The National Assembly has passed a resolution adjusting the personal income tax deduction threshold. The new deduction for taxpayers is set at 15.5 million VND per month (186 million VND annually), with an additional deduction of 6.2 million VND per month for each dependent. These changes will take effect starting from the 2026 tax year.

Commenting on this adjustment, Dr. Nguyễn Ngọc Tú, former Director of the General Department of Taxation and lecturer at Hanoi University of Business and Technology, noted that while the new threshold is more appropriate than before, it remains insufficient. “If not further increased, this level will soon become outdated and unreasonable, especially as the economy is projected to grow strongly, potentially exceeding 10% by 2026,” said Dr. Tú.

Dr. Tú further analyzed that the proposed deduction for dependents, set at 6.2 million VND, applies to individuals whom the taxpayer is obligated to support. However, the actual costs of supporting dependents, such as parents and school-aged children, are currently very high.

Echoing this sentiment, Dr. Châu Đình Linh from Ho Chi Minh City Banking University stated that the Ministry of Finance’s decision to adjust the deduction threshold based on factors like GDP growth and average per capita income is a commendable move.

However, the 15.5 million VND monthly deduction threshold is only relatively suitable for 2025. Given Vietnam’s rapid economic growth, this amount may quickly become outdated once implemented.

“Adjusting the deduction threshold is necessary and reasonable, as the current level no longer aligns with today’s cost of living and income levels. However, the effective date is set for the 2026 tax year, meaning it’s over a year away, during which living costs and inflation could fluctuate significantly,” Dr. Châu Đình Linh pointed out.

Experts predict the 15.5 million VND monthly deduction threshold may become outdated by 2026.

The expert also questioned whether the 15.5 million VND monthly deduction threshold is suitable for all provinces and cities.

“I believe the 15.5 million VND deduction threshold is not suitable for all provinces and cities. It’s important to remember that living costs in major cities like Hanoi and Ho Chi Minh City are very high, making this threshold still unreasonable and in need of further review for adjustments,” Dr. Châu Đình Linh stated.

Regarding the 6.2 million VND monthly deduction for dependents, Dr. Châu Đình Linh also noted that it remains low compared to global standards.

“A family with two young children, where the husband is the primary earner with an income of around 20–25 million VND per month, will still have a relatively high taxable income after deductions for the household and insurance. However, in reality, living expenses in urban areas like Hanoi or Ho Chi Minh City can consume nearly all of that income,” Dr. Châu Đình Linh explained.

Therefore, the expert suggested raising the deduction threshold for taxpayers to approximately 17 million VND per month, while increasing the deduction for dependents to at least 50% of the taxpayer’s deduction, equivalent to around 8.5 million VND per month.

Additionally, Dr. Châu Đình Linh emphasized that to ensure the policy remains relevant, the deduction threshold should be adjusted more frequently. “There needs to be a mechanism for updating the deduction threshold periodically, such as every 2–3 years. Furthermore, distinctions should be made between regions, as the cost of living in major cities and rural areas varies significantly,” Dr. Châu Đình Linh proposed.

Dr. Châu Đình Linh argued that the new regulations should be implemented sooner rather than waiting until 2026, as a 2026 implementation would result in a high policy lag, with taxpayers having to wait until March 2027 for settlement.

Similarly, Mr. Nguyễn Văn Được, CEO of Trong Tin Accounting and Tax Consulting Company, noted that the new deduction threshold was adjusted by the government based on the growth rate of average per capita income and GDP.

“While this new deduction threshold is considered more aligned with the population’s living standards, it still lags behind the actual growth rate of the economy and society,” Mr. Nguyễn Văn Được observed.

According to Mr. Được, the new deduction threshold represents an increase of over 40% compared to the previous level. “This increase is based on the approximately 40–42% growth in average per capita income and GDP since 2020, meaning it’s still adjusted mechanically. This approach will cause the law to become outdated, as the actual growth rate may exceed 42% by the time the new threshold takes effect,” Mr. Nguyễn Văn Được assessed.

Regarding the proposed 6.2 million VND deduction for dependents, Mr. Được noted that while this amount has increased, it remains low compared to living expenses, particularly in cities like Hanoi and Ho Chi Minh City.

The expert analyzed that if the deduction threshold is too low, it will increase the tax burden on workers, reducing their disposable income and indirectly affecting the demand for goods and services, making it difficult to stimulate economic production activities.

Mr. Nguyễn Văn Được also stressed that in the future, the revised Personal Income Tax Law will empower the government to flexibly adjust the deduction threshold. Additionally, the revised law will allow for the deduction of healthcare and education expenses before calculating taxable income.

Techcombank Launches Techcom Life, Elevating Insurance Experience for Vietnamese Customers

Techcombank (Vietnam Technological and Commercial Joint Stock Bank) has officially signed a distribution agreement to act as an agent for life insurance and health insurance products offered by Techcom Life (Technological and Commercial Life Insurance Joint Stock Company).

Empowering Financial Growth: Banks Secure Capital Flow for Economic Development

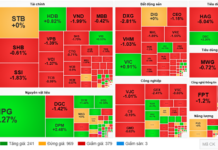

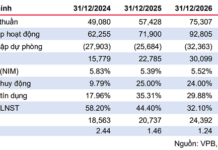

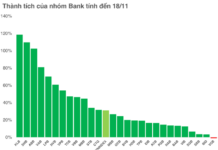

Credit recovery is soaring and is projected to sustain robust growth, fueled by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is pivotal in achieving the ambitious GDP growth target of 8% by 2025. The banking sector continues to strengthen its financial capabilities, solidifying a robust foundation to support its growth strategies and meet the economy’s capital needs.

Proposed Addition of Three Scenarios for State Land Reclamation

At the 10th session, the Government proposed to the National Assembly the addition of three scenarios where the State may reclaim land for socio-economic development in the interest of national and public welfare.

Unlocking Unprecedented Profits: The Rise of Fund Management

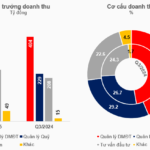

In Q3 2025, over 40 asset management companies operating in Vietnam’s stock market painted a vibrant picture of growth. Combined revenues surged to nearly VND 1.1 trillion, while net profits soared to approximately VND 570 billion, marking impressive year-over-year increases of 27% and 87%, respectively.