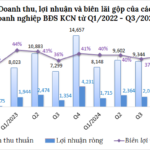

In a recent report, Agriseco Securities forecasts a 5–10% year-on-year profit growth for industrial park (IP) companies in 2025, with a stronger recovery expected in 2026.

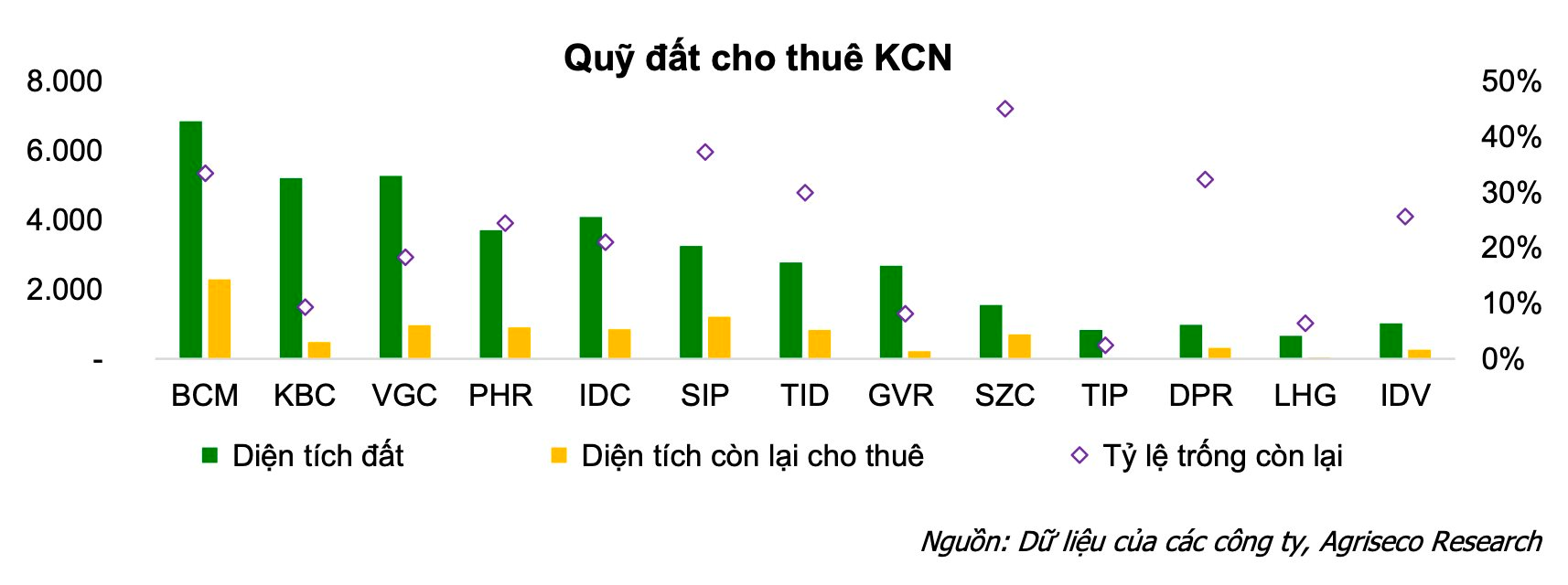

This growth is primarily driven by enterprises with large land banks ready for lease, pre-signed memorandums of understanding, or strategically located land that attracts new FDI inflows. For rubber companies transitioning to IPs with substantial land banks, profits are anticipated to surge due to land compensation and high rubber prices. Notable companies include GVR, PHR, and DPR.

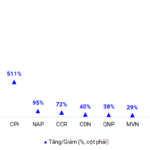

However, Agriseco cautions that IP land leasing revenues and profits during the “Trade War 2.0” period (2025–2026), while projected to grow, will be lower than those during Trade War 1 (2017–2018). This is because Vietnam previously benefited directly from capital relocation, whereas current tenant sentiment remains cautious due to uncertain tariff environments, despite potential U.S. tax reductions.

