Source: VietstockFinance

|

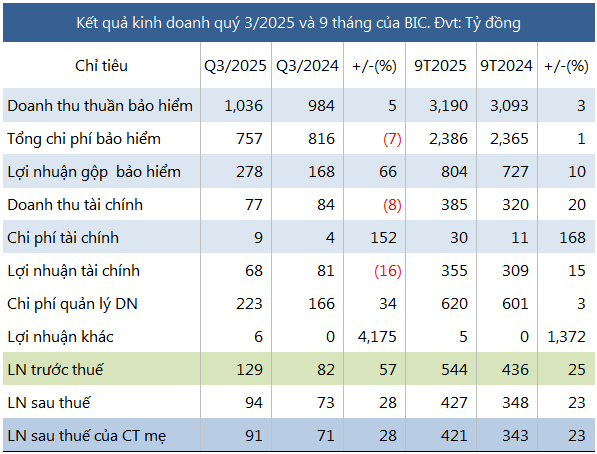

In Q3/2025, BIC’s insurance premium revenue surpassed VND 1.4 trillion, marking a 5% year-on-year increase. Reinsurance cession costs declined by 11% to VND 412 billion, driving net insurance revenue above VND 1 trillion—a 5% uptick.

Notably, insurance claims expenses plunged 26% to VND 224 billion, reducing total insurance operating costs by 7% to over VND 757 billion. Consequently, insurance business profits soared 66% to nearly VND 278 billion.

Despite a 16% drop in financial income to VND 68 billion and a 34% rise in management expenses to VND 223 billion, BIC sustained a 28% net profit growth to VND 91 billion, fueled by robust insurance operations.

Year-to-date, BIC’s nine-month net profit reached nearly VND 421 billion, up 23%. Insurance business profits climbed 10% to VND 804 billion, while financial income rose 15% to VND 355 billion, primarily from a 12% increase in deposit interest to VND 212 billion and a 3.2x surge in securities income to over VND 163 billion.

For 2025, BIC targets VND 710 billion in pre-tax consolidated profit, a 9% increase from 2024. As of Q3, the company has achieved 77% of its annual goal.

By Q3-end, BIC’s total assets exceeded VND 9.9 trillion, up 15% year-to-date. Financial investments accounted for 74% of total assets, rising 15% to VND 7.4 trillion, while reinsurance assets grew 4% to nearly VND 1.3 trillion.

Liabilities totaled nearly VND 6.7 trillion, up 17%, driven by an 86% increase in short-term loans to VND 527 billion and a 17x jump in other short-term payables to over VND 200 billion. Insurance reserves, comprising 60% of total liabilities, rose 6% year-to-date.

– 14:58 17/11/2025

Petrolimex Insurance Profit Growth Stalls

Net profit for Q3 and the first 9 months of 2025 at Petrolimex Insurance Joint Stock Corporation (HOSE: PGI) remained virtually unchanged compared to the same period last year.

Insider of HNA’s Board Chairman Registers Full Capital Withdrawal Following Company’s Significant Profit Announcement

Mr. Vo Dang Giap, the elder brother of Mr. Vo Trung Chinh, Chairman of the Board of Directors at Huana Hydropower Joint Stock Company (HOSE: HNA), has registered to sell his entire holding of 251,800 HNA shares. This transaction, representing 0.1% of the company’s charter capital, is scheduled to take place between November 3rd and 28th.