Technical Signals of VN-Index

During the morning trading session on November 14, 2025, the VN-Index continued to fluctuate with a small-bodied candle, preparing to test the Middle line of the Bollinger Bands.

The 100-day SMA will act as a support in the coming period, as the Stochastic Oscillator indicates a buy signal in the oversold region.

Technical Signals of HNX-Index

In the morning session on November 14, 2025, the HNX-Index continued its upward trend after surpassing the Middle line of the Bollinger Bands.

The short-term outlook is positive, with both the MACD and Stochastic Oscillator indicators signaling a rebound.

PVD – Petrovietnam Drilling & Well Services Corporation

In the morning session on November 14, 2025, the share price of PVD rose for the second consecutive session, with trading volume expected to exceed the 20-day average by the end of the session, indicating active investor participation.

Furthermore, the stock price is closely following the Upper Band of the Bollinger Bands, while the MACD indicator continues to widen its gap with the Signal line after giving a buy signal. This suggests a positive short-term outlook.

However, the price of PVD is retesting the 61.8% Fibonacci Retracement level (equivalent to the 26,900-27,700 range), while the Stochastic Oscillator is moving in the overbought region. If the indicator gives a sell signal and falls out of this region, short-term correction risks may emerge.

VNM – Vietnam Dairy Products Joint Stock Company

In the morning session on November 14, 2025, the share price of VNM rose for the fourth consecutive session, accompanied by a Big White Candle pattern and increasing trading volume above the 20-session average, reflecting investor optimism.

Currently, the price of VNM is retesting the September 2025 high (equivalent to the 61,900-63,400 range), while the MACD indicator continues to rise above the zero line after giving a buy signal. If the upward momentum persists and breaks through the previous high, the long-term uptrend will be further reinforced.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:04 November 14, 2025

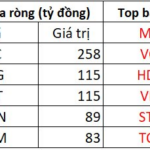

Foreign Block Continues Net Selling Streak, Offloading Nearly VND 500 Billion as VN-Index Rallies, Heavily Dumping “Bank, Securities” Stocks

In the afternoon trading session, VIC shares emerged as the most heavily accumulated stock by foreign investors across the entire market, with a staggering net buying value of 258 billion VND.