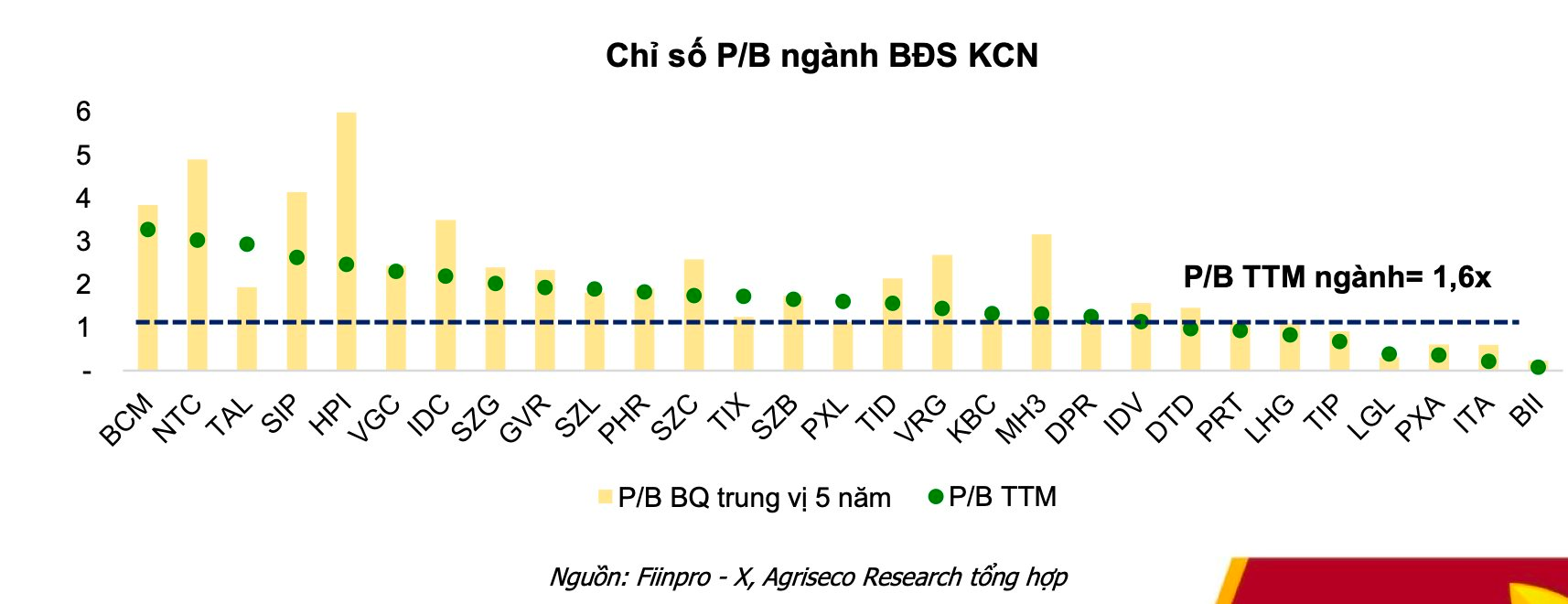

In terms of valuation, IP real estate companies are currently trading at an average P/B of 1.6 times, below the 5-year median of 2.1 times. Agriseco considers this valuation attractive given the growth prospects and land value of these companies in the coming years.

Based on criteria such as large lease-ready land banks in potential areas, safe valuations relative to mid-to-long-term growth potential, and positive sales performance, Agriseco highlights the following potential stocks: KBC, IDC, SIP, PHR, VGC.

For KBC, growth drivers in 2025–2027 are expected from: (1) Land lease handovers in existing IPs like Nam Son Hap Linh, Tan Phu Trung, and new projects in Trang Due 3, Loc Giang, Que Vo 2 expansion, and Hung Yen industrial clusters; (2) Revenue from real estate sales in Trang Cat urban area and Nanh town social housing.

With over 6,000 hectares of land and plans to expand by 2,500 hectares upon infrastructure completion, KBC has a solid foundation for sustained mid-to-long-term growth.

For IDC, IP leasing activities are expected to improve from 2026, boosting business results. Unrecognized revenue as of September 30, 2025, stands at over VND 6,051 billion, up 5% year-to-date.

Long-term growth is fueled by IDC’s expansion of over 1,200 hectares across four new IP projects: Tan Phuoc 1, My Xuan B1, Vinh Quang, and Phu Long, increasing total IP area to over 4,400 hectares. IDC’s new land banks in strategic locations with regional connectivity and logistics integration position it for mid-to-long-term growth.

For SIP, 2025–2026 business results are expected to grow due to: (1) 5–10% growth in the utilities segment from higher volumes and prices; (2) Active IP leasing. As of September 30, 2025, unrecognized revenue reached VND 13,200 billion (+9% year-to-date); (3) Urban area segment growth in 2026 from Phuoc Dong City project handovers, with low-rise units ready for delivery.

Long-term growth potential comes from new IPs, with SIP holding 3,200 hectares of land and 1,000 hectares available for lease in the Southeast region. Projects include Phuoc Dong 3 (650ha), Pham Van I, II (668ha), and Long Duc 2 (294ha), expected to sustain mid-to-long-term growth.

For PHR, 2025–2026 profit growth is driven by land compensation for IP projects, dividends, and revenue from Nam Tan Uyen 3 IP leasing. The rubber segment is expected to maintain growth due to high prices amid global supply shortages.

PHR also has 34 hectares in Tan Binh IP with 86% occupancy and new IP projects like Tan Lap 1 (200ha) and Tan Binh expansion (1,000ha) pending government approval for 2025–2027. Additionally, PHR is establishing three new IPs: Hoi Nghia (715ha), Binh My (1,000ha), and Tan Thanh (316ha). These projects are expected to contribute to mid-to-long-term growth due to rising rents and strong investment demand in Binh Duong.

Finally, VGC benefits from IP and construction material segments, with the Ministry of Construction planning to divest its remaining 38.6% stake. Long-term potential comes from expanding its 15 IPs totaling 4,600 hectares, with 850 hectares ready for lease. These IPs attract major tech investors like Samsung, Foxconn, and BYD. VGC aims to increase its IP portfolio to 20 IPs with 2,000–3,000 hectares by 2025.

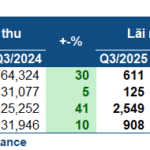

Seaports Reap Record Profits in Q3

The third quarter marked a remarkable harvest season for the port sector, as cargo throughput surged, profit margins expanded, and cash reserves reached unprecedented levels.

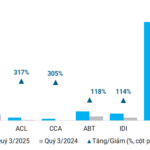

Seafood Industry Profits Surge to New Heights

Despite facing tariff pressures and a slowdown in export markets, the seafood industry group reported remarkable profit growth in Q3 2025. Several companies achieved their highest earnings in three years, with bank deposits reaching unprecedented levels.