KIS Vietnam has unveiled a new plan detailing the allocation of over VND 789 billion raised from a rights issue to existing shareholders. Unlike previous statements that vaguely mentioned using the funds for operational capital and business expansion, the company now provides a clearer breakdown of amounts and timelines for each purpose.

Over VND 596 billion (75.6%) will be allocated to margin lending and securities advance payment activities, while the remaining VND 193 billion (24.4%) will support proprietary trading. The entire amount is scheduled for disbursement in 2025 and 2026.

Until the funds are fully utilized, the company may deposit money or purchase certificates of deposit at banks to optimize capital efficiency. The Board of Directors reserves the right to adjust the allocation plan by less than 50% of the capital, subject to approval at the nearest shareholder meeting.

The updated plan also specifies a more precise additional share issuance ratio of 20.9878%, compared to the initial 20.98%. Additionally, the company ensures that the post-issuance shareholder count does not exceed 100.

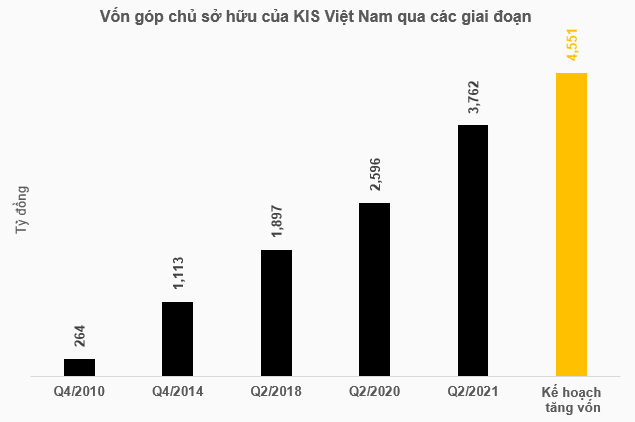

According to KIS Vietnam’s website, the company was established in December 2010 as a joint venture between Korea Investment & Securities Co., Ltd. (KIS Korea), the Vietnam National Textile and Garment Group, and other shareholders. KIS Korea initially held a 48.8% stake in November 2010 and has gradually increased its ownership to the current 99.8%.

Following multiple capital increases, the company’s equity now stands at nearly VND 3,762 billion. A successful upcoming capital raise will further boost this figure to over VND 4,551 billion.

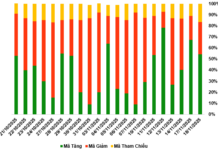

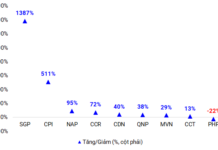

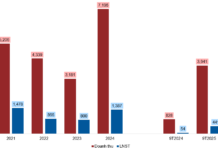

Source: Author’s compilation

|

In Q3 2025, KIS reported a net profit of over VND 194 billion, an 84% year-on-year increase driven by strong performance in proprietary trading, brokerage, and lending. This result offset the weak first-half performance, bringing the 9-month net profit to over VND 377 billion, a modest 4% increase.

For 2025, KIS Vietnam targets pre-tax profits of VND 750 billion. With VND 472 billion already achieved in the first nine months, the company has completed 63% of its annual goal.

As of Q3, the company’s total assets reached nearly VND 16.5 trillion, a 23% increase since the beginning of the year. The majority comprises lending balances of over VND 12.2 trillion, up 40% and setting a new record. Another notable item is financial assets at fair value through profit or loss (FVTPL), which rose from nearly VND 1.7 trillion to almost VND 2 trillion, primarily consisting of listed and unlisted equities, bonds, and fund certificates.

The upcoming capital raise, aimed at supporting margin lending and proprietary trading, is expected to further enhance revenue growth from these critical business segments.

– 6:00 PM, November 18, 2025

Global Brokerages Caught in the Capital Increase Vortex

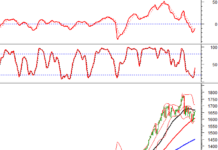

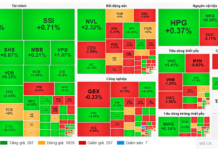

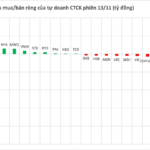

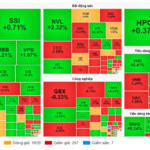

Amidst a market correction marked by liquidity tightening and index fluctuations, the race to raise capital within the securities sector has entered a new phase of heightened tension. After a period of relative inactivity, foreign investors are now re-emerging as key players in this competitive landscape. This resurgence signals a notable shift, particularly as the IPO trend is poised to extend its reach to foreign direct investment (FDI) enterprises, warranting close attention from market observers.

Becamex IJC Successfully Completes Sale of Over 251 Million Shares to 9,240 Shareholders

Following the conclusion of the issuance on November 7, 2025, Becamex IJC successfully distributed over 251.8 million shares to 9,240 shareholders, thereby increasing its chartered capital to 6,295.8 billion VND.