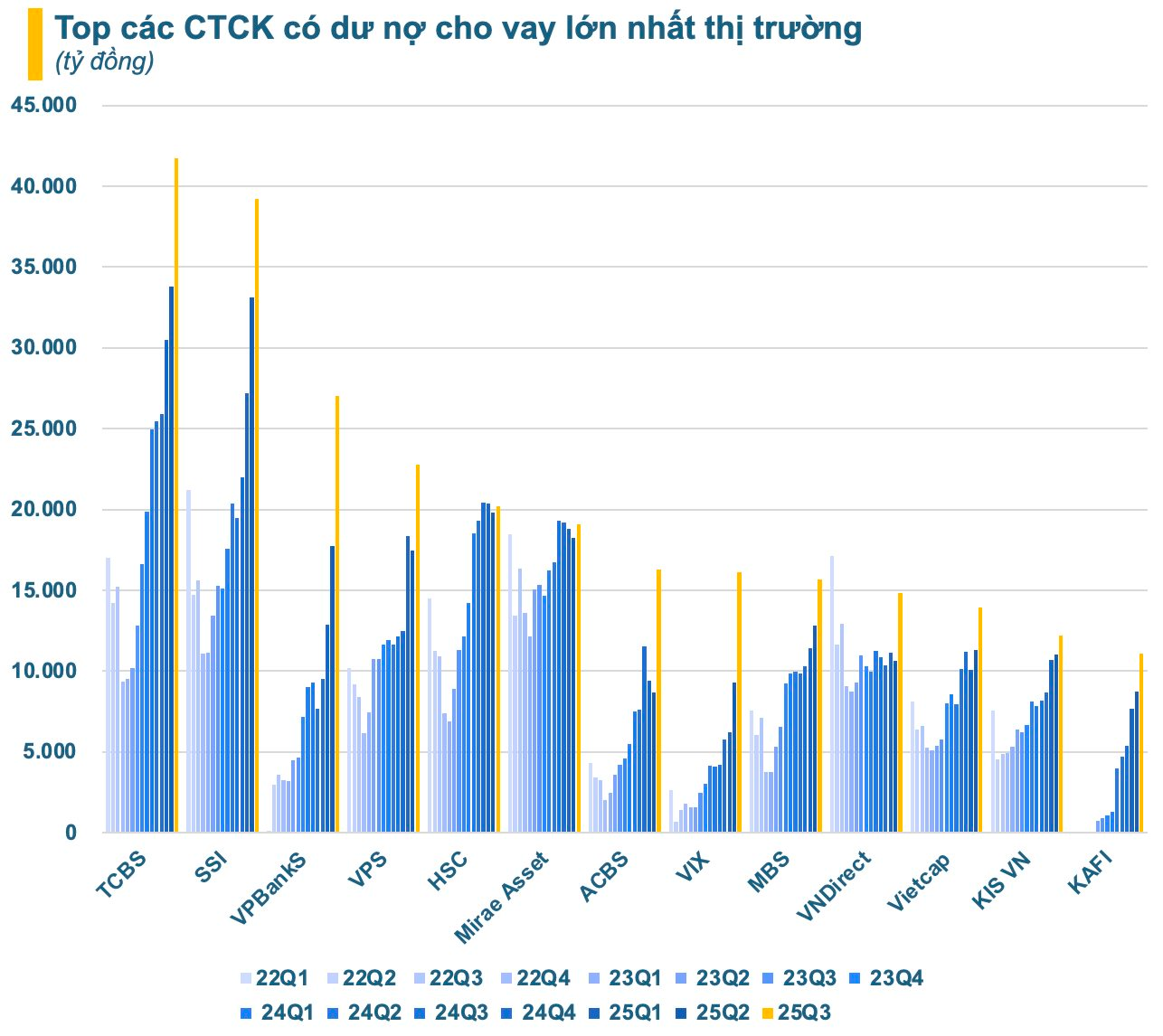

Improved capital capacity has allowed securities companies to significantly expand their core operations, particularly lending. The total outstanding loans in the market are estimated at around 383 trillion VND, an increase of over 138 trillion VND compared to the end of last year, setting a new record high. Most securities companies have seen growth in their outstanding loans, reaching unprecedented levels.

With their leading capital scale, TCBS and SSI also dominate the lending sector. By the end of Q3, TCBS held the largest loan portfolio in the market, exceeding 40 trillion VND, while SSI closely followed with a slightly smaller portfolio. Additionally, VPBankS has rapidly expanded its lending activities, securing the third position in the industry.

