KIS Vietnam Securities Corporation (KIS Vietnam) has announced the results of its written shareholder consultation, conducted from November 5 to 15, 2025.

Shareholders approved adjustments to the existing share offering plan for current investors, initially passed during the first Extraordinary General Meeting on October 15, 2025.

The revised plan includes the issuance of 78.9 million shares at a ratio of 100:20.9878, allowing shareholders holding 100 shares to purchase an additional 20.9878 shares. The offering price is set at VND 10,000 per share, with no transfer restrictions on the newly issued shares.

Shareholders may transfer their purchase rights once during the subscription period, up to five days before the registration deadline. Transferees cannot further transfer these rights. KIS Vietnam will manage the transfer process to ensure the post-issuance shareholder count does not exceed 100.

With the offering price at VND 10,000 per share, KIS Vietnam aims to raise over VND 789 billion. Approximately 75.6% (VND 596.4 billion) will enhance margin lending and advance payment capital, while the remaining 24.4% (VND 193 billion) will support proprietary trading activities.

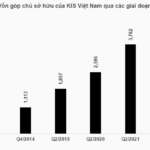

Upon completion, KIS Vietnam’s chartered capital will increase from VND 3,762 billion to over VND 4,551 billion.

In the first nine months of 2025, KIS Vietnam reported VND 1,927 billion in operating revenue, a 4.3% year-on-year increase. Proprietary trading contributed the most with VND 303 billion, followed by lending (VND 248 billion) and brokerage (VND 209 billion) revenues.

Operating expenses rose 5.6% to VND 1,273 billion, resulting in pre-tax profit of VND 472 billion, up 4.6% year-on-year.

For 2025, KIS Vietnam targets VND 750 billion in pre-tax profit, achieving 63% of this goal to date.

Established in December 2010, KIS Vietnam is a joint venture between Korea Investment & Securities (KIS Korea), the Vietnam Textile and Garment Group, and other shareholders. KIS Korea initially held a 48.8% stake, gradually increasing its ownership to the current 99.8%.

KIS Securities Finalizes Plan to Inject Hundreds of Billions into Proprietary Trading and Margin Lending

KIS Vietnam Securities Corporation (KIS Vietnam) has successfully obtained written approval from shareholders between November 5th and 15th. The outcome confirms the adjustment of certain details within the plan to offer over 78.9 million shares, as initially approved during the Extraordinary General Meeting of Shareholders on October 15th.

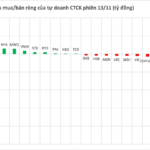

Global Brokerages Caught in the Capital Increase Vortex

Amidst a market correction marked by liquidity tightening and index fluctuations, the race to raise capital within the securities sector has entered a new phase of heightened tension. After a period of relative inactivity, foreign investors are now re-emerging as key players in this competitive landscape. This resurgence signals a notable shift, particularly as the IPO trend is poised to extend its reach to foreign direct investment (FDI) enterprises, warranting close attention from market observers.