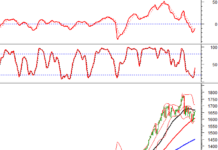

The morning session of November 17th opened on a positive note, with green dominating the trading board. The VN-Index steadily expanded its gains, though the market’s overall momentum lacked a breakout due to liquidity inching up only slightly compared to the previous week. This is seen as an improvement, signaling that investor sentiment is gradually returning, albeit with caution.

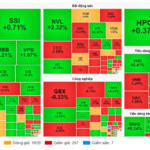

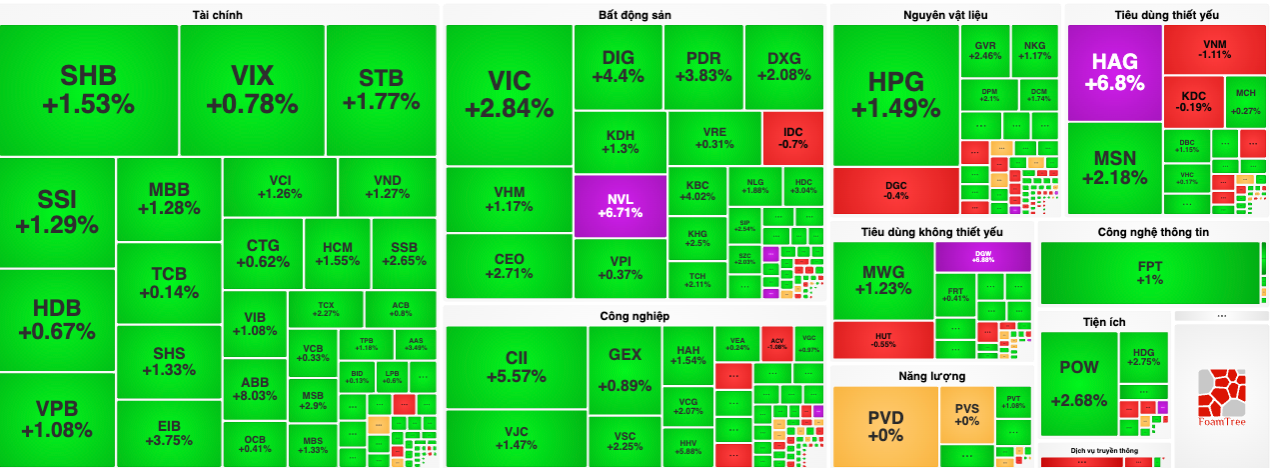

The market’s primary driver was large-cap stocks, particularly VIC, which contributed over 5 points to the VN-Index, becoming a key pillar supporting the index for most of the trading session. VIC closed up 2.8% at VND 217,000 per share—though not the day’s high. Following VIC in the leadership group were VHM, HPG, GVR, and MSN, which collectively bolstered the upward trend, with 28 out of 30 VN30 stocks ending in the green.

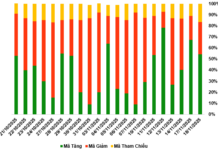

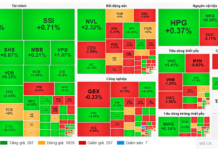

Green spreads widely across the board. Data: Vietstock.

On HoSE, over 220 stocks gained, indicating broad-based buying interest. Most sectors traded positively. While some large-cap stocks trimmed gains in the afternoon, mid-cap stocks maintained steady growth, unaffected by volatility in larger counterparts.

The real estate sector stood out as NVL unexpectedly hit its ceiling right at the morning open. This marked its third ceiling-hitting session in the last four trading days. The optimism spilled over to peers like CII, CEO, DIG, GEX, PDR, DXG, and KDH.

Securities stocks also had a positive session, with gains of 1-2% across the board. Meanwhile, the retail sector saw notable gains, with DGW hitting its ceiling at VND 42,700 per share, and MWG and FRT closing in the green.

Notably, HAG extended its ceiling-hitting streak. Stocks linked to Bầu Đức attracted strong buying interest following news of the company’s expanded investment plans and intentions to list subsidiaries in the near future.

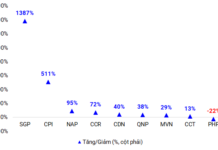

At the close, the VN-Index rose 18.96 points (1.16%) to 1,654.42. The HNX-Index gained 0.4% to 268.69, while the UPCoM-Index added 0.47% to 120.66. Liquidity on HoSE reached over VND 21.1 trillion, slightly higher than the previous session but still below market expectations.

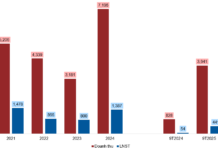

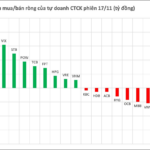

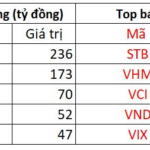

A downside today was foreign investors’ net selling of over VND 974 billion, concentrated in STB, VHM, VRE, and VCI.

Foreign Block Continues Net Selling Spree, Offloading Nearly 1 Trillion VND as VN-Index Surges, with Heavy Dumping of a Banking Stock

Foreign investors’ trading activity remains a significant drawback, as they continued to offload substantial holdings across all three major exchanges.