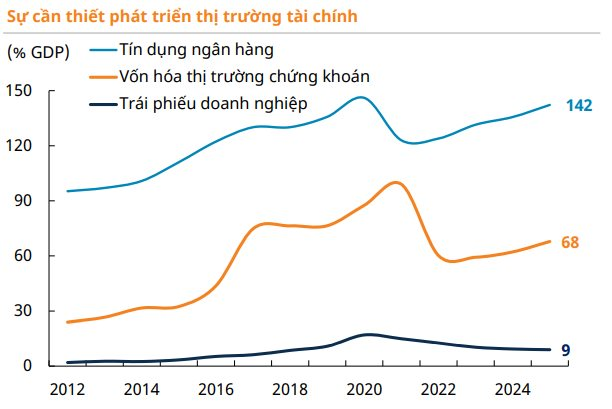

In a recent macroeconomic and strategic report, Mirae Asset Securities (MASVN) highlights Vietnam’s significant reliance on bank credit, emphasizing the need for financial market development to ensure sustainable growth.

By 2030, Vietnam aims to achieve a stock market capitalization of 120% of GDP (up from the current 68%). To this end, the country is actively implementing policy and infrastructure solutions, enhancing corporate governance standards, and facilitating foreign investor access to information and investment opportunities.

Key initiatives include adopting international accounting standards, encouraging large listed companies to publish financial reports in accordance with International Financial Reporting Standards (IFRS), and strengthening corporate governance in line with OECD standards for public companies.

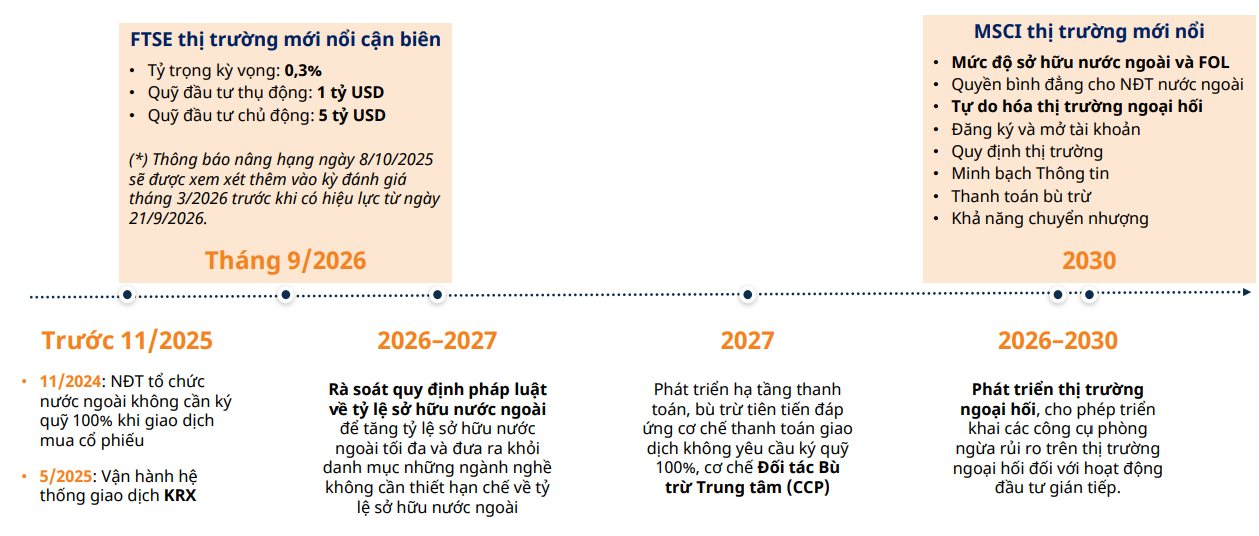

Additionally, as part of the stock market upgrade roadmap, Vietnam aims to achieve higher recognition by 2030, with FTSE Russell classifying it as a high-level emerging market and MSCI potentially upgrading its status to an emerging market.

Mirae Asset notes that from 2026 to 2027, Vietnam will review legal regulations on foreign ownership ratios, expanding industries without ownership restrictions.

By 2027, the focus will shift to developing advanced payment and clearing infrastructure, including a Central Counterparty Clearing (CCP) mechanism.

During the 2026–2030 period, Vietnam aims to develop the foreign exchange market, allowing for more flexible risk hedging tools and swap transactions.

For the bond market, Vietnam aims to increase the corporate bond market size to 25% of GDP by 2030. To achieve this, regulatory reforms and enhanced transparency are being implemented to bolster investor confidence.

