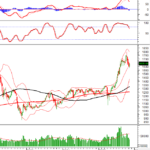

The VN-Index experienced a volatile trading week, opening with a sharp decline below the 1,600-point threshold, only to swiftly rebound to around 1,630 in subsequent sessions, fueled by bottom-fishing demand in several large-cap stocks. By week’s end, the VN-Index had gained 36.36 points (+2.27%) compared to the previous week.

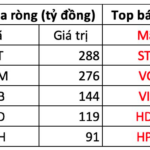

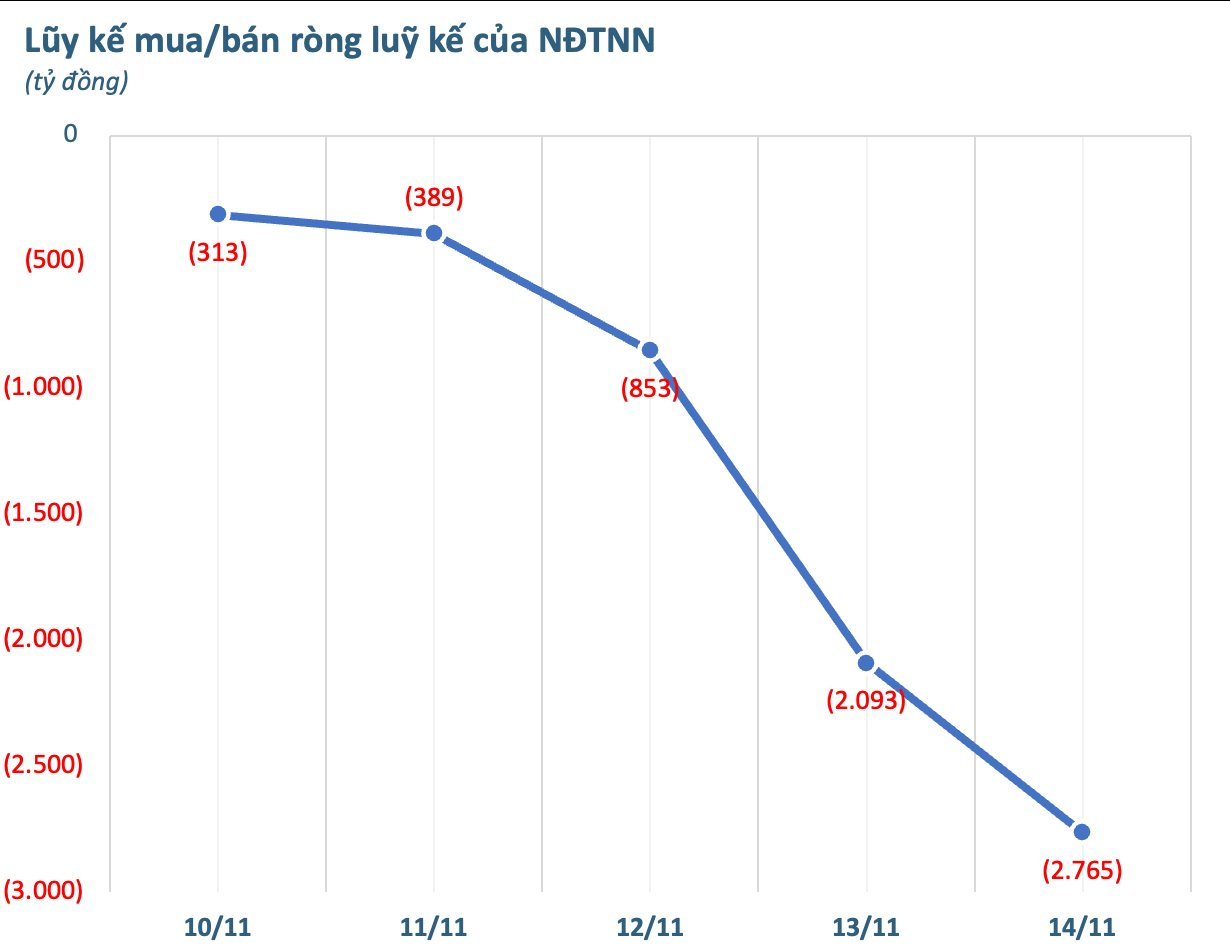

In terms of foreign trading activity, foreign investors continued their net selling trend, with pressure intensifying towards the week’s close. Over the five sessions, foreign investors net sold VND 2,765 billion across the market.

On individual exchanges, foreign investors net sold VND 2,298 billion on HoSE, VND 167 billion on HNX, and VND 300 billion on UPCoM.

