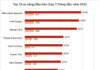

A market survey on November 18 revealed that live pig prices are trading between 46,000 and 53,000 VND/kg, with some localities like Hung Yen, Nam Dinh, and Dong Nai dropping to 45,000 – 46,000 VND/kg. Compared to March this year, when live pig prices in many northern provinces surpassed 76,000 VND/kg and even reached 80,000 VND/kg—the highest since Tet 2021—current prices have nearly halved.

Since the surge in live pig prices earlier this year, a widespread restocking wave has been triggered, with farmers hoping for an “early Tet feast” by year-end. However, from May to June, the supply-demand balance shifted, causing live pig prices to plummet. By September, prices fell from an average of 58,000 VND/kg to 48,000 VND/kg, breaking the low set in January 2024.

According to the Vietnam Livestock Association, the volume of pigs brought to market in October and the first half of November increased by 8-10% year-on-year, while retail demand rose only 2-3%. The oversupply has left farmers with no choice but to sell at a loss to recover capital or continue raising pigs and incur heavier losses.

Speaking to Tien Phong, Nguyen Quang Hien from Vinh Tuong, Phu Tho, shared that at the current price of 47,000 VND/kg, farmers cannot cover costs and start losing 500,000 – 800,000 VND per pig. “No one wants to sell in a panic, but we must sell to keep the capital flowing,” Hien said.

Interestingly, despite the continuous decline in live pig prices, pork prices at markets remain high, ranging from 120,000 to 160,000 VND/kg, while supermarkets charge 165,000 to 210,000 VND/kg depending on the cut. Popular products like pork belly, tenderloin, and shoulder meat have seen little to no reduction. Even as live pig prices dropped to 46,000 VND/kg, slaughtered pig prices at abattoirs remained at 67,000 – 71,000 VND/kg.

The multi-layered pork supply chain keeps retail prices high despite falling live pig prices.

Mai Anh from Ha Dong, Hanoi, mentioned raising this issue with vendors multiple times at the market, but they always respond that prices at abattoirs haven’t dropped much, so they can’t reduce prices either. “Every day I read about live pig prices falling, but pork at the market is still 150,000 – 160,000 VND/kg. Who benefits from this?” Mai Anh wondered.

Industry experts note that the benefit lies with the middlemen. A representative from a major livestock company in Ho Chi Minh City explained that reducing prices isn’t easy. Wholesalers and retailers tightly control prices and are reluctant to lower them at this time.

A pig travels through 4-6 layers from farm to consumer: trader – abattoir – wholesale market – retailer – supermarket/retailer. Each layer adds costs and profit margins, but the reduction in input costs is retained.

Estimates suggest that intermediary costs and profits account for 30-40% of the final price. The mechanism of “suppressing input prices – holding output prices” forces farmers to sell cheaply and incur losses, while consumers pay more and suffer. Meanwhile, intermediaries control pricing and reap most of the profits.

Nguyen Van Trong, former Deputy Director of the Department of Livestock and Animal Health under the Ministry of Agriculture and Environment, believes the root of the problem lies not with farmers or retailers but with market structure. Vietnam relies heavily on fresh pork and direct transactions without transparent pricing data.

“When live pig prices rise, retail prices increase immediately. But when live pig prices fall, retail prices remain stagnant because the market is priced based on sellers’ psychology rather than actual supply and demand. The expectation of higher pork prices during Tet is another factor keeping prices up,” he said.

The expert warns that if live pig prices remain below 50,000 VND/kg, many farmers will stop restocking after selling their current batches. This could lead to a rapid supply shortage from early 2026, causing prices to surge again—a scenario that has repeated for years.

Trong also notes that the pork market isn’t short of supply but lacks transparency. To break the cycle of “surplus this year, shortage next year,” it’s essential to disclose the price chain from farm to retail, control intermediaries, promote chilled and frozen pork to compete with fresh pork, and develop a national price data system for regulation.

Pork Prices Plummet: A Sharp Decline in Hog Rates

Pork prices have plummeted to their lowest point in nearly four years, dropping from 80,000 VND/kg to record lows in just seven months. This drastic decline has left many farmers facing significant losses, while the pork market remains sluggish and unpredictable.

Soaring Land Prices Pose Significant Risks to Businesses and Citizens

Crafting a tailored adjustment roadmap is essential to prevent market shock and abrupt impacts on businesses and citizens.