Infrastructure Cost Deduction Discrepancies in Land Pricing

The Ho Chi Minh City Real Estate Association (HoREA) has recently provided feedback on the draft resolution of the National Assembly, which outlines mechanisms and policies to address challenges in the implementation of the Land Law.

HoREA continues to propose improvements to the application of the “land price table” and “land price adjustment coefficient” for calculating land use fees and land rent when the state allocates or leases land, or permits changes in land use for real estate projects, commercial housing, and urban areas.

Additionally, they advocate for addressing inconsistencies in the “deductible infrastructure costs” to encourage investors to develop in challenging areas, thereby increasing land value.

HoREA proposes specific infrastructure investment rates for unique projects. Illustrative image.

Mr. Le Hoang Chau, Chairman of HoREA, stated that while points d and e of Article 5 in the draft resolution correctly identify “infrastructure construction costs for the land area returned to the state” as a basis for calculating land use fees and rent, the determination of “infrastructure construction costs” remains unclear, as it is entirely dependent on construction law regulations.

Therefore, the Association suggests that the Ministry of Construction be tasked with issuing technical standards and specific infrastructure investment rates to determine infrastructure costs for unique projects, such as those on weak land foundations, land reclamation projects, or remote areas with high infrastructure costs.

This addition is deemed essential to ensure fairness and transparency in determining investors’ financial obligations, while also incentivizing development in challenging and underdeveloped regions.

According to Mr. Chau, the current determination of “infrastructure construction costs” is based on “construction law provisions.” However, existing construction laws do not provide detailed guidelines for calculating these costs.

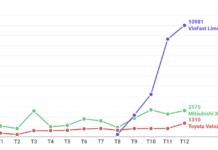

Annually, the Ministry of Construction publishes investment rates and composite construction prices for the upcoming year, as seen in Decision 409/QĐ-BXD dated April 11, 2025. This decision sets the investment rate for urban technical infrastructure at 7.5 to 8.5 million VND per hectare, depending on the project scale.

In practice, however, infrastructure investment costs for projects are typically 30% higher than the rates specified in the Ministry’s decision. Notably, the investment rates in Decision 409/QĐ-BXD decrease as project scale increases, whereas larger urban projects often incur higher infrastructure costs due to the need for social and “soft” infrastructure investments.

Special Mechanisms Needed for Unique Projects

Mr. Chau argues that this creates an imbalance for projects with unique geological conditions, such as those on weak land foundations, land reclamation projects, or remote areas, where material transportation, labor, and infrastructure costs are significantly higher than in more accessible regions.

Thus, the Association urges the government to instruct the Ministry of Construction to issue technical standards and infrastructure investment rates tailored to unique projects in areas with weak land foundations, land reclamation, or remote regions lacking connectivity infrastructure.

Refining the regulations on deductible infrastructure costs and establishing realistic investment rate determination mechanisms will encourage investors to develop in challenging areas, ultimately enhancing land value.

Mr. Chau also expressed HoREA’s support for the government’s submission of the replacement Construction Law to the National Assembly, hoping that subordinate legislation will address current inconsistencies, fostering a transparent and sustainable investment environment aimed at achieving double-digit economic growth from 2026 onward.

Unlocking Growth: Phat Dat’s Leadership Philosophy – “Strategic Investment, Layered Development”

Vietnam’s real estate market is entering a profound reshaping phase, with infrastructure and urban planning emerging as the primary drivers of investment capital.

Northern Investors Shift Preferences, Affirming Real Estate Potential in Ho Chi Minh City’s Western Region

Expanding investments into Ho Chi Minh City and its surrounding areas, where lies the “sure-win” destination for Northern investors in terms of both value and investment potential?