Lending is becoming increasingly vital to the business results of securities companies, especially as brokerage competition intensifies and proprietary trading struggles to sustain long-term growth. With the stock market’s robust development and a growing investor base, margin lending demand is expected to rise significantly, offering ample opportunities for securities companies.

First Securities Company with Assets Surpassing 100 Trillion VND

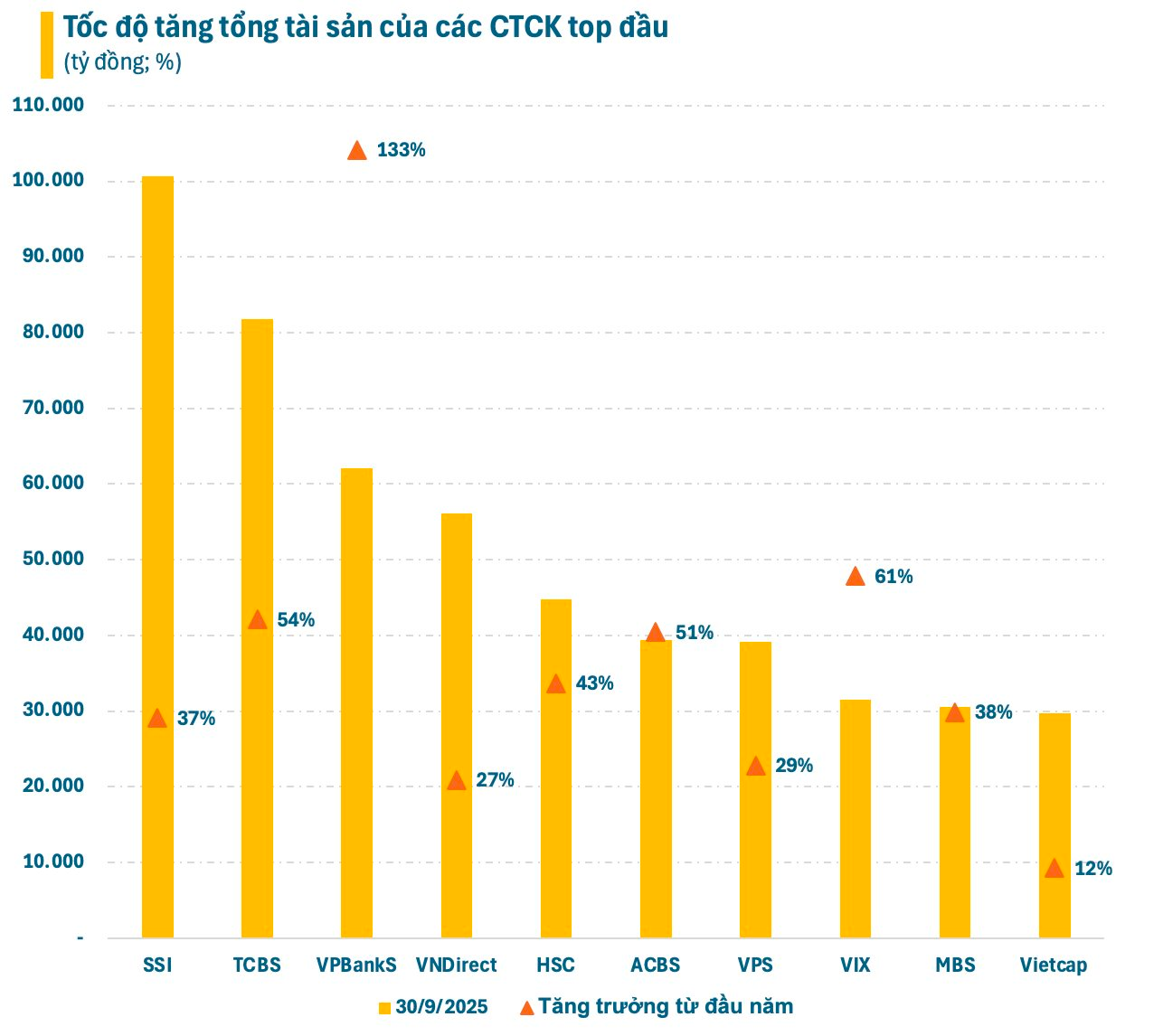

The expansion of core activities has driven a significant increase in the total assets of securities companies. The top 10 firms now have total assets of at least 30 trillion VND, all recording double-digit growth. Notably, VPBankS’s total assets grew by 133% compared to the beginning of the year, propelling it to the third position, just behind SSI and TCBS.