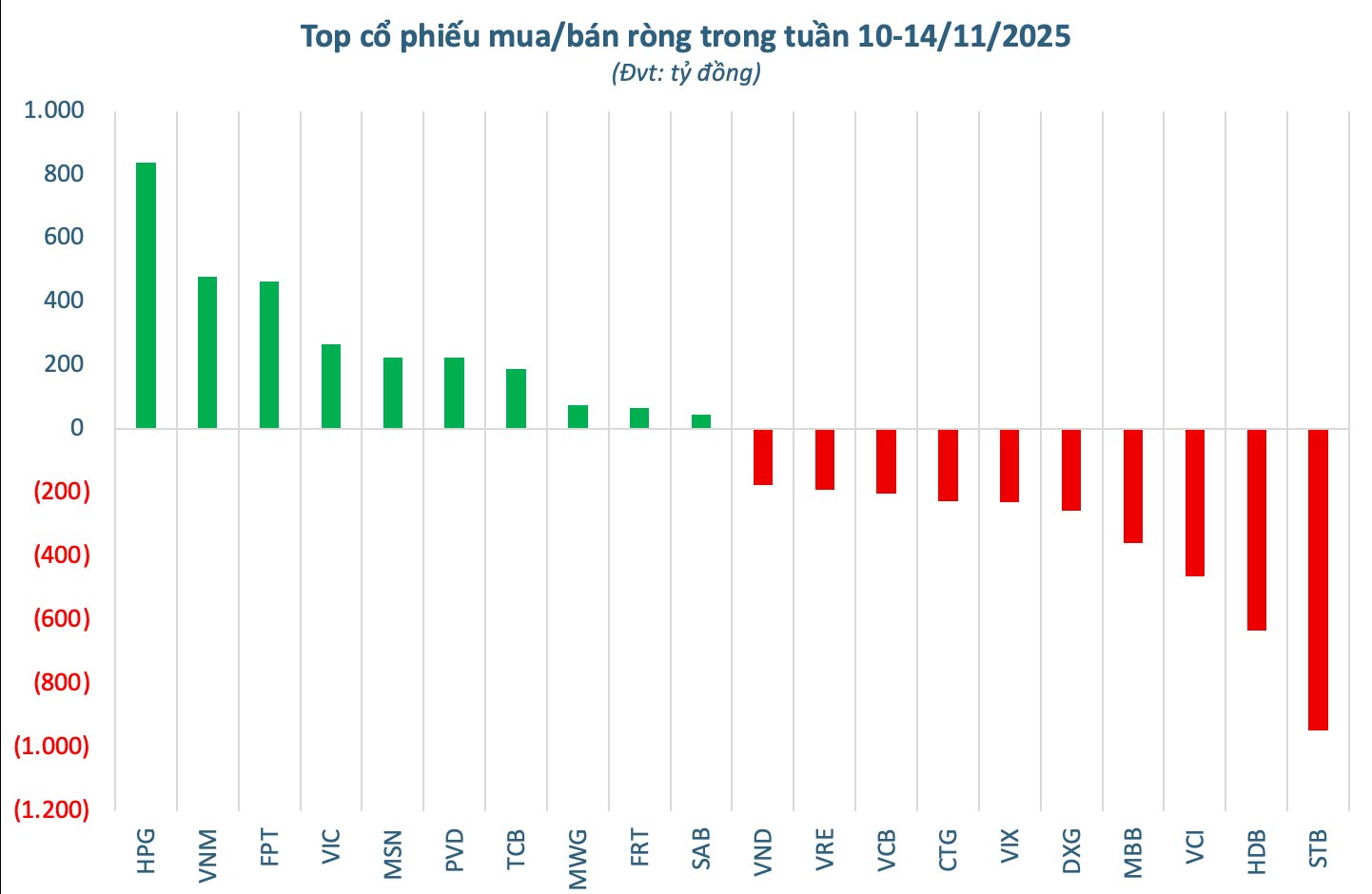

Analyzing specific stocks, STB faced the heaviest selling pressure, with a net outflow of VND 946 billion, significantly outpacing other stocks. HDB followed with VND 632 billion, trailed by VCI (VND 461 billion) and MBB (VND 356 billion). Real estate, construction, and financial stocks such as DXG (VND -257 billion), VIX (VND -228 billion), CTG (VND -226 billion), VCB (VND -201 billion), VRE (VND -190 billion), and VND (VND -176 billion) also experienced notable net selling.

On the buying side, foreign investors recorded the strongest net buying in HPG, with VND 838 billion, significantly ahead of other stocks. VNM followed with VND 479 billion, then FPT (VND 464 billion) and VIC (VND 268 billion). Other large-cap stocks like MSN and PVD saw net buying of VND 225 billion each. Additionally, TCB (VND 190 billion), MWG (VND 77 billion), FRT (VND 68 billion), and SAB (VND 47 billion) also attracted foreign capital during the week.

Vietstock Weekly 17-21/11/2025: Does the Recovery Momentum Need Further Validation?

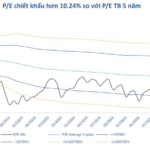

The VN-Index has rebounded after four consecutive weeks of adjustment, signaling a resurgence in bottom-fishing demand around the 1,580-1,600 support zone. However, sustaining this recovery will hinge on a significant improvement in liquidity in the coming period. Meanwhile, volatility risks are likely to persist as key indicators like the Stochastic Oscillator and MACD continue to weaken following sell signals.

Market Update: VN-Index Requires More Time for a Breakthrough on November 14th

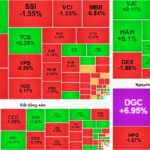

Capital flows are currently concentrated in select stock groups, necessitating additional time for the market to establish a sustainable upward trajectory.