Shares of Pomina Steel (ticker: POM) surged dramatically, hitting the upper limit for two consecutive sessions amidst a severe shortage. The stock closed the November 14th session with a buy surplus at the ceiling price, reaching nearly 12 million units—equivalent to over 4% of its total outstanding shares. Notably, this resurgence of the once-prominent steel giant coincides with trading restrictions, limiting transactions to Fridays only.

Previously, Pomina was delisted from HoSE in May 2024 due to severe disclosure violations. Now trading on UPCoM, this marks a significant decline for a company once dominant in Vietnam’s steel industry. The situation underscores persistent challenges without a clear resolution.

Founded in 1999, Pomina operated three integrated mills with an annual capacity of 1.1 million tons of construction steel and 1.5 million tons of billets. At its peak, it commanded nearly 30% market share as one of Vietnam’s largest steel producers. However, its position eroded as competitors like Hoa Phat gained momentum.

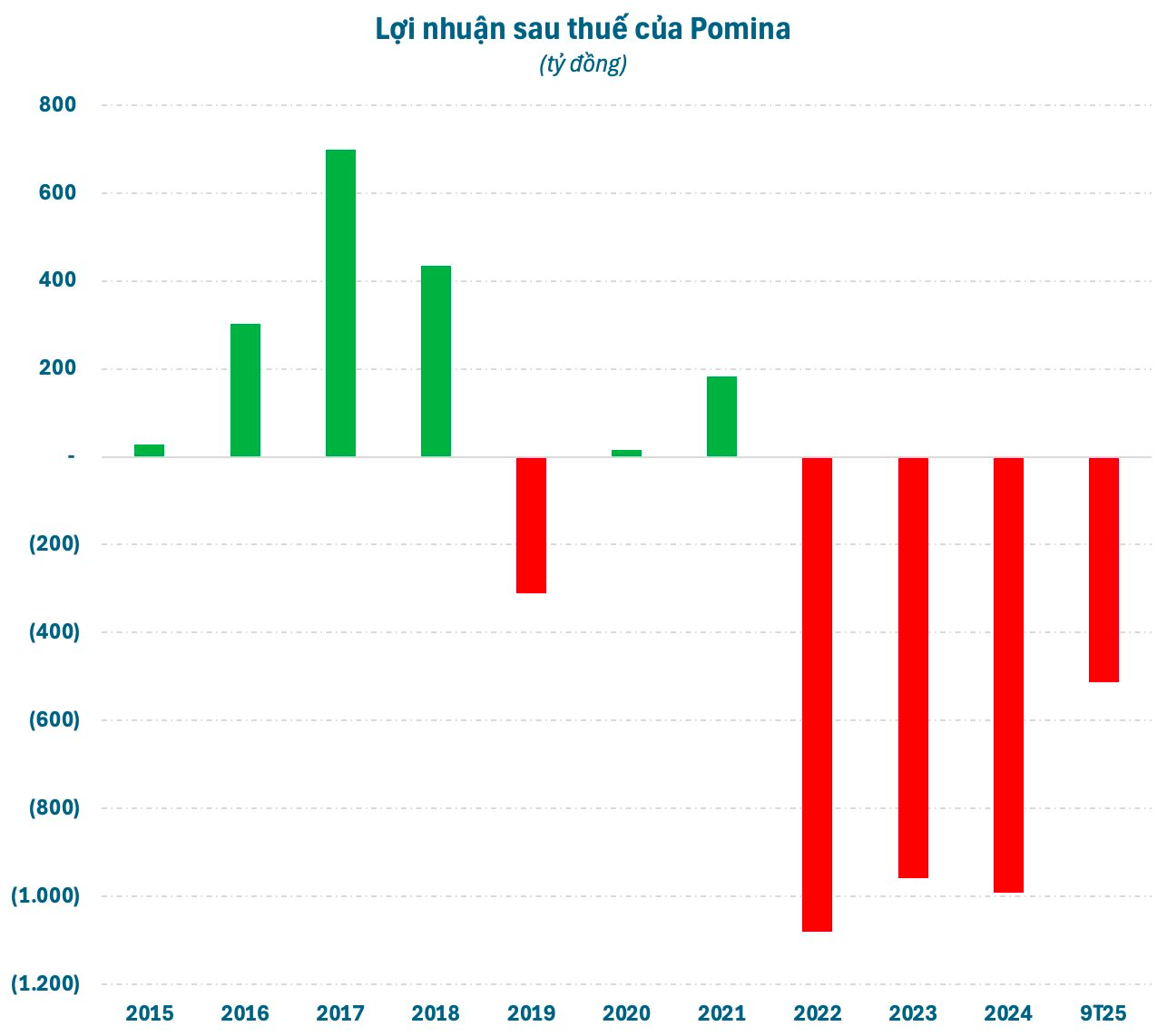

Given the steel industry’s cyclical nature, Pomina’s performance fluctuated wildly. Historically, profits ranged from VND 400–700 billion annually. Post-boom, earnings plummeted, leading to substantial losses.

From 2022–2024, Pomina incurred annual losses exceeding VND 1 trillion. In Q1–Q3 2025, losses surpassed VND 500 billion, pushing cumulative deficits past VND 3 trillion. This negative equity prompted an emergency restructuring meeting.

Pomina’s board recently scheduled an extraordinary meeting in December to approve 2025 YTD financials and a restructuring plan. Details remain undisclosed. This isn’t the first revival attempt.

In 2024, Pomina partnered with Japan’s Nansei Steel to sell a 51% stake, but foreign ownership caps derailed the deal. Domestic talks with Thaco Industries also failed.

Renewed restructuring hopes emerge via ties to VinMetal, a Vingroup subsidiary. Established in October, VinMetal raised its charter capital to VND 15 trillion, focusing on construction steel, high-strength alloys, and EV/infrastructure materials.

Notably, VinMetal appointed Do Tien Si—Pomina’s CEO and Deputy Chairman—as its legal representative. With 30+ years in steel and corporate leadership, Si’s role bridges both entities.

VinMetal targets civil construction, hot-rolled steel, and specialty alloys for EVs and high-speed rail. Vingroup aims to supply Vinhomes and VinFast while securing materials for strategic projects like the North-South high-speed rail.

Surprise Powerhouse Injects Nearly $52 Million to Scoop Up Vietnamese Stocks in Final Week’s Session

Proprietary trading desks at securities companies unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), scooping up a staggering VND 1.195 trillion worth of shares.