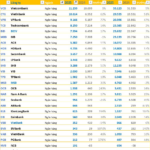

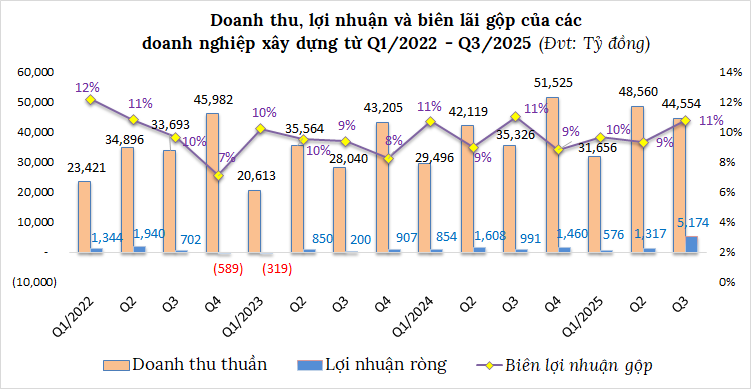

The total revenue from 99 construction companies listed on the stock exchanges (HOSE, HNX, UPCoM) that released their Q3/2025 financial reports exceeded VND 44.5 trillion, marking a 26% increase year-over-year. Net profit reached a record high of nearly VND 5.2 trillion, surging by 422%. The industry’s gross margin for the quarter stood at 11%.