As of Q3 2025, SSI leads the industry with total assets exceeding 100 trillion VND, far ahead of its competitors. This marks the first time a Vietnamese securities company has reached this milestone. TCBS follows closely with total assets surpassing 80 trillion VND. Both companies have seen substantial asset growth since the beginning of the year.

The rapid growth in asset scale, outpacing the increase in equity capital, indicates a higher leverage ratio among securities companies. This strategy is justified given the low lending interest rates, allowing firms to leverage additional capital for business expansion.

Intensifying Market Share Battle

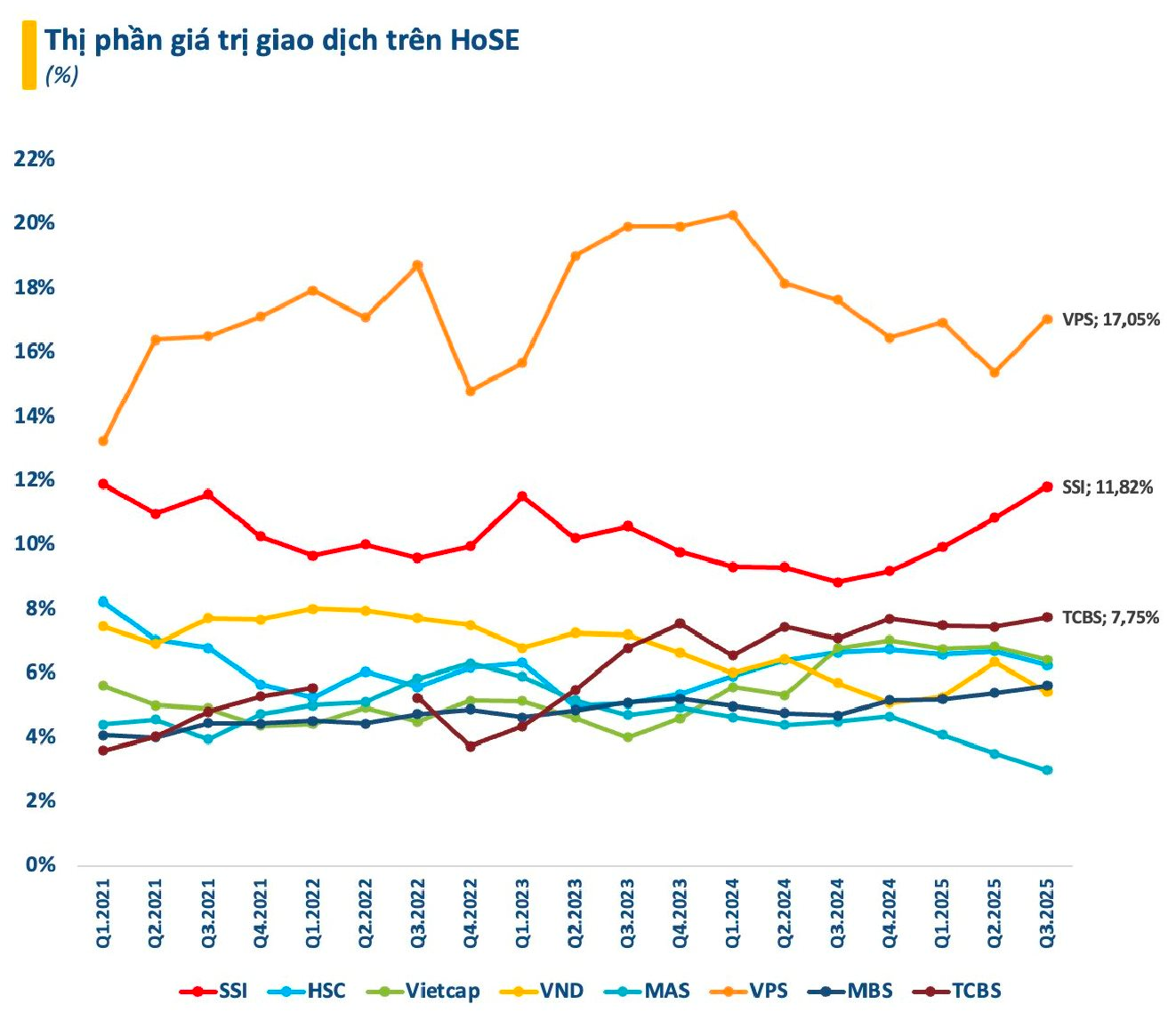

Beyond capital strength, market share is a critical factor in evaluating a securities company. In the battle for market share, VPS continues to dominate across the HoSE, HNX, UPCoM, and derivatives markets. However, its market share has significantly narrowed as SSI rebounds strongly and TCBS accelerates impressively.

