Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 649 million shares, equivalent to a value of more than 18.1 trillion VND; the HNX-Index reached over 66.7 million shares, equivalent to a value of more than 1.5 trillion VND.

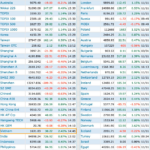

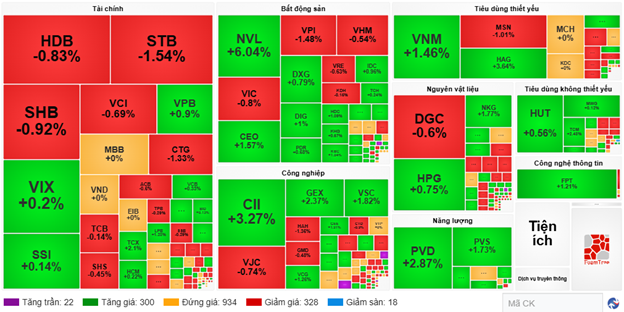

The VN-Index opened the afternoon session with prolonged tug-of-war dynamics, but the buyers gained the upper hand, helping the index stay above the reference level until the end of the session and closing in the green. In terms of influence, TCX, LPB, HPG, and VHM were the most positively impactful stocks on the VN-Index, contributing over 2.5 points of increase. Conversely, CTG, VPL, MSN, and STB faced selling pressure, reducing the index by more than 1.3 points.

| Top 10 Stocks Impacting VN-Index on November 14, 2025 (in points) |

Similarly, the HNX-Index showed optimistic movements, positively influenced by stocks such as PVI (+3.69%), HUT (+2.23%), IDC (+2.4%), and MBS (+1.69%).

| Top 10 Stocks Impacting HNX-Index on November 14, 2025 (in points) |

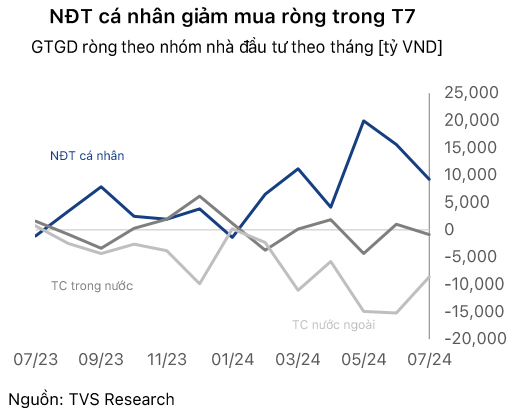

At the close, the market saw a slight increase, with green dominating most sectors. The information technology sector led with a 0.99% gain, primarily driven by FPT (+1.11%), VEC (+4.34%), and DLG (+1.49%). The healthcare and materials sectors followed with increases of 0.48% and 0.38%, respectively. Conversely, the communication services sector was the only one to decline, dropping 0.22%, mainly due to FOX (-0.81%), VNZ (-2.53%), and CTR (-0.32%).

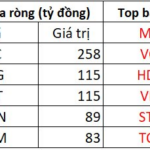

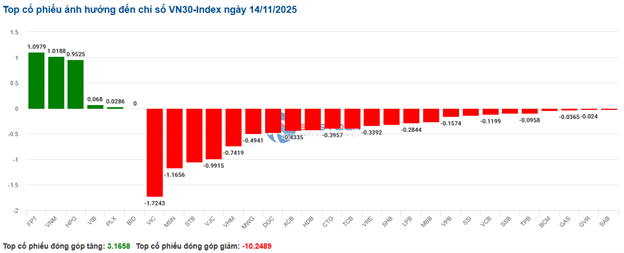

In terms of foreign trading, foreign investors continued to net sell over 692 billion VND on the HOSE, focusing on STB (210.61 billion), VCI (177.49 billion), VIC (145.38 billion), and HDB (106.73 billion). On the HNX, foreign investors net bought over 43 billion VND, concentrating on PVS (95.87 billion), TNG (1.67 billion), VFS (1.16 billion), and APS (690 million).

| Foreign Net Buying and Selling Trends |

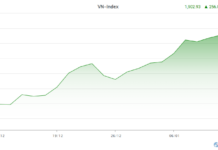

Morning Session: Efforts to Hold at 1,630 Points

At the mid-session break, the VN-Index slightly decreased by 0.82 points (-0.05%), closing at 1,630.62 points; the HNX-Index closed near the reference level at 266.33 points. Market breadth was balanced, with 346 stocks declining, 322 advancing, and 934 unchanged.

Among the top 10 stocks influencing the VN-Index, VIC had the most negative impact, reducing the index by 1.47 points. CTG and VHM further decreased the index by over 1 point. Conversely, TCX, FPT, VPB, and VNM were the most positive contributors, adding a total of 1.83 points to the index.

| Top 10 Stocks Impacting VN-Index in the Morning Session of November 14, 2025 (in points) |

Divergent trends continued to dominate, with sectors fluctuating within narrow ranges. In the green, the information technology sector temporarily led the market with a 1.09% increase, primarily due to FPT (+1.21%) and VEC (+1.69%).

