I. VIETNAMESE STOCK MARKET OVERVIEW FOR THE WEEK OF NOVEMBER 10-14, 2025

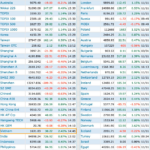

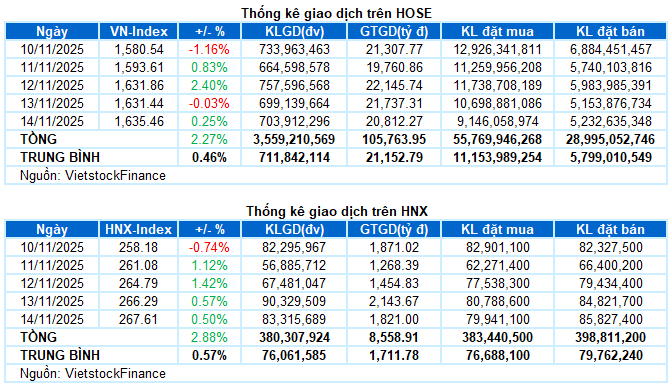

Trading Activity: Major indices maintained their upward trend during the November 14th session. The VN-Index edged up by 0.25%, closing at 1,635.46 points, while the HNX-Index rose by 0.5%, reaching 267.61 points. For the entire week, the VN-Index gained a total of 36.36 points (+2.27%), and the HNX-Index added 7.5 points (+2.88%).

The Vietnamese stock market witnessed a notably positive recovery week following four consecutive weeks of decline. In the first two sessions, the VN-Index traded below the 1,600-point threshold with subdued trading activity. However, the absence of a strong sell-off despite losing this critical psychological support level set the stage for the subsequent rebound. The recovery momentum was significantly triggered mid-week, and the index maintained a balanced state in the final two sessions, characterized by clear market polarization. The VN-Index gained a total of 36.36 points over the week, closing at 1,635.46 points.

In terms of impact, TCX, LPB, and HPG were the top contributors in the final session, adding 2 points to the VN-Index. Conversely, CTG, VPL, and MSN led the decline, subtracting over 1 point from the index.

Sector performance remained polarized. The information technology sector led the market with a nearly 1% increase, primarily driven by FPT (+1.11%), VEC (+4.34%), and DLG (+1.49%).

Indices for large-cap sectors such as industrials, financials, and real estate fluctuated within narrow ranges, with mixed gains and losses. While several stocks maintained strong buying interest, including CII (+2.65%), GEX (+1.92%), VSC (+1.1%); VIX (+3.2%), MBS (+1.69%), TCX (+3.04%), LPB (+2.04%); CEO (+1.57%), DXG (+1.32%), DIG (+2.25%), IDC (+2.4%), HDC (+1.82%), and NVL hitting the ceiling, many others traded in the red, such as HVN, BMP, GMD, HAH, MST; STB, VCI, CTG, ACB; KSF, BCM, VCR, and more.

The communication services sector was the only one to decline, with significant selling pressure on FOX (-0.81%), VNZ (-2.53%), SGT (-2.07%), and TTN (-1.14%).

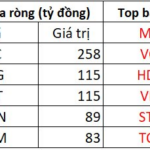

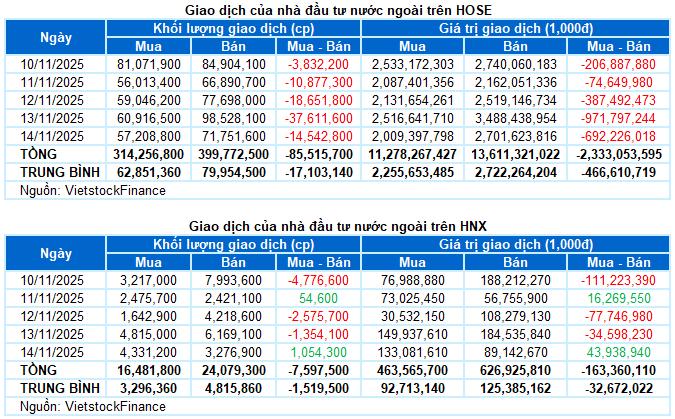

Foreign investors continued to net sell, with a total value of nearly VND 2.5 trillion across both exchanges over the week. Specifically, foreign investors net sold over VND 2.3 trillion on the HOSE and more than VND 163 billion on the HNX.

