The overall outlook for Vietnam’s industrial park (IP) real estate sector in Q3/2025 remains positive.

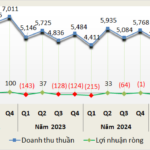

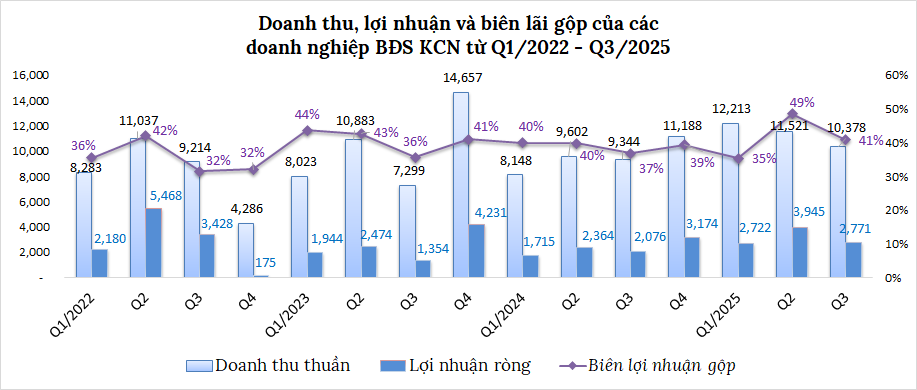

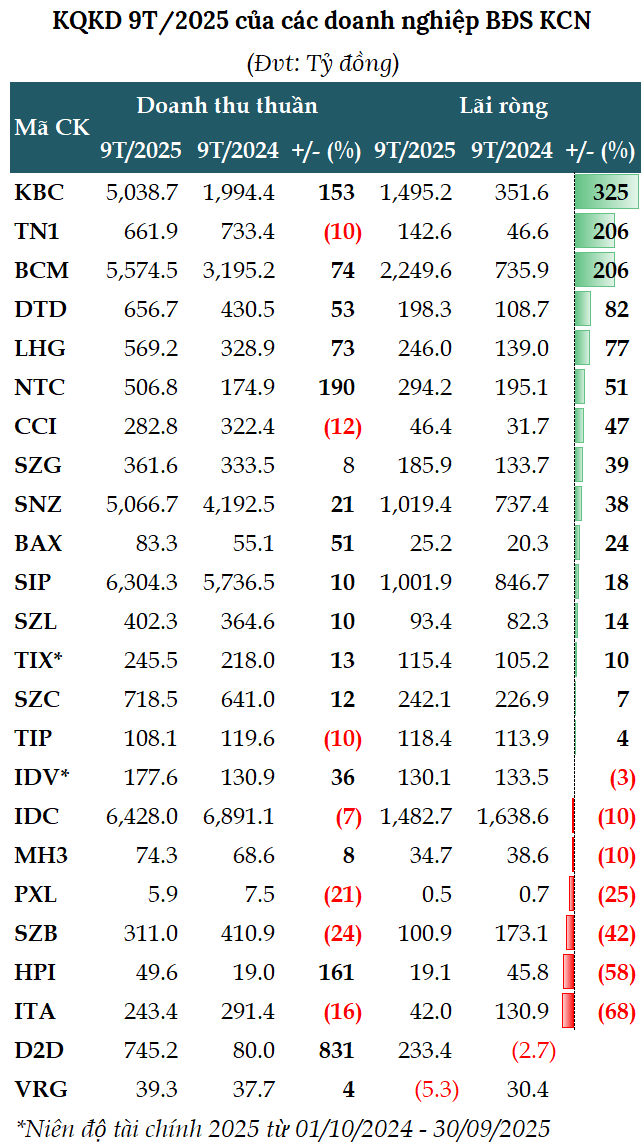

According to VietstockFinance, the total revenue of 24 listed IP real estate companies reached nearly VND 10.4 trillion, with net profit of VND 2.8 trillion, up 11% and 33% year-on-year, respectively. However, compared to the previous quarter, both revenue and profit declined by 10% and 30%. The gross margin for the quarter stood at 41%, 4 percentage points higher than the same period last year.