The industrial sector also saw several stocks attracting positive demand, such as ACV (+1.09%), GEE (+1.91%), GEX (+2.37%), VCG (+1.26%), CC1 (+1.61%), and CII (+3.27%). However, some stocks adjusted significantly, including VJC (-0.74%), BMP (-1.04%), THD (-1.27%), PHP (-1.44%), HAH (-1.36%), and SJG (-14.41%).

Meanwhile, the real estate sector was the laggard, adjusting by 0.58%, influenced by VIC (-0.8%), KSF (-1.33%), BCM (-1.62%), VPI (-1.48%), TAL (-2.22%), and VCR (-5.8%). However, buying interest remained in some stocks like NVL (+6.04%), CEO (+1.57%), DIG (+1%), KBC (+1.04%), HDC (+1.09%), and SCR (+2.7%), preventing the sector from falling too deeply in the morning session.

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of 562.78 billion VND across all three exchanges, with selling concentrated in VCI and STB, valued at 126.46 billion and 121.27 billion, respectively. Meanwhile, VNM led the net buying with a value of 189.68 billion VND, far ahead of other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of November 14, 2025 |

10:30 AM: Red Dominates Financial Sector, VN-Index Continues to Fluctuate

Investor hesitation caused the main indices to fluctuate around the reference level. As of 10:30 AM, the VN-Index decreased by 5.26 points, trading around 1,625.12 points. The HNX-Index increased slightly, trading around 266 points.

Stocks in the VN30 basket showed mixed movements, but selling pressure dominated. Specifically, VIC, MSN, STB, and VJC reduced the index by 1.72 points, 1.17 points, 1.05 points, and 0.99 points, respectively. Conversely, FPT, VNM, and HPG were among the few to maintain green, contributing over 3 points to the VN30-Index.

Source: VietstockFinance

|

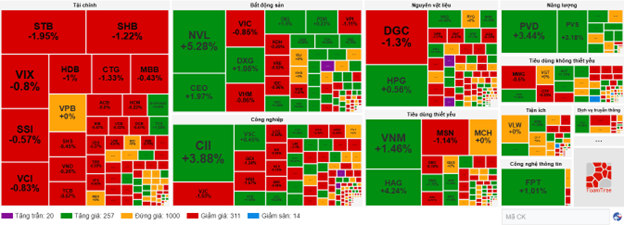

Sector breadth showed balanced green and red, but the financial and real estate sectors continued to underperform, declining by 0.4% and 0.66%, respectively.

Within the banking sector, notable declines included STB (-1.95%), SHB (-1.22%), HDB (-1%), and CTG (-1.43%). Additionally, securities stocks such as VIX (-0.6%), SSI (-0.43%), VCI (-0.69%), and VND (-0.26%) also recorded slight declines.

The real estate sector remained constrained by Vingroup stocks, with VIC (-0.9%), VHM (-0.96%), and VRE (-0.63%) declining. Conversely, other stocks showed optimistic green, including NVL (+5.28%), CEO (+1.97%), DIG (+1.25%), and DXG (+1.05%).

Compared to the opening, sellers gradually gained the upper hand. The number of declining stocks reached 311, while advancing stocks numbered 257.

Source: VietstockFinance

|

Opening: Financial and Real Estate Sectors Show Early Divergence

At the opening of November 14, as of 9:30 AM, the VN-Index decreased by over 6 points to 1,624 points. Similarly, the HNX-Index slightly decreased by nearly 1 point, trading around 265 points.

Red dominated the financial sector from the opening bell. Leading stocks declined negatively from the start, including SHB (-1.22%), SSI (-0.57%), and STB (-0.51%).

The real estate sector continued to show contrasting movements among Vingroup stocks, with VHM (-1.71%), VIC (-0.8%), and VRE (-0.78%) declining, while other stocks were well-supported by buying interest, such as NVL rising to the ceiling, DXG (+2.89%), CEO (+3.94%), and DIG (+3%).

Large-cap stocks like VIC, VHM, and VCB weighed on the market, collectively reducing it by over 3.3 points. Conversely, NVL, TCX, and HPG led the upward trend, but their combined increase was less than 0.5 points.

– 15:30 14/11/2025

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.

Market Pulse November 14: Striving to Hold the 1,630-Point Threshold

At the mid-session break, the VN-Index dipped slightly by 0.82 points (-0.05%), closing at 1,630.62 points, while the HNX-Index hovered near the reference mark at 266.33 points. Market breadth remained balanced, with 346 decliners, 322 gainers, and 934 unchanged stocks.