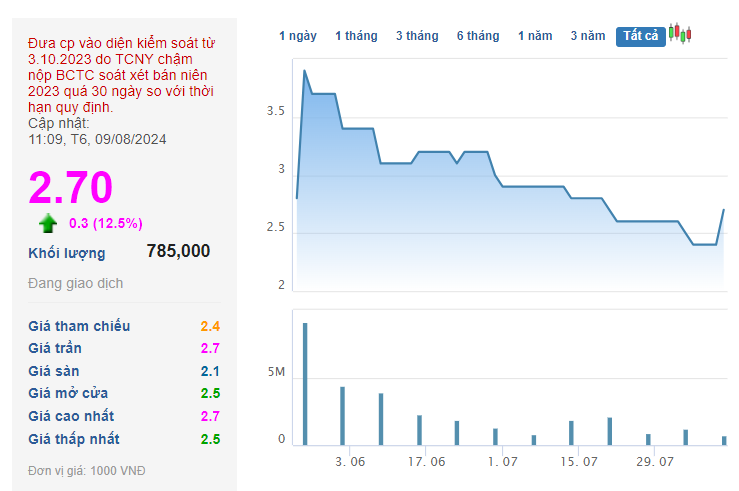

Seven consecutive ceiling sessions of BQP – Source: VietstockFinance

|

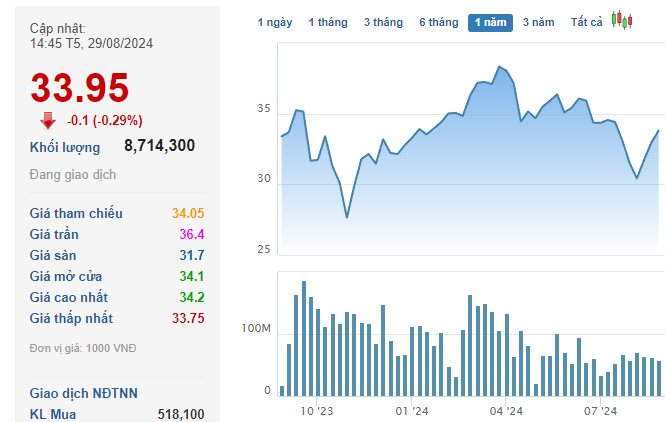

Closing the session on November 13, BQP shares continued to rise to the maximum limit of 31,900 VND/share, marking the 7th consecutive “purple” session since its listing. The current market price is more than three times the initial reference price of 10,000 VND/share, while the average trading volume during this period exceeded 5,000 shares/session.

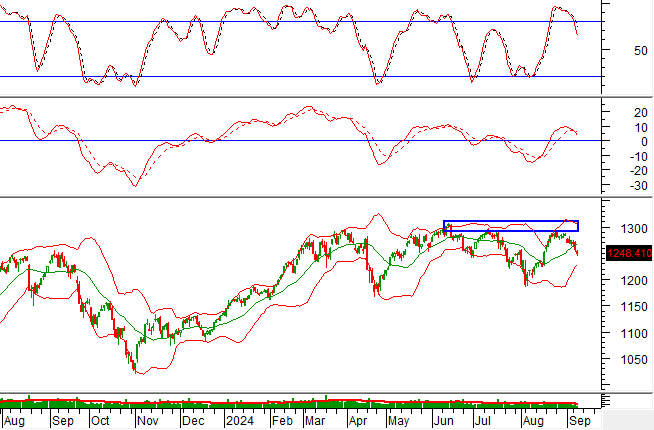

The continuous rise of BQP occurs amidst a volatile overall market, with the VN-Index experiencing four consecutive weeks of decline and losing more than 43 points, falling below the 1,600-point mark in the session on November 7.

| Price increase since listing of BQP |

In response to the sharp rise in share prices, BQP issued an explanation, stating that the shares have only been traded on UPCoM since November 5, 2025. The price fluctuations in recent sessions are primarily attributed to the natural supply and demand dynamics of the stock market, with the company taking no actions to influence the share price.

The company also affirmed that its production and business activities remain normal and stable, in line with the 2025 plan, with no internal information or unusual events affecting price movements.

Profit growth amidst the hot streak

Established in 2019, Binh Thuan High-Quality Plastics has a charter capital of 150 billion VND, with Binh Thuan Plastics Group holding 53.12% of the capital. The company operates a factory in Dong Van IV Industrial Park (Ninh Binh) with a total investment of over 229 billion VND and a capacity of 29 million products/year.

Plastic factory of BQP

|

According to the Q2 2025 financial report (July 1 – September 30), BQP recorded revenue of over 345 billion VND and a net profit of 8.8 billion VND, up 31% and 37% year-on-year, respectively. For the first two quarters of the fiscal year, revenue increased by 15% to nearly 623 billion VND, while net profit reached 16.3 billion VND, a 24% increase.

As of September 30, the company had undistributed after-tax profits of over 17 billion VND, a significant increase from 802 million VND at the beginning of the fiscal year; bank deposits of nearly 54 billion VND, down 18%. Inventory totaled over 169 billion VND, accounting for nearly one-third of total assets and increasing by 14% compared to the beginning of the period, primarily consisting of raw materials and supplies, which made up more than 89%. Short-term loan debt reached nearly 148 billion VND, up 17%.

– 18:53 13/11/2025

Which Blue-Chip Stocks Are Fueling Positive Market Sentiment?

Amidst recent market turbulence, numerous large-cap stocks have plummeted by 15–25% in just weeks, casting a shadow of caution over investor sentiment. Yet, amidst this volatility, select billion-dollar stocks have demonstrated remarkable resilience, rebounding sooner than the broader market. These stalwarts have emerged as critical pillars of stability, offering a glimmer of hope as markets retreat into sensitive territory.