Source: VietstockFinance

|

Broad-based Growth, Early Achievers Emerge

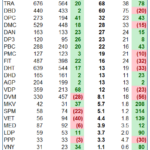

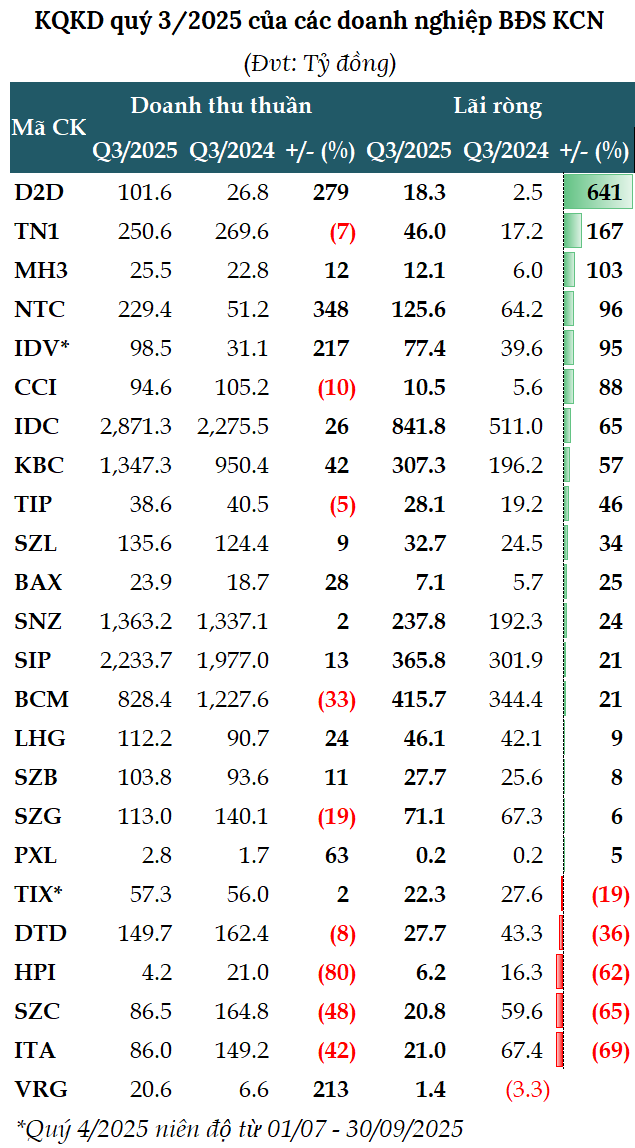

In Q3/2025, 18 out of 24 companies reported profit growth, while 5 saw declines and 1 turned a loss into a profit.

Source: VietstockFinance

|

Notably, Industrial and Urban Development Corporation No. 2 (HOSE: D2D) saw its profit surge to over VND 18 billion, more than 7 times higher than the same period last year, thanks to the transfer of Chau Duc IP land. After nine months, its post-tax profit exceeded VND 233 billion, a strong reversal from a loss of nearly VND 3 billion in the same period last year, surpassing its full-year profit target by 33%.

Binh Long Rubber Industrial Park (UPCoM: MH3) reported a profit of VND 12 billion, double that of the same period last year, due to cost-cutting measures and higher interest income from deposits and loans. However, its nine-month profit dipped 10% to nearly VND 35 billion, achieving 90% of its annual target.

Nam Tan Uyen Industrial Park (NTC) recorded a net profit of nearly VND 126 billion in Q3, up 96%—the highest since Q1/2019—after recognizing the full value of land lease contracts. After nine months, it has already exceeded its annual profit plan.

Similarly, Sonadezi (SNZ) reported a profit of nearly VND 238 billion, up 24%, bringing its nine-month profit to nearly VND 1,020 billion, 19% above its annual plan.

Sài Gòn VRG Investment (SIP) maintained steady growth, with a net profit of nearly VND 366 billion, up 21% year-on-year, driven by strong revenue from utility services and real estate. Its nine-month cumulative profit exceeded VND 1.1 trillion, surpassing its annual target.

Leading the sector in profit was IDICO (HNX: IDC), with nearly VND 842 billion, up 65% year-on-year, accounting for 28% of the sector’s total profit. However, due to weak performance in the first half, its nine-month profit reached nearly VND 1,483 billion, down 10%, achieving 87% of its annual plan.

Closely following was Becamex Group (HOSE: BCM), with a net profit of nearly VND 416 billion, up 21%. Its nine-month profit reached nearly VND 2,250 billion, three times higher than the same period last year, achieving 92% of its annual plan.

In the North, Kinh Bac Urban Development Corporation (HOSE: KBC) reported a Q3 profit of over VND 307 billion, up 57%, driven by increased revenue from land leases, real estate transfers, and factory rentals. Its nine-month profit exceeded VND 1,495 billion, 4.3 times higher than the same period last year. However, due to a high annual target, the company has only achieved 49% of its goal after three quarters.

Source: VietStockFinance

|

Losing Steam

While some companies surged ahead, others showed signs of slowing down. Notably, Sonadezi Chau Duc (HOSE: SZC) reported a profit of just over VND 20 billion, down 65%, the lowest in 10 quarters. This was primarily due to a 77% decline in its core IP infrastructure business, which generated only VND 33 billion. After nine months, SZC’s profit reached over VND 242 billion, up 7%, achieving 80% of its annual plan.

