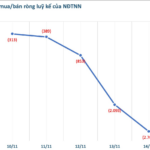

The market continued its sharp correction in the final session of the week on November 14th, pressured by selling in banking and securities stocks. The benchmark VN-Index fluctuated at high levels, but a late surge in buying interest from the Vingroup sector, along with select banking and steel stocks, propelled the index back to the 1,635-point mark. Trading volume remained subdued compared to the previous session, reflecting investor hesitation. At the close, the VN-Index gained 4 points to settle at 1,635.46. Foreign investors remained net sellers, offloading 672 billion VND across the market.

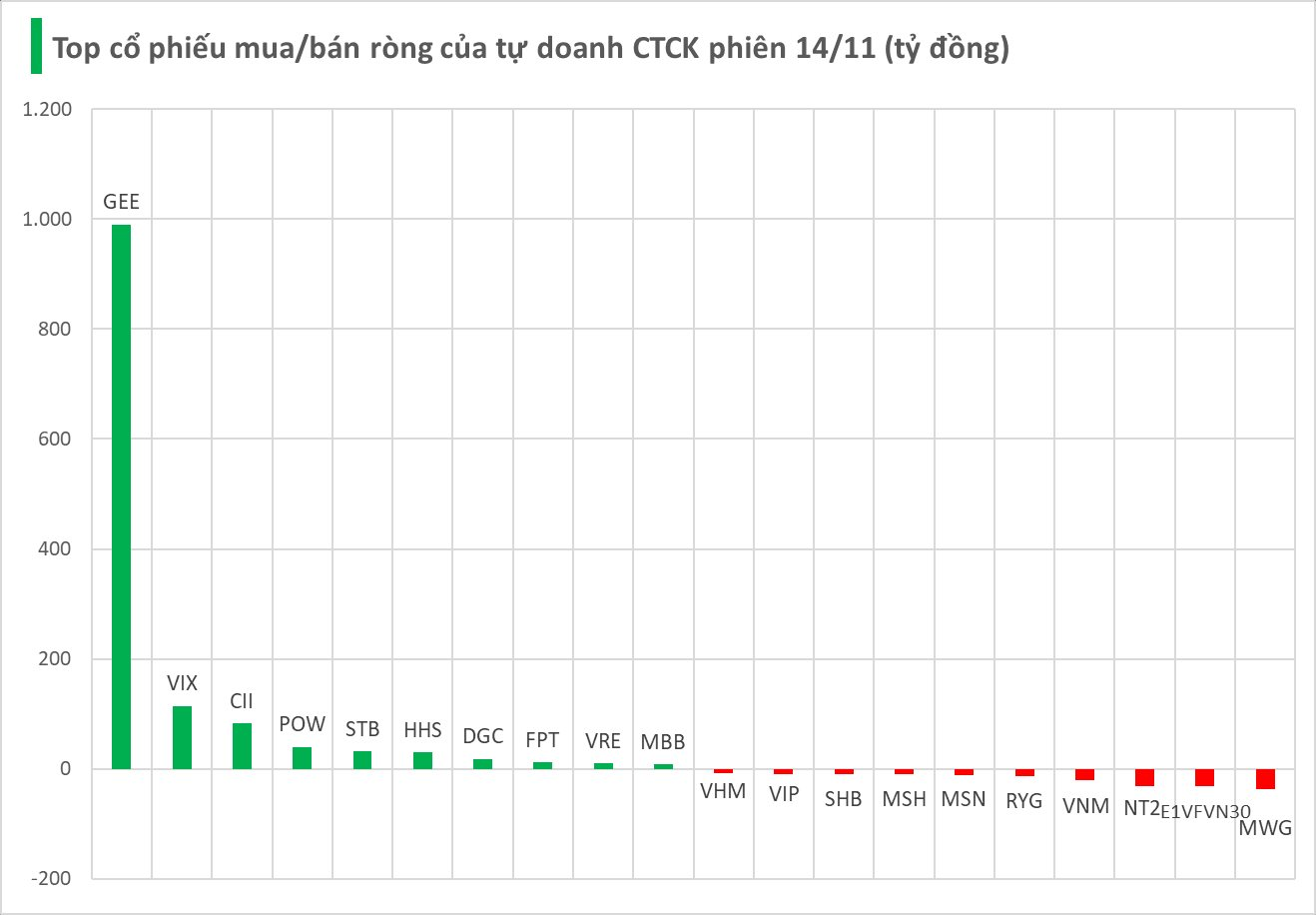

Proprietary trading desks of securities firms unexpectedly turned net buyers, purchasing 1,195 billion VND on HOSE.

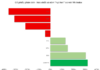

Specifically, GEE dominated net buying with 990 billion VND, far outpacing other stocks. VIX followed with 115 billion VND, trailed by CII (83 billion), POW (40 billion), STB (32 billion), HHS (30 billion), DGC (18 billion), FPT (12 billion), VRE (10 billion), and MBB (8 billion VND).

Conversely, securities firms were net sellers of MWG, offloading 37 billion VND, followed by NT2 (-32 billion), E1VFVN30 (-32 billion), VNM (-20 billion), and RYG (-14 billion VND). Other notable net sells included MSN (-11 billion), MSH (-10 billion), SHB (-10 billion), VIP (-9 billion), and VHM (-8 billion VND).

Beyond monitoring market movements, investors have an exciting opportunity to participate in the “Billion-Dollar Stock Market Season 2” competition, hosted by Pinetree Securities in collaboration with CafeF.

Following the resounding success of the inaugural season, which attracted over 7,000 participants, Season 2 introduces a significant innovation: two competition categories – Equities and Derivatives – compared to the sole Equities category in Season 1. This expansion caters to both novice and seasoned investors, providing a platform to showcase analytical skills and market adaptability.

Registration is currently open, with the Equities category running from October 27th to November 14th, 2025, and the Derivatives category extending until December 25th, 2025. The competition boasts a total prize pool of 500 million VND, including a top prize of 80 million VND in cash. Participants need only hold a trading account with Pinetree, with a minimum capital of 10 million VND, to enter. Beyond cash prizes, contestants can also win attractive stock gifts.

Leveraging cutting-edge Korean technology, a lifetime commission-free trading policy, and a 0% margin rate for the first 30 days, Pinetree anticipates that “Billion-Dollar Stock Market Season 2” will once again serve as a premier investment arena. Here, Vietnamese investors can demonstrate their prowess and strive for “billion-dollar” success. For detailed information and competition rules, please click here.

Stocks Linked to Bầu Đức Deliver a Surprising Turn

Amidst positive developments on the afternoon of November 14th, the VN-Index closed the week’s final session with a modest gain of over 4 points. However, liquidity remained subdued, continuing its downward trend. Notably, stocks associated with Bầu Đức emerged as a surprising highlight.

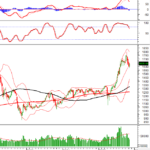

Vietstock Weekly 17-21/11/2025: Does the Recovery Momentum Need Further Validation?

The VN-Index has rebounded after four consecutive weeks of adjustment, signaling a resurgence in bottom-fishing demand around the 1,580-1,600 support zone. However, sustaining this recovery will hinge on a significant improvement in liquidity in the coming period. Meanwhile, volatility risks are likely to persist as key indicators like the Stochastic Oscillator and MACD continue to weaken following sell signals.