SSI once held the top market share on HoSE before VPS emerged with a robust brokerage team and competitive commission rates. Meanwhile, TCBS adopted a unique strategy by pioneering a “Zero fee” policy, leveraging technology, fintech, and eliminating the need for brokers. This approach helped TCBS surpass many established names to secure the third position in HoSE trading market share.

A larger market share reflects a thicker customer base, enabling securities companies to cross-sell other products like margin lending, consulting, and fund certificates. These revenue streams can significantly exceed trading fees, prompting more firms to adopt Zero fee policies like TCBS to compete for market share.

Profit Breakout “Dark Horse”

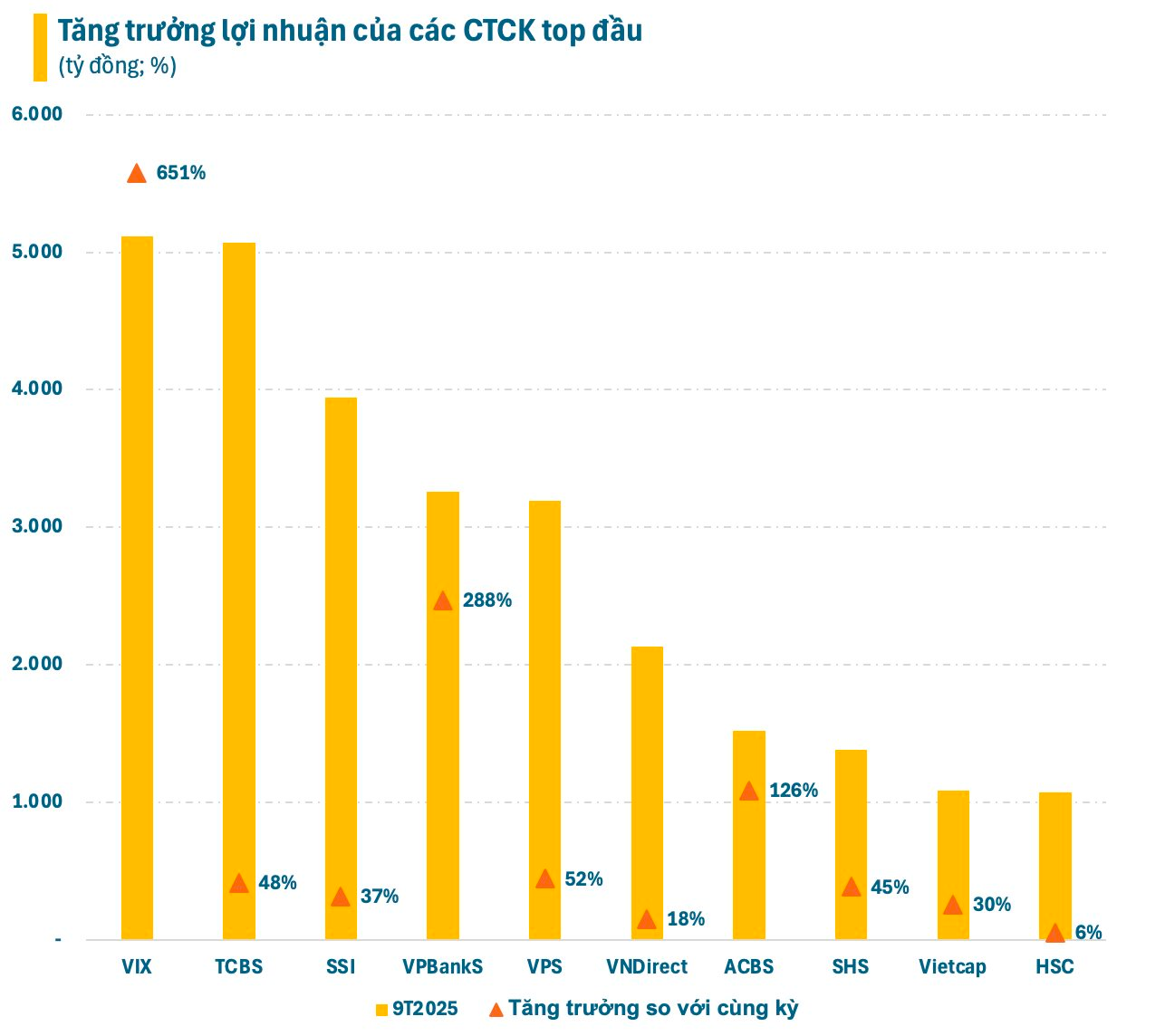

With the market’s boom, securities companies’ profits have grown positively. The top 10 profit-making securities companies in the first nine months all recorded pre-tax profits exceeding one trillion VND, with positive growth compared to the same period last year. Some even doubled their profits, achieving record highs.

Despite not leading in brokerage or lending market share, VIX has been the most impressive performer in the profit race. The company reported a pre-tax profit of over 5.1 trillion VND in the first nine months, a 650% increase compared to the same period in 2024. VIX’s profit primarily stems from proprietary trading, benefiting from the market’s strong upward trend.

VPBankS is another notable performer, accelerating strongly in Q3. Its Q3 pre-tax profit surged nearly sevenfold year-on-year, surpassing both TCBS and SSI to rank second in the industry. For the first nine months, VPBankS climbed to fourth place in terms of profit, overtaking several major players.

Over the long term, TCBS, SSI, and VPS demonstrate stable performance, excelling across key business segments like brokerage and lending. Their profit composition is more sustainable, ensuring high efficiency even in less booming market conditions.

Shift in Market Capitalization Leadership

Beyond operational activities, the capitalization race among securities companies has intensified following the IPO wave. Most notably, TCBS’s successful IPO valued the company at over 4 billion USD. Although its stock price has since adjusted downward, TCBS’s market capitalization remains above 100 trillion VND, leading the securities industry. This blockbuster deal not only revalues the securities sector but also heats up the IPO race, adding quality assets to the market.