Source: VietstockFinance

|

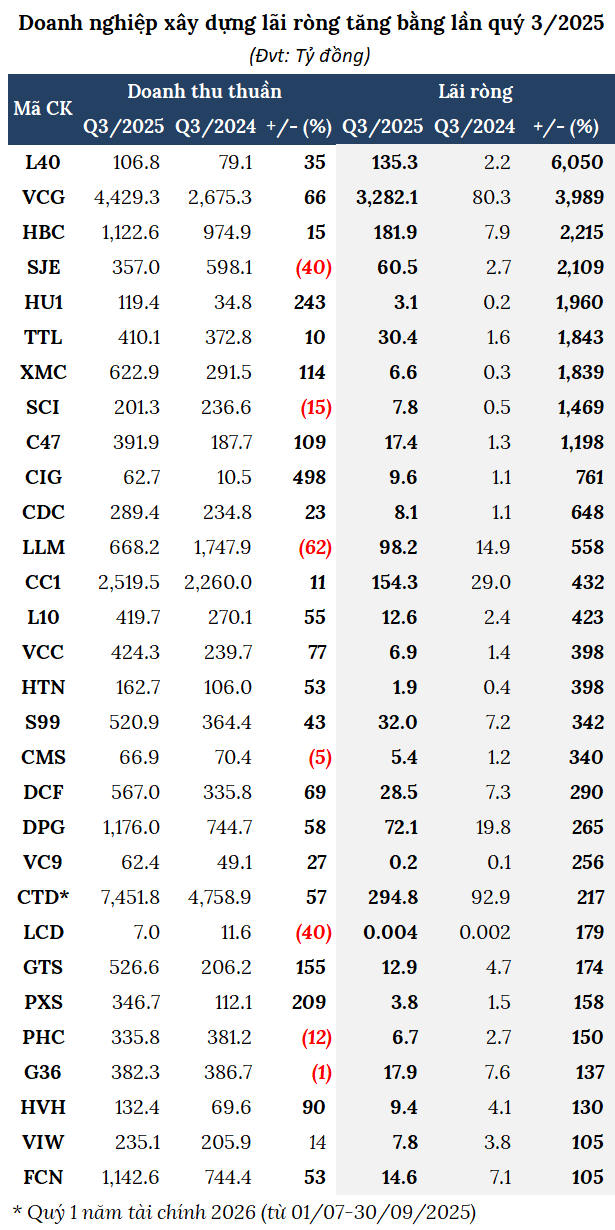

Leading Players See Profits Soar

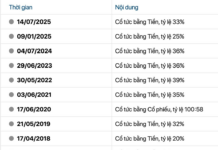

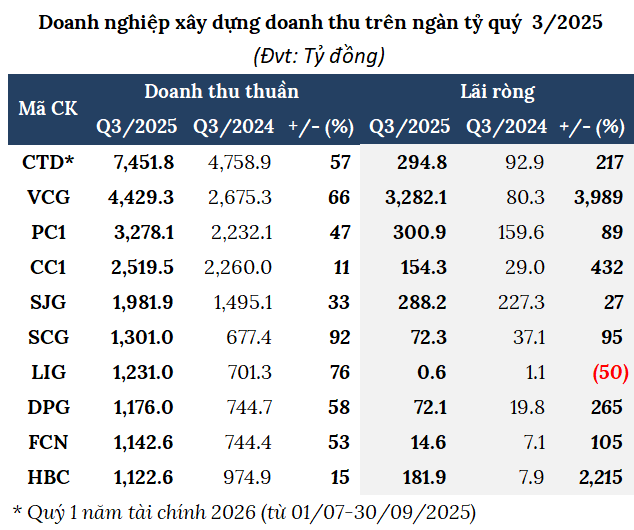

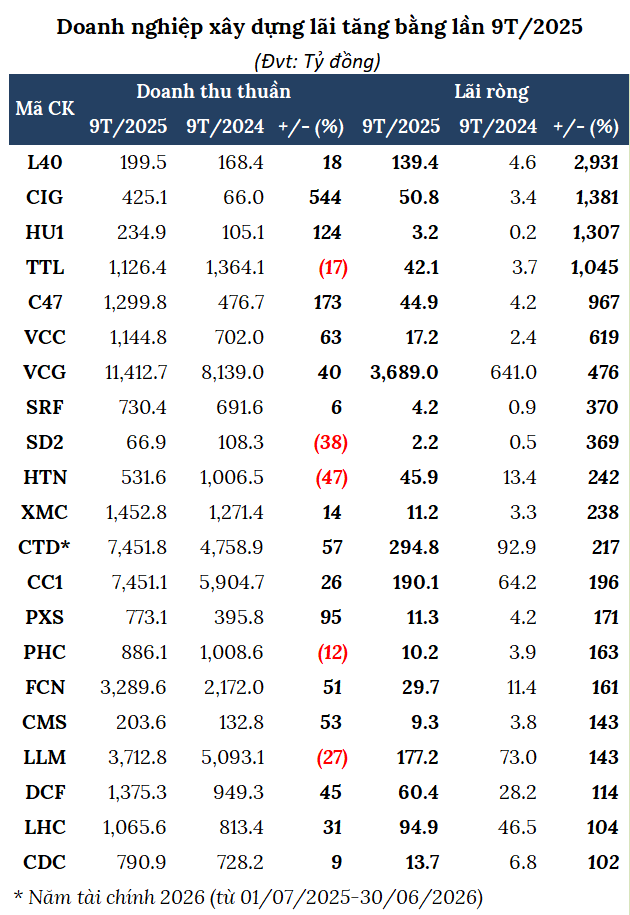

Data from VietstockFinance reveals that 49 out of 99 companies reported profit growth, with 30 of them doubling their earnings. This remarkable surge is primarily attributed to the high profits of industry leaders, though not from core business operations. For instance, Vinaconex (HOSE: VCG) achieved a historic net profit of nearly VND 3.3 trillion, accounting for 63% of the industry’s total profit, thanks to the divestment from the Cát Bà Amatina resort project.

In the first nine months, VCG earned nearly VND 3.8 trillion, a 394% increase year-over-year, surpassing its annual profit target by 215%.

Vinaconex’s Record Profit of VND 3.3 Trillion from Cát Bà Resort Divestment

| VCG’s Q3/2025 Net Profit Hits Record High |

Despite Vinaconex’s impressive earnings, it wasn’t the top performer. That title goes to Construction Investment Corporation 40 (HNX: L40), which reported a record profit of over VND 135 billion, a 62-fold increase year-over-year. This was driven by the profit from transferring ownership of Hà My Complex JSC, the developer of the Hà My Urban Complex in Đà Nẵng. Over nine months, L40’s net profit reached over VND 139 billion, a 30-fold increase, far exceeding its annual plan.

L40’s Leadership Change Leads to Hundred-Billion Deal

| L40’s Q3/2025 Net Profit Hits Record High |

Hòa Bình Construction Group (UPCoM: HBC) also had a strong quarter with a profit of VND 182 billion, a 23-fold increase, largely due to court-awarded compensation for late payments. However, its nine-month profit dropped by 72% to VND 238 billion, equivalent to 72% of its 2025 target.

Meanwhile, Coteccons (HOSE: CTD) started its 2026 fiscal year (July 1 – September 30, 2025) with a net profit of nearly VND 300 billion, more than triple the previous year, driven by a 59% increase in construction contracts, achieving over 40% of its annual plan.