Tan Tao Investment and Industry Corporation (UPCoM: ITA) saw its profit drop 69% to VND 21 billion. After nine months, ITA’s profit reached VND 42 billion, down 68%, achieving only 19% of its annual plan.

Which Industrial Park Giant Has the Highest Debt?

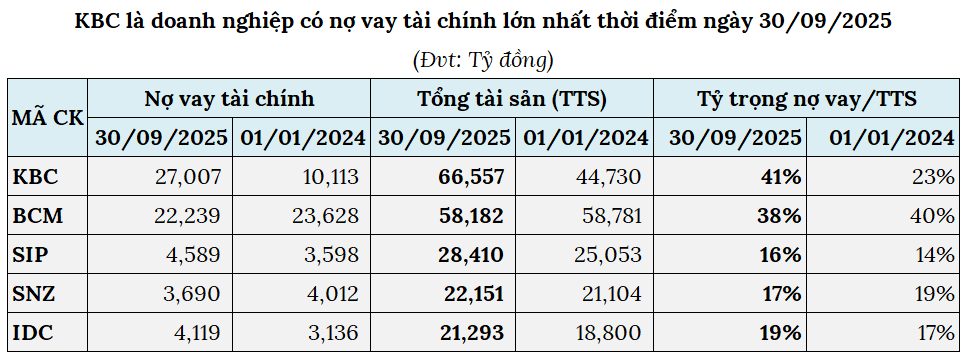

As of September, KBC had the highest financial debt, exceeding VND 27 trillion (over USD 1 billion), mostly long-term bank loans, 2.7 times higher than the beginning of the year and accounting for 67% of total debt. Kinh Bac has been increasing its debt since early 2025, primarily to fund the Trang Cat project and accelerate other construction projects.

Next is BCM, with debt exceeding VND 22.2 trillion, including over VND 13.7 trillion from bonds.

Source: VietStockFinance

|

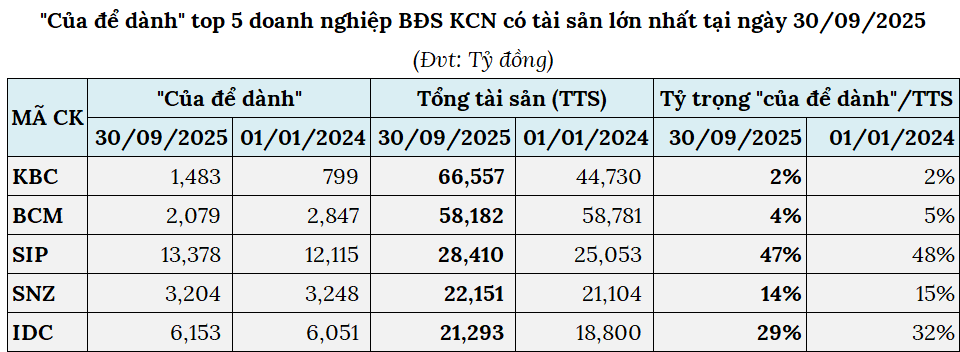

On the other hand, some companies hold significant advance payments from land and factory tenants, providing substantial long-term reserves. SIP leads with nearly VND 13.4 trillion, accounting for 47% of total assets, up 10% from the beginning of the year. IDC follows with nearly VND 6.2 trillion, up 2%, accounting for 29% of its capital.

Source: VietStockFinance

|

Foreign direct investment (FDI) remains a key driver for the IP real estate sector. In the first 10 months of 2025, realized FDI in Vietnam reached USD 21.3 billion, up 8.8% year-on-year and the highest in five years. Real estate investment accounted for USD 1.5 billion, or 7% of the total.

– 08:16 13/11/2025

Traphaco (TRA) Appoints New Female CEO from Sales & Marketing Amid 79% Profit Surge

Traphaco (TRA) has appointed Ms. Dao Thuy Ha, Deputy General Director in charge of Sales & Marketing, as the new General Director. This decision follows the company’s impressive 79% profit growth in Q3 2025.

Cement Industry Profits Surge in Q3, Anticipating Strong Year-End Growth

Third-quarter revenue for 17 listed cement companies rose 6%, with industry-wide profits surpassing 70 billion VND, a stark reversal from the 60 billion VND loss incurred in the same period last year. This marks the second consecutive profitable quarter. Fueled by increased public investment disbursement and a gradually recovering real estate market, the sector is poised for accelerated growth in the final months of the year.

Nghệ An Welcomes ‘Eagle’ to Cement Its Position as North Central Vietnam’s Green Industrial Hub

Nestled in a prime geographical location, with a rapidly developing infrastructure and flexible investment policies, Nghe An is emerging as a magnet for major FDI players. This transformative growth solidifies its position as the leading hub for green industrial development in the North Central Coast region of Vietnam.