Meanwhile, VPS is in the midst of an IPO attracting nearly 20,000 investors. The subscription volume has already exceeded the total number of shares offered (202.3 million units). The deal is expected to raise over 12 trillion VND for VPS. However, this is not the largest capital raise by a securities company through an IPO.

The record for the largest IPO in the securities industry belongs to VPBankS, which raised nearly 13 trillion VND. Backed by VPBank’s comprehensive financial ecosystem, VPBankS is poised to become a formidable contender in the securities industry post-listing. The company is already showing strong acceleration across multiple fronts.

In summary, the growing stock market presents significant opportunities for securities companies. However, the rewards will not be evenly distributed. Only those with ambition, capability, and readiness to seize opportunities will thrive. Conversely, less proactive and slower-changing firms risk falling behind in the increasingly fierce competitive environment.

FChoice is an annual award announced by CafeF, honoring outstanding events, individuals, policies, and businesses in Vietnam’s economy. Launched in 2021, FChoice is more than just an award; it is a “map of achievements” highlighting breakthrough stories with significant impacts on the national economy, particularly in finance. FChoice does not have fixed categories but selects based on annual achievements and public interest.

As Vietnam’s economy undergoes a strong transformation towards digitalization and sustainability, FChoice serves as a “launchpad” for successful stories to spread, contributing to building a prosperous Vietnam. Join us in following and voting to honor the drivers of Vietnam’s economic transformation this year!

Unraveling the Margin Record: Reflections and Insights

The VNIndex has declined for four consecutive weeks, while margin lending debt has reached an all-time high, presenting significant challenges to Vietnam’s stock market. To achieve sustainable growth, the market urgently requires fresh capital, driven by investor confidence and proactive decision-making.

Deputy Minister of Finance Outlines Strategies for Robust Growth in Bond and Stock Markets by 2026

At the October 2025 Government Press Conference, Deputy Minister of Finance Nguyễn Đức Chi outlined strategic measures to bolster capital mobilization through initial public offerings (IPOs) and corporate bond issuances.

VCI Approves Private Placement of Up to 127.5 Million Shares, Anticipating 10-20% Profit Surge in Annual Plan

On the afternoon of November 7thOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE:On the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in theOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in the company’s business prospects and changes in executive leadership.