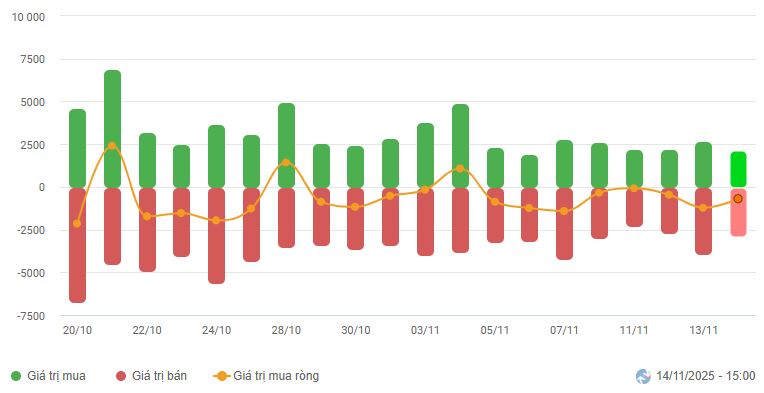

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

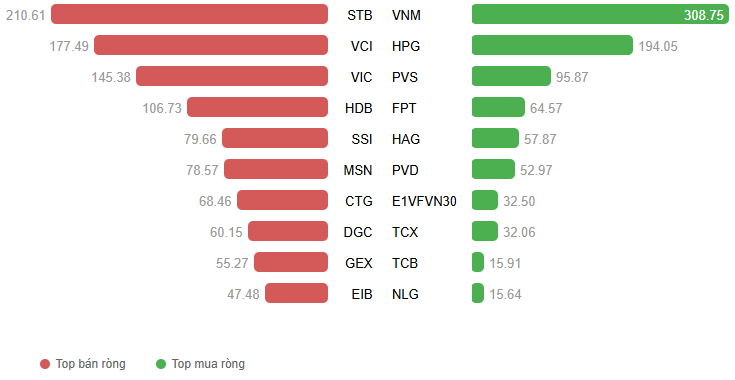

Net Trading Value by Stock Code. Unit: Billion VND

Top Performing Stock of the Week: CII

CII +10.31%: CII experienced a strong recovery week after three weeks of adjustment. The stock price rose for four consecutive sessions, surpassing the Middle Band of the Bollinger Bands.

Currently, the Stochastic Oscillator continues to rise after giving a buy signal and has exited the oversold region. Simultaneously, the MACD indicator has also given a buy signal by crossing above the Signal line, further reinforcing the positive short-term outlook.

Worst Performing Stock of the Week: JVC

JVC -10%: JVC had a less-than-ideal trading week, with the stock price falling below the 50-day SMA and clinging to the Lower Band of the Bollinger Bands. Alternating sessions of gains and losses with volatile trading volumes reflect investor uncertainty.

The MACD indicator has fallen below the zero line and continues to widen its distance from the Signal line. The risk of further adjustment remains if conditions do not improve in the upcoming sessions.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:15 14/11/2025

Technical Analysis Afternoon Session 14/11: Preparing to Test the Middle Bollinger Band

The VN-Index remains in a tight tug-of-war, forming a small-bodied candle as it approaches testing the Middle line of the Bollinger Bands. Meanwhile, the HNX-Index shows promising momentum, with both the MACD and Stochastic Oscillator indicators signaling a buy opportunity.

Foreign Block Continues Net Selling Streak, Offloading Nearly VND 500 Billion as VN-Index Rallies, Heavily Dumping “Bank, Securities” Stocks

In the afternoon trading session, VIC shares emerged as the most heavily accumulated stock by foreign investors across the entire market, with a staggering net buying value of 258 billion VND.