Closing the session on November 11, the VN-Index ended at 1,593 points, up 13 points (or 0.83%).

The trading session on November 11 opened dynamically, with the VN-Index swiftly gaining 5 points in the early minutes. This surge was fueled by the return of blue-chip stocks in the banking sector (BID, VCB), securities (SSI, HCM), steel (HPG, HSG), and the Vingroup conglomerate (VIC, VHM, VRE).

The upward momentum continued, pushing the index past the 1,595-point mark, driven by inflows into essential consumer stocks. Notable performers included VNM (Vinamilk), MSN (Masan), and MWG (The Gioi Di Dong). However, profit-taking pressure emerged in the latter half of the morning session, particularly in banking stocks, narrowing the gains.

In the afternoon session, the market experienced a 30-minute tug-of-war, with the VN-Index briefly dipping below the reference level due to technical selling. Yet, mid-session saw a surge in bottom-fishing demand for banking, consumer, and securities stocks, swiftly reversing the index’s trajectory. The positive sentiment spread to real estate (NVL, PDR) and public investment stocks (CTD, HBC), solidifying the VN-Index above the 1,590-point threshold.

By the close, the VN-Index settled at 1,593 points, up 13 points (0.83%).

According to the Bank for Foreign Trade of Vietnam Securities (VCBS), while buying interest is gradually returning, the market may still face significant volatility on November 12.

VCBS notes that investor sentiment remains cautious, with capital flows sharply diverging. Preference is given to stocks in sectors with unique narratives or promising Q4/2025 outlooks, such as retail, securities, and banking.

“Investors can leverage pullbacks to strategically allocate funds into recently breakout stocks,” VCBS advises.

Meanwhile, several securities firms predict that the recovery on November 12 may face continued volatility to test buying interest. Nonetheless, opportunities remain for selective accumulation strategies. Investors should closely monitor liquidity and foreign trading patterns to adjust their portfolios promptly.

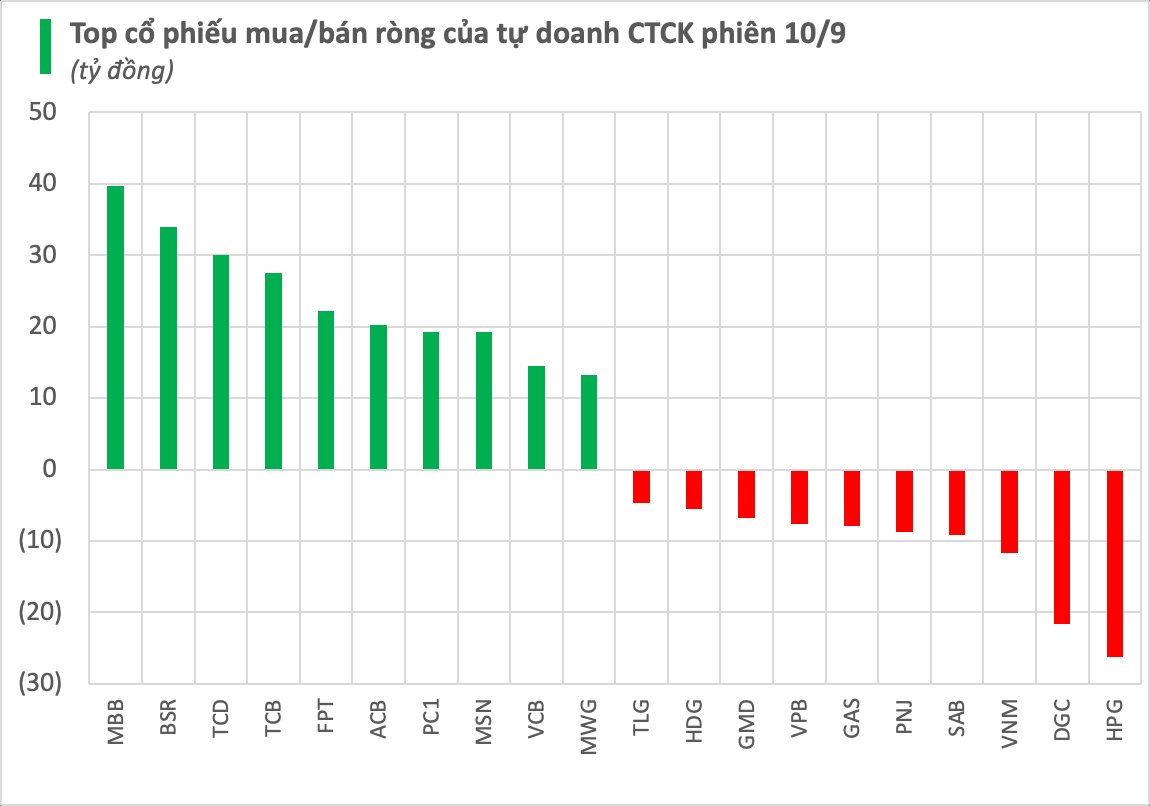

November 12th Session: Brokerage Proprietary Traders Unexpectedly Net Buy VND 500 Billion in Gelex Group Stocks, Contrasting Heavy Selling in a Major Bank Stock

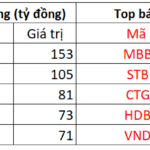

Proprietary trading desks at securities companies executed a net buy of VND 152 billion on the Ho Chi Minh Stock Exchange (HOSE) today.