I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

Most VN30 futures contracts rose during the November 14, 2025 trading session. Specifically, 41I1FB000 (I1FB000) increased by 0.36%, reaching 1,869.7 points; VN30F2512 (F2512) rose by 0.54%, hitting 1,865 points; contract 41I1G3000 (G3000) gained 0.22%, reaching 1,864.9 points; and contract 41I1G6000 (I1G6000) declined by 0.17%, closing at 1,852.5 points. The underlying index, VN30-Index, ended the session at 1,871.54 points.

Additionally, most VN100 futures contracts also advanced during the November 14, 2025 session. Notably, 41I2FB000 (I2FB000) rose by 0.06%, reaching 1,780 points; 41I2FC000 (I2FC000) increased by 0.13%, hitting 1,780.7 points; contract 41I2G3000 (I2G3000) surged by 1.08%, reaching 1,780 points; and contract 41I2G6000 (I2G6000) remained unchanged at 1,760.5 points. The underlying index, VN100-Index, closed at 1,780.35 points.

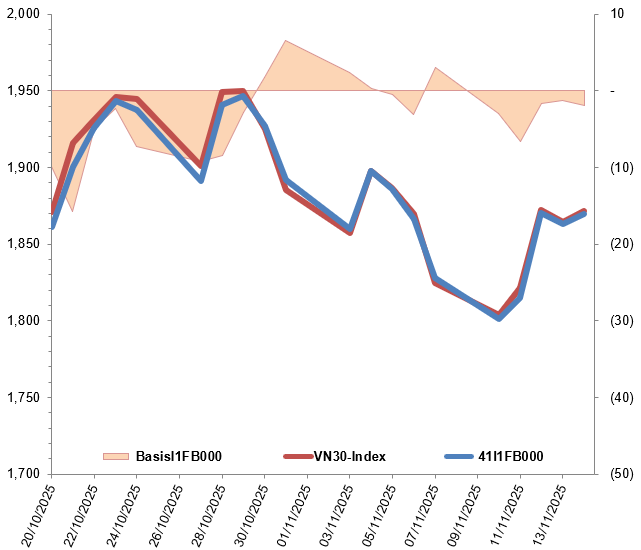

During the week of November 10-14, 2025, I1FB000 continued its downward trend from the previous session, starting the week with a decline as short sellers dominated early. After a sharp drop, subsequent sessions turned more optimistic as buyers regained control, helping the contract recover to nearly 1,878 points. In the final two sessions, buyers and sellers engaged in a fierce tug-of-war, restraining the contract’s recovery but closing the week in positive territory with a 41.9-point gain.

Intraday Chart of 41I1FB000 for November 10-14, 2025

Source: https://stockchart.vietstock.vn/

At the close, the basis of the 41I1FB000 contract widened compared to the previous session, reaching -1.84 points. This indicates a more bearish sentiment among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

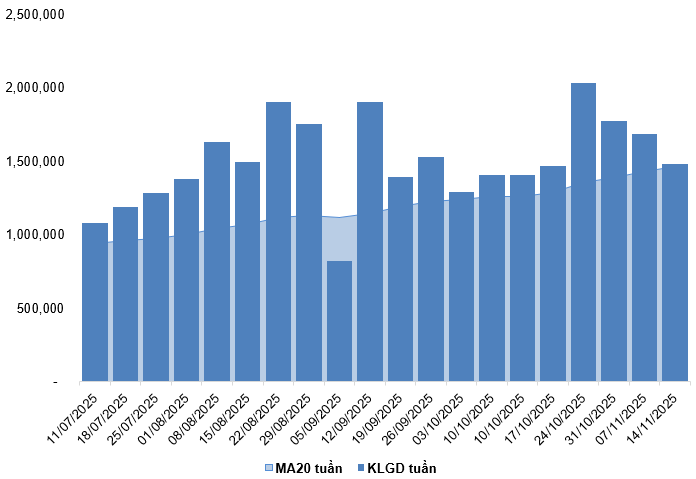

Trading volume and value in the derivatives market decreased by 19.98% and 20.04%, respectively, compared to the November 13, 2025 session. For the week, trading volume and value fell by 11.86% and 13.49%, respectively, compared to the previous week.

Foreign investors returned to net selling, with a total net sell volume of 1,448 contracts on November 14, 2025. For the week, foreign investors were net buyers of 1,758 contracts.

Weekly Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

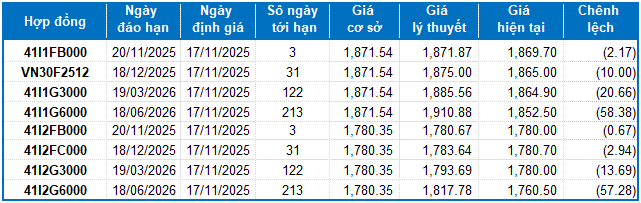

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of November 17, 2025, the fair price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

During the November 14, 2025 session, the VN30-Index edged higher, forming a small-bodied candlestick pattern with trading volume remaining below the 20-session average. This suggests investor hesitation.

Currently, the index is testing the upper boundary of a developing Falling Wedge pattern. However, the VN30-Index remains below the 50-day SMA, and the MACD indicator continues to hover below zero after issuing a sell signal. This indicates lingering short-term risks.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

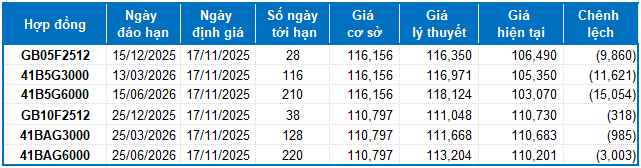

Based on the fair pricing method as of November 17, 2025, the fair price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on these contracts and consider buying, as they offer excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 15/11/2025

Derivatives Market on November 14, 2025: Mixed Signals Emerge

On November 13, 2025, the VN30 and VN100 futures contracts diverged in their performance. The VN30-Index exhibited a tug-of-war pattern, forming a small-bodied candlestick accompanied by declining trading volume, which remained below the 20-session average. This suggests a cautious sentiment among investors.

Derivatives Market Outlook on November 13, 2025: Has Pessimism Subsided?

On November 12, 2025, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index extended its winning streak to a second consecutive session, forming a White Marubozu candlestick pattern. This bullish signal was further reinforced by a notable increase in trading volume compared to the previous session, indicating a shift in investor sentiment from pessimism to cautious optimism.

Afternoon Technical Analysis, November 12: Cautious Sentiment Persists

The VN-Index and HNX-Index experienced a modest recovery, marked by small-bodied candles and subdued trading volumes in the morning session, indicating investor caution.