FPT Corporation (stock code: FPT, HoSE) has announced that it will finalize the shareholder list for the first interim dividend payment of 2025 in cash on December 2nd.

The dividend rate is set at 10%, meaning each share will receive 1,000 VND. The payment date is scheduled for December 12, 2025. With over 1.7 billion outstanding shares, FPT will allocate more than 1,700 billion VND for this dividend payout.

In 2025, FPT shareholders will receive a total dividend rate of 35%, comprising 20% in cash and 15% in bonus shares. For the 2024 dividend, FPT has successfully completed the payout to shareholders at a rate of 35%, including 20% in cash and 15% in bonus shares.

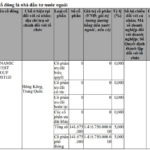

As of September 30, 2025, FPT holds nearly 37,000 billion VND in deposits, an increase of approximately 5,900 billion VND compared to the beginning of the year, representing a 19% growth. This substantial deposit has generated 1,235 billion VND in interest income over the first nine months, accounting for over 51% of the total financial revenue.

The company’s equity stands at 42,831 billion VND, including 17,035 billion VND in share capital and 13,905 billion VND in undistributed after-tax profits.

In terms of business operations, during the first nine months of the year, FPT recorded 49,887 billion VND in revenue and 6,540 billion VND in pre-tax profit, marking increases of 10.3% and 17.6%, respectively, compared to the same period last year. After-tax profit attributable to the parent company’s shareholders reached 6,867 billion VND, a 19.2% year-on-year increase. The company has achieved 66% of its annual revenue target and 71% of its profit goal, setting new records for both revenue and profit in a nine-month period.

The Technology segment (encompassing Domestic IT Services and Overseas IT Services) remains the cornerstone of the corporation, contributing 62% of revenue and 45% of pre-tax profit, equivalent to 30,949 billion VND and 4,333 billion VND, respectively. These figures reflect growth rates of 10.7% and 13.7% compared to the same period last year.

Telecommunications Services reported revenue of 13,738 billion VND, a 11.5% increase, and pre-tax profit of 3,091 billion VND, up 21.3%.

The Education segment of FPT saw a 1% year-on-year revenue growth, reaching 5,195 billion VND.

ABBANK: Vũ Văn Tiền Reappointed as Chairman, Phạm Duy Hiếu Steps Down as CEO

On November 14, 2025, the Board of Directors of An Binh Commercial Joint Stock Bank (ABBANK) issued resolutions to adjust key leadership positions within the Board and the bank’s Executive Committee. These strategic changes aim to strengthen governance foundations and accelerate operational efficiency.

Trương Gia Bình: Losing $1 Million in the U.S. and India, FPT Software’s Revival Thanks to Japan

“With a $1 million budget for global expansion, we faced setbacks in Silicon Valley and Bangalore, where investments yielded no contracts. As funds dwindled, Japan emerged as our turning point, offering the first deal that revitalized FPT Software’s journey.”

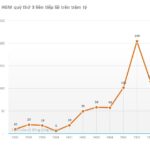

Massive 85% Cash Dividend Payout Announced by Company Following Record-Breaking Profit Surge

With this latest dividend payout, the total cash dividend for 2025 reaches an impressive 130% (13,000 VND per share).