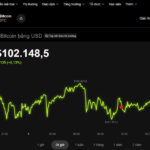

On the evening of November 13th, the cryptocurrency market experienced a downturn. Data from the OKX exchange revealed that Bitcoin dropped by nearly 2% in the past 24 hours, settling at approximately $103,040.

Other major cryptocurrencies followed suit, with Ethereum losing over 1% to $3,498, BNB dipping 0.5% to $967, and Solana declining more than 2% to $156. Notably, XRP bucked the trend, rising over 2% to $2.40.

According to Cointelegraph, Bitcoin’s negative performance occurred against the backdrop of a buoyant U.S. stock market.

Midweek, investors anticipated the U.S. House of Representatives would soon pass a bill to end the government shutdown, boosting market sentiment.

This optimism propelled the Dow Jones Industrial Average up by 0.9%, led by financial stocks such as Goldman Sachs, JPMorgan Chase, and American Express. The S&P 500 edged up 0.1%, while the Nasdaq slipped 0.3% due to weakness in tech shares.

Bitcoin is currently trading at $103,040. Source: OKX

In contrast to equities, Bitcoin plunged from its daily high of $105,300 to a weekly low of $101,200, marking a 3.4% decline.

Meanwhile, gold prices rose to around $4,180 per ounce, and silver surpassed $53, driven by safe-haven demand and expectations of updated economic data once the government reopens.

Experts suggest that Bitcoin’s decline reflects a shift of capital away from riskier assets. As the budget bill vote approaches, investors are favoring traditional policy- and credit-linked investments.

The rally in precious metals also underscores prevailing defensive sentiment, with markets betting on potential Federal Reserve easing if economic data stabilizes post-reopening.

For Bitcoin, the price drop is attributed to profit-taking after a recent recovery, coupled with institutional investors’ continued caution toward the cryptocurrency market.

However, positive signs emerged as inflows into spot Bitcoin ETFs rebounded, reaching over $524 million on November 12th—the highest since early October. This indicates gradually restoring confidence following the market’s sharp downturn earlier in the month.

Analysts predict that if the Fed signals a dovish stance in its upcoming meeting and equity markets stabilize post-reopening, Bitcoin could regain upward momentum as investors seek alternative opportunities.

Today’s Crypto Market, November 11: Bitcoin Price Plunges Unexpectedly—What’s Happening?

Bitcoin’s price is forecasted to potentially dip to around $100,000, with a possible further decline to the $90,000–$93,000 range before stabilizing.

Today’s Crypto Market, Nov 7-11: Brokerage Firm Abruptly Shelves Plans for New Exchange Launch

Analysts suggest that if Bitcoin’s price stabilizes around the $100,000 mark, the cryptocurrency could potentially embark on a steady recovery path.