How to Calculate Retirement Pension in 2026 for Mandatory Social Insurance Participants?

According to Article 66 of the 2024 Social Insurance Law, the latest method for calculating retirement pensions in 2026 for mandatory social insurance participants is as follows:

Monthly Retirement Pension = Pension Rate × Average Monthly Salary Used for Social Insurance Contributions

The pension rate and the average monthly salary used for social insurance contributions are determined as follows:

For Female Workers: The monthly pension is calculated at 45% of the average salary used for social insurance contributions, corresponding to 15 years of contributions.

For each additional year of contributions, the pension rate increases by 2%, up to a maximum of 75% for 30 years of contributions.

For Male Workers: The monthly pension is calculated at 45% of the average salary used for social insurance contributions, corresponding to 20 years of contributions.

For each additional year of contributions, the pension rate increases by 2%, up to a maximum of 75% for 35 years of contributions.

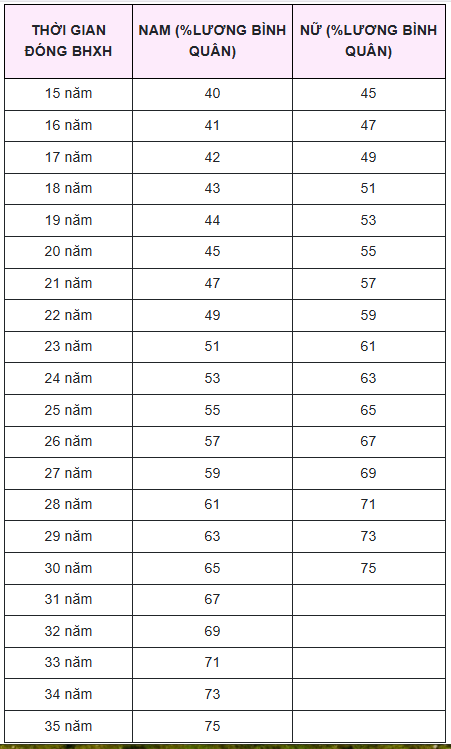

A notable change from the 2014 Social Insurance Law is the provision for male workers with contribution periods between 15 and 20 years. Their monthly pension is calculated at 40% of the average salary used for social insurance contributions, corresponding to 15 years of contributions, with an additional 1% for each extra year. This significant adjustment allows more male workers with shorter contribution periods to qualify for retirement pensions.

The specific monthly pension amounts for workers are as follows:

Note:

– The monthly pension for workers in specific occupations or special roles within the People’s Armed Forces is determined by the government and funded by the state budget.

– For individuals eligible under Article 65 of the 2024 Social Insurance Law, the monthly pension is calculated as above, with a 2% reduction for each year of early retirement. If the early retirement period is less than 6 months, the pension rate remains unchanged; for periods between 6 and 12 months, a 1% reduction applies.

– For workers with contribution periods under international agreements where Vietnam is a member, but with less than 15 years of contributions in Vietnam, each year of contribution is calculated at 2.25% of the average salary used for social insurance contributions.

Average Monthly Salary Used for Mandatory Social Insurance Contributions

– For workers under the state-regulated salary system, the average salary used for social insurance contributions is calculated based on the years of contributions before retirement:

For workers whose salaries are determined by their employers, the average salary used for social insurance contributions is calculated based on the entire contribution period.

– For workers with both state-regulated and employer-determined salary periods, the average salary used for social insurance contributions is calculated collectively, with the state-regulated period averaged according to Article 72, Section 1, of the 2024 Social Insurance Law.

How to Calculate Retirement Pension in 2026 for Voluntary Social Insurance Participants?

According to Articles 99 and 104 of the 2024 Social Insurance Law, the method for calculating retirement pensions in 2026 for voluntary social insurance participants is as follows:

Monthly Retirement Pension = Pension Rate × Average Income Used for Social Insurance Contributions

(1) Pension Rate

The pension rate and the average income are determined as follows:

For Female Workers: The monthly pension is calculated at 45% of the average income used for social insurance contributions, corresponding to 15 years of contributions.

For each additional year of contributions, the pension rate increases by 2%, up to a maximum of 75% for 30 years of contributions.

For Male Workers: The monthly pension is calculated at 45% of the average income used for social insurance contributions, corresponding to 20 years of contributions.

For each additional year of contributions, the pension rate increases by 2%, up to a maximum of 75% for 35 years of contributions.

For male workers with contribution periods between 15 and 20 years, the monthly pension is calculated at 40% of the average income used for social insurance contributions, corresponding to 15 years of contributions, with an additional 1% for each extra year.

(2) Average Income Used for Social Insurance Contributions

– The average income used for voluntary social insurance contributions is calculated based on the entire contribution period.

– The monthly income used for social insurance contributions is adjusted based on the consumer price index for each period, as stipulated by the government.

Note: For workers with contribution periods under international agreements where Vietnam is a member, but with less than 15 years of contributions in Vietnam, each year of contribution is calculated at 2.25% of the average income used for social insurance contributions, as per Article 104 of the 2024 Social Insurance Law.

Retirement in 2025: Calculating Your Monthly Pension After 33 Years of Social Insurance Contributions

Article 66 and Article 72 of the 2024 Social Insurance Law outline the detailed methodology for calculating monthly pension benefits for individuals enrolled in mandatory social insurance (BHXH).

![[Infographic] Flood Levels in the Northern Regions Over the Next 24 Hours](https://xe.today/wp-content/uploads/2024/09/lu-kv-mien-100x70.jpg)