Source: VietstockFinance

|

Challenges Persist

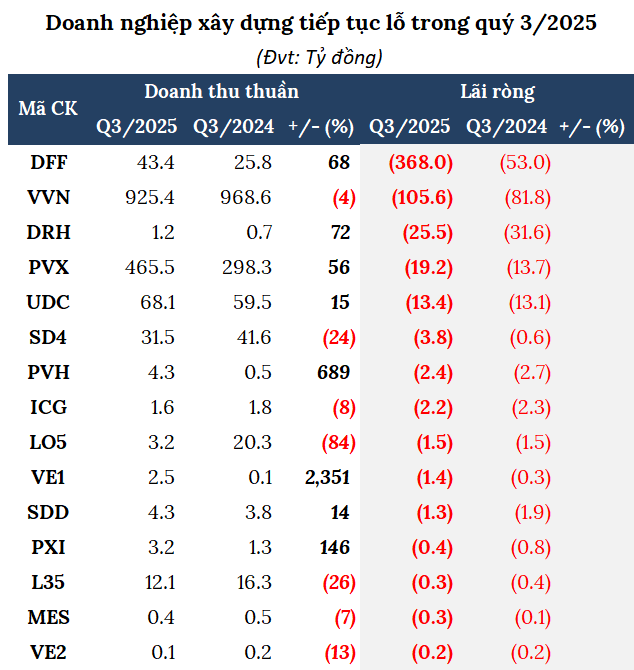

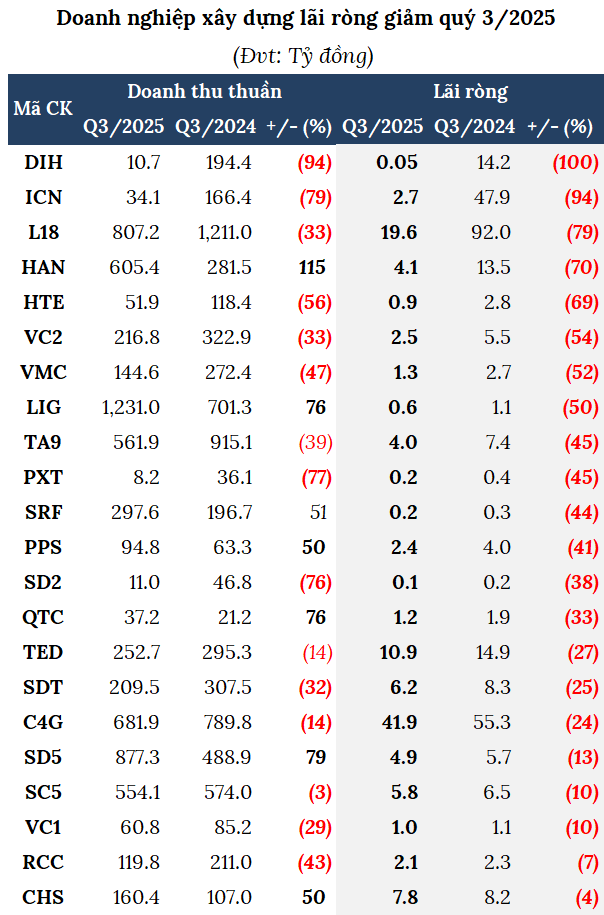

While some companies thrived, others continued to struggle with significant losses.

Đua Fat Group (UPCoM: DFF) extended its losing streak to nine consecutive quarters, recording a record loss of over VND 368 billion, bringing cumulative losses to over VND 1,273 billion and negative equity of VND 473 billion.

Vietnam Industrial Construction Corporation (VVN) reported its 12th consecutive quarterly loss of VND 106 billion, with cumulative losses nearing VND 3,233 billion and negative equity of over VND 2,386 billion.

Notably, after 38 consecutive quarters of losses (since Q1/2016), Vinaconex 39 (UPCoM: PVV) turned a profit in Q3, earning over VND 200 billion, not from core operations but from asset transfers to offset bank debt. This reduced PVV’s cumulative losses to over VND 334 billion, though equity remains negative at VND 12 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

Billion-Dollar Revenues

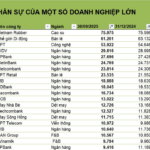

In Q3, 10 construction companies achieved revenues exceeding VND 1 trillion. Alongside established leaders like CTD, VCG, CC1, and PC1, FECON (HOSE: FCN) joined the list with nearly VND 1,143 billion, up 53%, and a net profit of nearly VND 15 billion, up 105%.

Đạt Phương Group (HOSE: DPG) reported revenue of nearly VND 1,176 billion and a profit of VND 72 billion, up 58% and 265%, respectively. Licogi 13 (HNX: LIG) generated VND 1,231 billion in revenue, up 76%, but profits halved to nearly VND 600 million.

