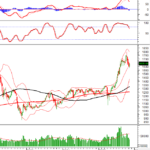

After a tense trading session, Vietnam’s stock market closed the week on a positive note as the VN-Index rebounded. However, the overall market sentiment remained cautious, with both buying and selling activities showing restraint.

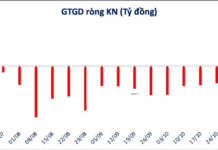

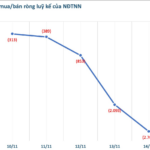

At the close of the November 14th session, the VN-Index gained 4 points to reach 1,635.46. Trading value on HoSE amounted to approximately VND 18,160 billion. Foreign investors continued their net selling streak, offloading VND 672 billion across the market. Key details include:

On HoSE, foreign investors net sold approximately VND 672 billion

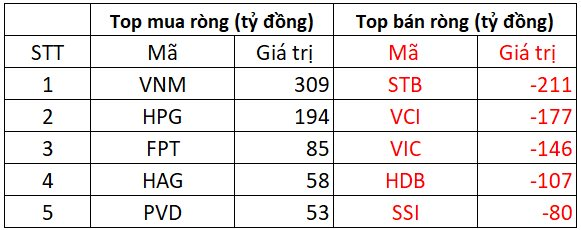

On the buying side, VNM shares were the most heavily accumulated by foreign investors, with a value of VND 309 billion. HPG followed closely, with net purchases of VND 194 billion. Other blue-chip stocks like HAG, PVD, and FPT were also in focus, with net buying values ranging from VND 53 billion to VND 85 billion.

Conversely, the top net-sold stocks were from the financial sector. STB led with VND 211 billion in net sales, followed by VCI, VIC, and HDB with net sales ranging from VND 107 billion to VND 177 billion. SSI also saw net sales of VND 80 billion from foreign investors.

On HNX, foreign investors net bought approximately VND 44 billion

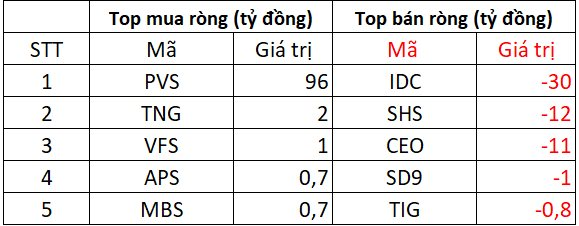

Foreign investors actively net bought PVS shares with VND 96 billion. VFS, APS, and MBS saw minor net purchases, ranging from a few hundred million to VND 1 billion.

In contrast, IDC, SHS, and CEO were net sold by foreign investors, with values ranging from VND 11 billion to VND 30 billion. SD9 and TIG also saw net sales, though values were below VND 1 billion.

On UPCOM, foreign investors net sold nearly VND 44 billion

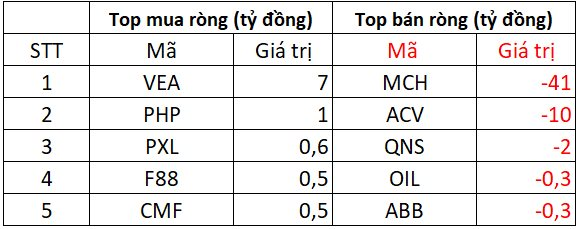

Foreign investors allocated approximately VND 7 billion to net buy VEA shares. PHP, PXL, F88, and CMF also saw minor net purchases, ranging from a few hundred million to VND 1 billion.

MCH and ACV were net sold by foreign investors, with values of VND 41 billion and VND 10 billion, respectively. OIL and ABB saw light net sales of a few hundred million each.

In addition to monitoring foreign investor activity, stock market participants have an exciting opportunity with the “Billion-Dollar Stock Challenge Season 2,” organized by Pinetree Securities in collaboration with CafeF.

Following the resounding success of the first season, which attracted over 7,000 participants, Season 2 introduces two competition categories—Equity and Derivatives—expanding opportunities for both novice and professional investors to showcase their analytical skills and market adaptability.

Registration is currently open, with the Equity category running from October 27th to November 14th, 2025, and the Derivatives category extending until December 25th, 2025. The competition boasts a total prize pool of VND 500 million, including a top prize of VND 80 million in cash. Participants need only a Pinetree trading account with a minimum balance of VND 10 million to enter. Beyond cash prizes, contestants can also win attractive stock gifts.

Leveraging cutting-edge Korean technology, lifetime free trading, and a 0% margin rate for the first 30 days, Pinetree aims for “Billion-Dollar Stock Challenge” Season 2 to be a premier investment arena where Vietnamese investors can demonstrate their prowess and achieve real-world success. For detailed information and competition rules, click here.

Surprise Powerhouse Injects Nearly $52 Million to Scoop Up Vietnamese Stocks in Final Week’s Session

Proprietary trading desks at securities companies unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), scooping up a staggering VND 1.195 trillion worth of shares.

Vietstock Weekly 17-21/11/2025: Does the Recovery Momentum Need Further Validation?

The VN-Index has rebounded after four consecutive weeks of adjustment, signaling a resurgence in bottom-fishing demand around the 1,580-1,600 support zone. However, sustaining this recovery will hinge on a significant improvement in liquidity in the coming period. Meanwhile, volatility risks are likely to persist as key indicators like the Stochastic Oscillator and MACD continue to weaken following sell signals.