Favorable Conditions for a Vibrant Stock Market

According to Mirae Asset analysts, current conditions are highly favorable for a more dynamic stock market in the coming years. In 2025, several large-scale IPOs were recorded in the real estate and securities sectors, and in 2026, more companies are planning initial public offerings.

A notable supporting factor is Decree 245/2025/NĐ-CP, which significantly simplifies listing procedures and reduces the time for post-IPO stock listing from 90 days to 30 days, thereby enhancing market attractiveness and quality supply.

Alongside the IPO wave, other market factors also show significant potential. As of October 2025, the total number of securities accounts exceeded 11.3 million, primarily due to a rapid increase in domestic individual investors.

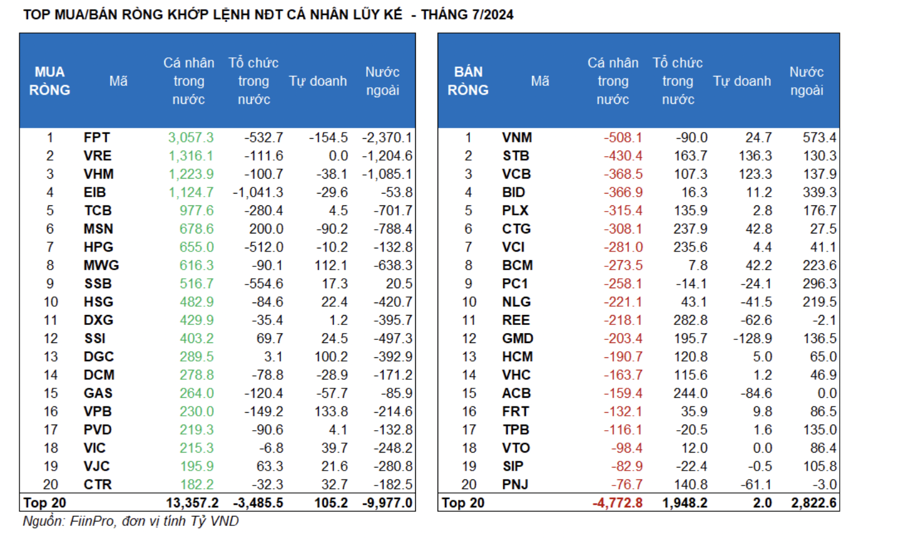

Transaction structures have also shifted notably, with the trading ratio of domestic institutional investors rising sharply since May 2025. In the first 10 months of the year, domestic institutional investors accounted for 36% of trading volume, while foreign investor trading ratios fell to 11%. This reflects the growing role of domestic capital, particularly from domestic financial institutions.

Simultaneously, securities companies are increasing capital to meet market demands.

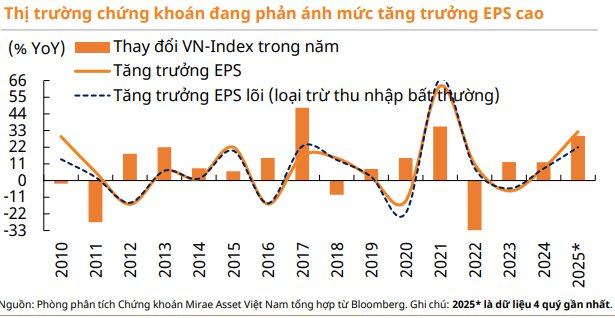

Furthermore, Vietnam’s stock market potential is bolstered by its attractive valuation compared to regional markets, alongside high profit growth and ROE. Currently, the VN-Index trades at a P/E ratio of 15.5, significantly lower than the peak valuations of previous market cycles (above 20), offering growth potential in the coming period.

“Profit Accumulation, Loss Mitigation: Embracing a New Investment Mindset”

The topic of ‘profit accumulation and loss deduction’ coupled with the spirit of self-reliance in investment continues to captivate strong attention from the online community. Not only are numerous investors engaged, but several financial experts and a comprehensive digital securities company from South Korea have also joined in sharing insights on this subject.

Kixx Lubricant Expands Customer Reach Through GS25 Convenience Stores

Starting November 2025, Kixx will distribute two motorcycle engine oil products across GS25 stores and launch Kixx Station, offering customers a professional oil change experience right at their convenience store.

WinCommerce Surges with Nearly 25% Growth in October, New Stores Profitable Year-to-Date

WinCommerce, the powerhouse behind the WinMart and WinMart+ supermarket and convenience store chains, is experiencing a remarkable growth trajectory this year. Month after month, the company has consistently achieved double-digit revenue growth, signaling a robust recovery in consumer demand and the proven effectiveness of its operational model.