Buy SZC with a target price of VND 45,400 per share

Shinhan Vietnam Securities (SSV) reports that Sonadezi Chau Duc Corporation (HOSE: SZC) achieved VND 86 billion in revenue in Q3/2025, a 46% decrease year-over-year, with a net profit of VND 20 billion, down 65%. For the first nine months, cumulative revenue reached VND 718 billion (up 12%), and net profit was VND 242 billion (up 6%). SZC‘s land leasing activities slowed in Q2–Q3/2025 due to global trade uncertainties from April to August 2025.

Specifically, industrial park land leasing revenue was VND 588 billion (up 4%), with approximately 30 hectares leased, primarily from 2024 MOU agreements recorded in Q1/2025: Electronic Tripod Vietnam (18 ha) and Vina One Steel Plant (12 ha).

Real estate revenue from Sonadezi Huu Phuoc Phase 2 was VND 4.9 billion (down 71%). SSV expects SZC‘s housing sales to improve by year-end 2025 as the property market recovers, supported by provincial mergers and the Bien Hoa–Vung Tau expressway’s completion. Additionally, SZC is eligible to sell 210 social housing units from June 2025, boosting residential real estate revenue.

BOT revenue from Project 768 resumed toll collection on April 5, 2025, generating VND 66 billion. Golf course revenue was VND 36 billion, down 8% year-over-year.

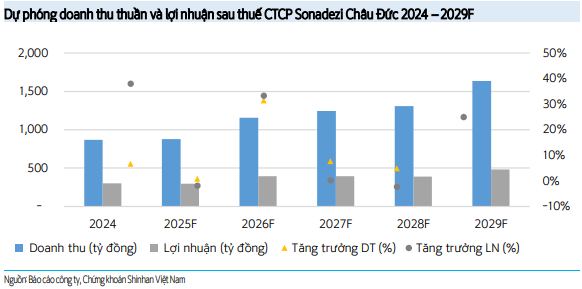

SSV forecasts SZC‘s 2025 revenue at VND 879 billion (up 1%) and 2026 at VND 1,156 billion (up 31%). Net profit for 2025 is projected at VND 297 billion (down 2%), and 2026 at VND 396 billion (up 33%).

In 2025, SZC‘s revenue and profit will primarily come from industrial land leasing (78% of total revenue). By 2026, growth is expected to stabilize, driven by sustainable leasing revenue, contributions from Sonadezi Huu Phuoc, and steady growth from the golf course and BOT 768.

Ba Ria–Vung Tau remains a top FDI destination, with 2025’s 9-month FDI reaching USD 1,907 million, up 3.2 times year-over-year. This boosts demand for Chau Duc Industrial Park land. With strategic location and infrastructure, land rental prices are projected to rise 5–8% from 2025–2028.

However, global trade tensions may reduce investment demand. SSV estimates new land leases will slightly decline to 35 ha in 2025 and 40 ha in subsequent years.

Sonadezi Huu Phuoc’s 30 shophouses and 54 townhouses, carried over to 2025, will contribute to future revenue. SZC plans to launch 210 additional units in 2025, driving growth.

SSV recommends buying SZC at VND 45,400 per share. Learn more here.

Increase BSR holdings with a target price of VND 18,200 per share

Agribank Securities (Agriseco) reports Binh Son Refining and Petrochemical (HOSE: BSR) achieved Q3/2025 revenue of VND 35,290 billion (up 10.4%) and a net profit of VND 908.6 billion, compared to a loss of VND 1,210 billion in Q3/2024. Profitability rebounded due to improved refining margins from stable oil prices and higher sales volume.

In 9M/2025, revenue was VND 103,957 billion (up 19.4%), and net profit was VND 2,155 billion (up 219.7%), achieving 91% of revenue and 287% of profit targets for 2025.

OPEC notes global refining margins for Brent, WTI, and Oman crude have recovered since May 2025 due to (1) lower global supply in H1/2025, (2) power outages disrupting Spanish and Portuguese refineries, and (3) Asian refinery maintenance tightening supply despite increased processing.

With Vietnam’s 8% GDP growth target for 2025 and double-digit growth in 2026–2030, urbanization, domestic trade, and logistics will surge. Dung Quat and Nghi Son refineries currently meet only 70% of domestic demand, while fuel consumption is expected to grow 7–10% annually.

Jet fuel demand is also rising as tourism rebounds, with international arrivals up 22% in H1/2025.

BSR plans a Q4/2025 share issuance to fund Dung Quat refinery upgrades, expected to operate by 2028. This will boost long-term profits through (1) 17% higher refining capacity and (2) cost optimization by processing high-sulfur crude.

Buy MWG with a target price of VND 103,406 per share

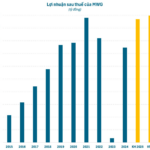

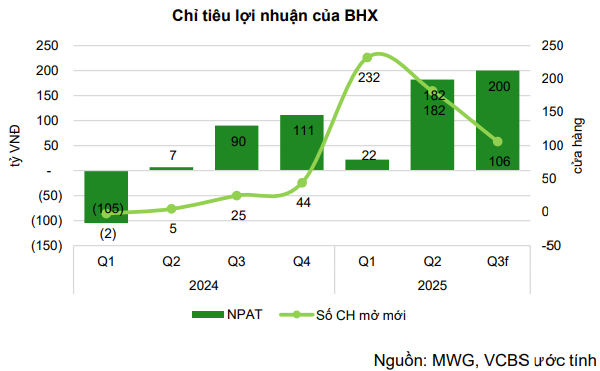

Vietcombank Securities (VCBS) highlights Bach Hoa Xanh (BHX) as a key growth driver for Mobile World Investment Corporation (HOSE: MWG), contributing significantly to consolidated profits with consistent earnings.

By October 2025, BHX operated 2,367 stores, adding nearly 600 since January, exceeding expansion plans. Over 85% of stores are profitable or breakeven, showcasing successful optimization. After consolidating in the South, BHX expanded to Thanh Hoa with 43 stores, targeting a market with 40% national consumption potential.

With 2025 revenue nearing VND 53,000 billion and strong profit growth, MWG plans a 2028 BHX IPO to attract strategic investors and unlock value.

Q4/2025 ICT growth (The Gioi Di Dong/Dien May Xanh) is clear but pressured margins.

Q4 typically boosts sales with year-end promotions, Black Friday, and iPhone 17 upgrades (launched in September). Apple products may contribute 40–45% of phone revenue, sustaining momentum. The 2% VAT reduction supports pricing.

However, ICT gross margins may drop 50–100 basis points as MWG competes aggressively to maintain market share.

With strong cash flow and slower expansion, MWG lends to partners, improving financial income. Investors should assess credit risks as this is a short-term profit support rather than sustainable growth.

VCBS recommends buying MWG at VND 103,406 per share. Learn more here.

– 10:30 17/11/2025

Accelerating BSR’s Research on Bio-Diesel Fuel Innovation

On November 7th in Hanoi, leaders of Binh Son Refining and Petrochemical Joint Stock Company (BSR) held a meeting to accelerate the progress of the Pilot BioDiesel Project. This initiative focuses on refining the technology and conducting semi-industrial scale trial production of biodiesel fuel derived from agricultural and food processing waste, as well as microalgae oil.

Market Plunge Sparks Buying Spree: The Gioi Di Dong, Khai Hoan Land Chairman Lead Stock Acquisition Wave

Amidst the sharp decline in the stock market, a wave of listed companies and their internal shareholders have been actively accumulating shares, signaling a strong vote of confidence in their long-term prospects.