Billion-dollar stocks maintain momentum as VN-Index hovers around 1,600 points

Among companies with a market capitalization exceeding 1 billion USD, several stocks have demonstrated a stronger ability to maintain momentum compared to the broader market during the VN-Index‘s adjustment to the 1,600-point level.

An increased proportion of stocks in the 1 billion USD group show short-term upward trends.

|

As of the trading session on November 12, approximately 30% of these stocks have shown a recovery in their short-term upward trends.

Some stocks, such as BCM, GVR, SAB, VNM, BID, and REE, have rebounded ahead of the market, despite being overlooked for several months.

BCM, GVR, BID, and REE are among the billion USD stocks with modest performances.

|

Notably, BID peaked earlier than the market during the upgrade anticipation phase. Currently, it is one of the few bank stocks showing early recovery efforts.

Meanwhile, BCM and GVR, representing the industrial zone and rubber sectors, are also rebounding. Although they have not fully recovered from the 2025 tariff shock, this indicates a more stable investor sentiment compared to April 2025.

In the defensive sector, BVH has shown a positive shift, even as many banks increased short-term deposit rates. The insurance sector is expected to benefit from rising interest rates and a shift towards safer assets.

Stocks like VNM, SAB, GAS, and REE have also stabilized, outperforming the broader blue-chip market.

According to Ms. Nguyễn Thị Bảo Trân, a securities analyst at Mirae Asset (Vietnam), “There is a shift in capital towards insurance and energy sectors, reflecting investors’ defensive stance. In volatile times, capital tends to favor less cyclical sectors or those with strong financial foundations.”

Upcoming market support factors

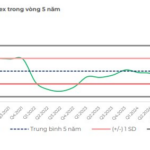

Despite significant adjustments, the market has several medium-term support factors, including monetary policy, credit growth, and capital market restructuring.

The State Bank reports that credit growth reached approximately 15% by the end of October 2025 compared to the end of 2024. Credit is projected to grow by 19-20% by the end of 2025, the highest in recent years, indicating improved capital demand and absorption.

The government aims to make IPOs and corporate bonds key medium- to long-term capital raising channels.

Decree 245/2025/NĐ-CP has reduced listing time to around 30 days when combined with IPO processes.

Another focus is increasing participation from institutional investors, particularly investment funds.

The Ministry of Finance is developing regulations for infrastructure bond funds, a capital raising channel for national infrastructure development.

Regulators are also considering money market funds (MMFs), a globally popular low-risk, liquid investment option, suitable for risk-averse investors.

Additionally, controlled short-selling is under consideration.

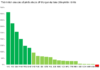

Recent changes demonstrate the regulator’s commitment to meeting FTSE Russell’s secondary emerging market standards.

FTSE Russell plans to upgrade Vietnam to a “Secondary Emerging Market” in the FTSE GEIS index, effective September 2026, pending a March 2026 review.

Notably, FTSE has preliminarily included 28 Vietnamese stocks in the FTSE Global All Cap Index, marking significant progress in Vietnam’s international financial integration.

– 10:00 13/11/2025

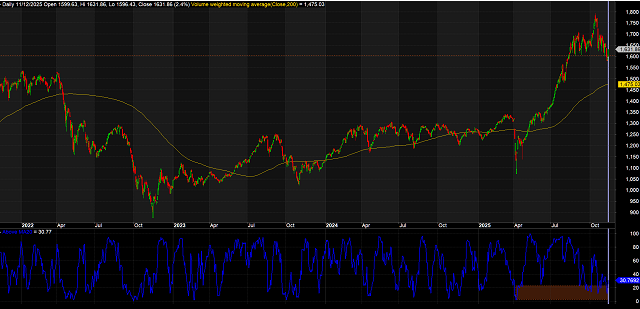

Technical Analysis Afternoon Session 13/11: Stochastic Oscillator Signals a Buy Opportunity

The VN-Index staged a modest recovery, forming a small-bodied candle, while the Stochastic Oscillator signaled a return to buying momentum. Meanwhile, the HNX-Index extended its upward trajectory, decisively breaching the Middle line of the Bollinger Bands.

A Key Signal That Stocks Have Bottomed Out

In November, DSC identified this region as a promising area with the potential to establish a mid-term bottom, presenting an opportune moment for cash-holding investors to consider entering the market.