Source: VietstockFinance

|

Source: VietstockFinance

|

The Burden of Receivables

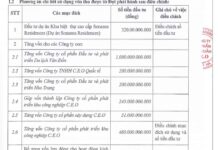

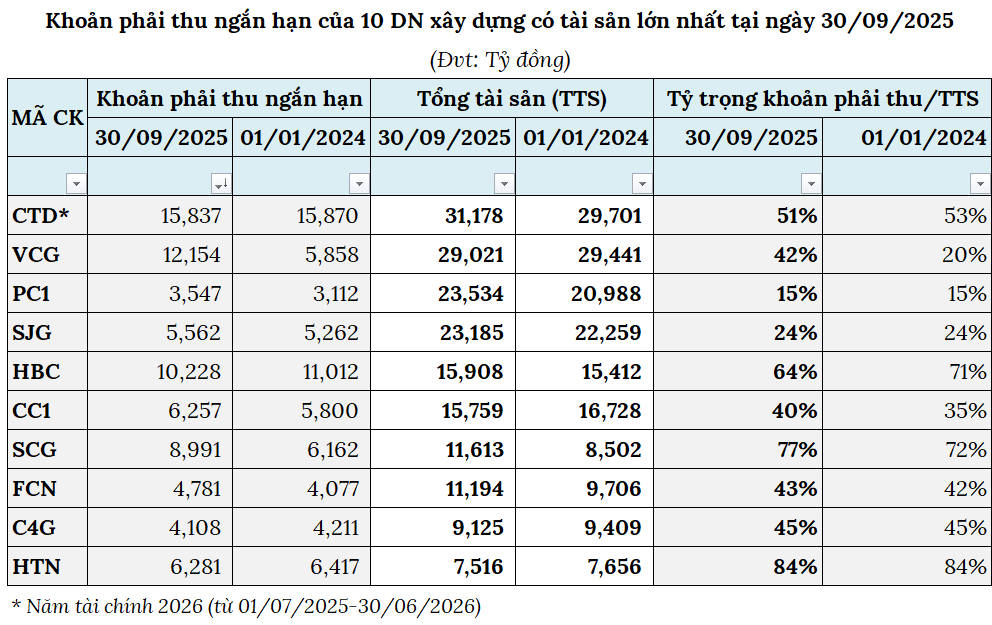

One of the biggest challenges for construction companies is debt recovery. As of September 30, 2025, short-term receivables, particularly from customers, dominate the balance sheets of the 10 largest construction companies by total assets.

Hưng Thịnh Incons (HOSE: HTN) has short-term receivables of nearly VND 6.3 trillion, accounting for 84% of total assets, with customer receivables exceeding VND 2.7 trillion.

SCG Group (HNX: SCG) has short-term receivables of nearly VND 9 trillion, up 46% from the beginning of the year and representing 77% of total capital, with customer receivables of nearly VND 3.7 trillion.

In terms of value, CTD leads with short-term receivables of over VND 15.8 trillion, 51% of total assets, 96% of which are customer receivables, with bad debt provisions of over VND 1.3 trillion.

VCG’s short-term receivables surged to nearly VND 12.2 trillion, more than double the beginning of the year, accounting for 42% of total assets, due to VND 6.3 trillion in short-term loan receivables, 9.4 times higher than the beginning of the year. Bad debt provisions exceed VND 527 billion.

Source: VietstockFinance

|

Rising Material Costs: The Biggest Hurdle

According to the Q3/2025 construction industry report by the General Statistics Office and the Ministry of Finance, the primary challenge for construction companies is the surge in raw material prices, followed by a lack of new construction contracts.

Other issues include capital shortages, unpaid construction debts, labor shortages, insufficient raw material supply, complex administrative procedures, and delayed land clearance.

To improve conditions, construction companies urge the government, ministries, and local authorities to provide support with raw materials, access to preferential capital, faster procedures, and reduced loan interest rates. They also call for transparent bidding information, reduced administrative procedures, and penalties for project owners delaying debt settlements to ensure capital circulation and timely land handover.

– 08:00 14/11/2025

The 2025 Q3 Layoff Wave: 14 Banks Cut Nearly 7,300 Jobs, While Two FPT Subsidiaries Ramp Up Hiring Despite Parent Group’s Reduction

Among companies disclosing workforce figures, FPT Retail (FRT) leads with the highest personnel growth, adding 1,983 employees. FPT Telecom (FOX) follows closely in second place, with an increase of 986 employees.

Q3/2025 Financial Report Deadline: BIDV, Petrolimex, Gemadept, Vinpearl, and More Announce Updates by October 31st

Vietcombank and VietinBank have both reported impressive pre-tax profits for Q3/2025, surpassing the VND 10,000 billion mark.