Illustrative Image

China is in the process of establishing a liquefied natural gas (LNG) tanker fleet to import gas from Russia, despite U.S. sanctions on Moscow’s energy sector. While these efforts are in their early stages, signs of ownership and shipping operations within China are beginning to mirror patterns previously observed in Russia.

Experts suggest that building a domestic LNG fleet will enable China to transport Russian gas covertly, bypassing international restrictions on one of the Kremlin’s critical industries.

A notable example is the LNG tanker CCH Gas, which transports Russian gas and is currently blacklisted. It concealed its location while heading to a Chinese port. Its registered owner, CCH-1 Shipping, has a legal address in Hong Kong that matches the mailbox of Samxin Secretarial Services—a common tactic to obscure actual ownership in fuel transactions involving Iran or Russia. Another LNG tanker, recently renamed Kunpeng, was spotted near Singapore with a similar ownership structure.

However, constructing a covert LNG fleet is no simple task. LNG must be transported at -162°C, requiring far more complex handling and shipping technology than conventional oil tankers.

Additionally, China has relaxed restrictions on private investors, allowing them to own more than 10% in certain rail and energy projects, many of which are publicly funded. This move paves the way for greater non-state participation in these strategic sectors.

This scenario echoes Russia’s “shadow fleet,” built to export oil and gas while evading international sanctions. Estimates suggest that one in every six oil tankers globally belongs to Russia’s covert fleet, accounting for approximately 17% of all active oil tankers. Most are older vessels operating under neutral flags, posing environmental risks while facilitating sanction-evading oil sales.

These developments indicate that China is proactively building capacity to transport Russian gas, opening a new chapter in international energy and trade strategies amid tightening geopolitical tensions and sanctions.

Over the past few years, China has emerged as the world’s largest LNG importer, surpassing Japan as the top buyer of super-chilled gas since 2021. This dominance has reshaped Asia’s energy landscape, with China accounting for over 40% of the continent’s total LNG import growth. Imports for 2025 are projected to decline by 6-11%, reaching 76.65 million tons.

Russia’s Massive Rare Earth Mine: Why the World’s Decades-Long Supply Remains Untapped

Tomtor, Russia’s largest rare earth mine, is capturing global attention amidst a volatile supply landscape.

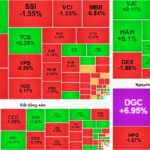

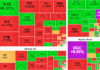

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.