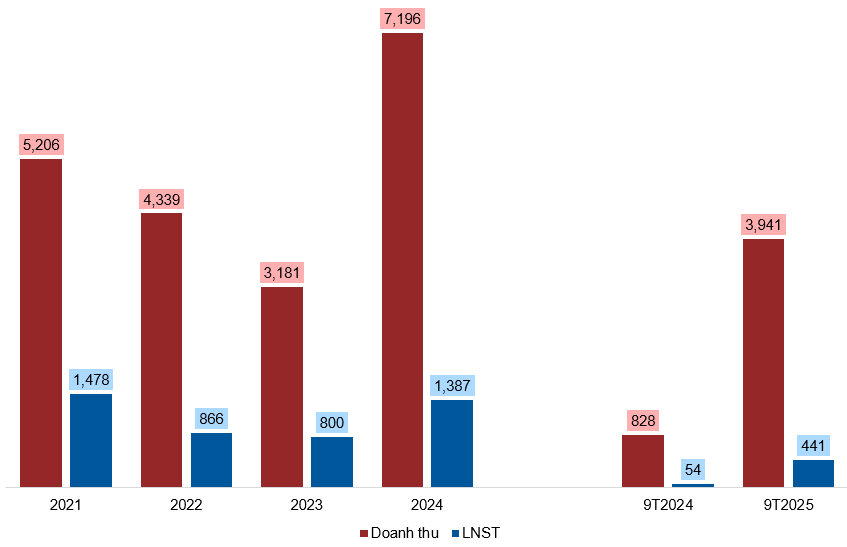

Exceptional Growth Driven by Key Project Handovers

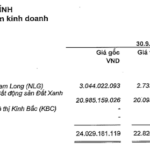

NLG’s 9-month revenue in 2025 surpassed VND 5 trillion, matching the entire 2024 figure, primarily from Southgate (VND 3.13 trillion) and Can Tho (VND 1.04 trillion) projects.

NLG’s Q4/2025 outlook remains positive, as the company announced a 15% stake transfer in Izumi City in July, with profits expected to be recognized in the final quarter.

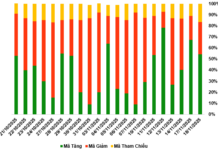

NLG’s 9-Month 2025 Business Results

(Unit: VND billion)

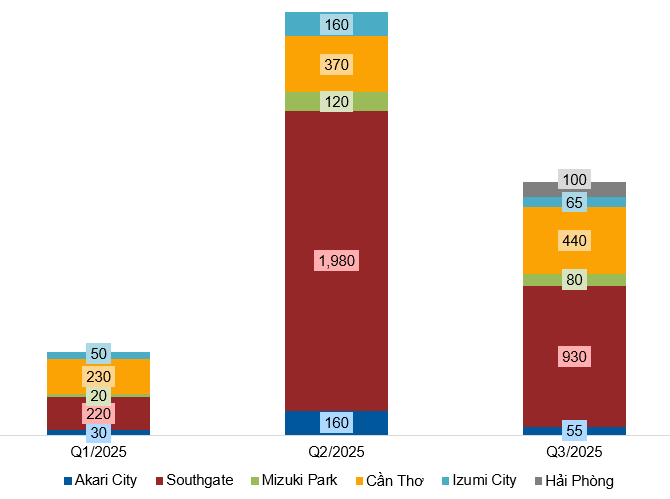

NLG’s 9-Month 2025 Sales Revenue

(Unit: VND billion)

Source: NLG

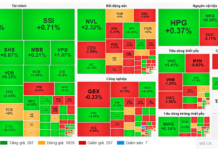

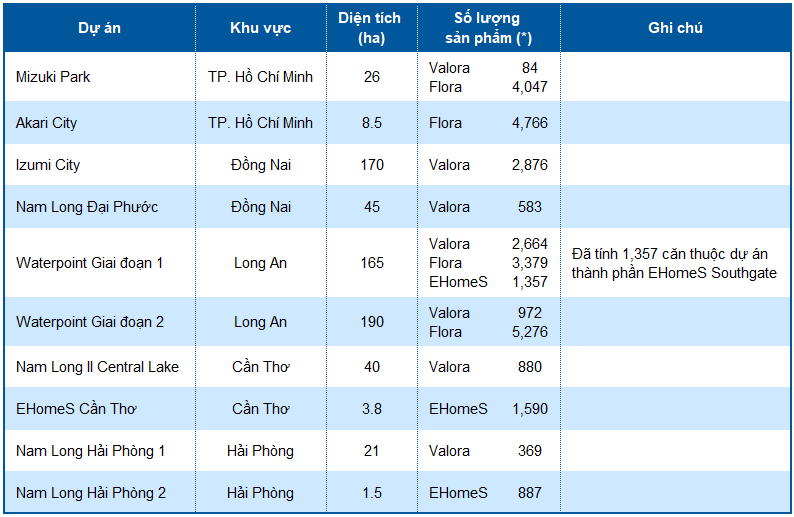

With a diverse project portfolio (see table below), NLG ensures a robust inventory for future years, a significant advantage over market competitors.

NLG’s Current Project Portfolio

Source: NLG Annual Report

(*Note: EhomeS – social housing for low-income customers; Flora – mid to high-end apartments; Valora – luxury villas and townhouses)

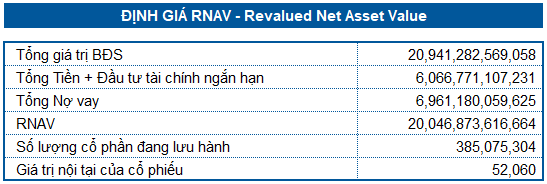

NLG Stock Valuation

Using the Revalue Net Asset Value (RNAV) method, NLG’s fair value is estimated at VND 52,060, significantly higher than its current market price. This positions NLG as an attractive investment for long-term investors.

Vietstock Corporate Analysis Department, Advisory Division

– 09:00 18/11/2025

Q4 Business Results: Unlocking Nam Long’s Explosive Growth Potential

Nam Long Investment Corporation (HOSE: NLG) has delivered an impressive performance in the first three quarters of 2025. What will drive growth in the final quarter?