Novaland Group (stock code: NVL) has submitted a document to the Hanoi Stock Exchange (HNX) detailing its bond principal and interest payment status.

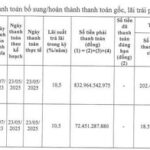

According to the plan, Novaland was scheduled to pay approximately VND 824 billion in principal and over VND 72 billion in interest for the NVLH2123011 bond series on November 14th. However, due to insufficient funds, NVL has only managed to pay nearly VND 8 billion in principal and over VND 730 million in interest.

Novaland is currently in negotiations with investors regarding the outstanding debt for this bond series. As of November 14th, NVL owes nearly VND 816 billion in principal and almost VND 72 billion in interest for the NVLH2123011 bonds.

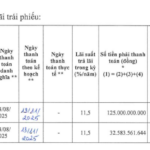

This is not the first time Novaland has delayed payments to holders of the NVLH2123011 bond series. In late August, Novaland was due to pay nearly VND 833 billion in principal for these bonds. However, citing insufficient funds, NVL only paid approximately VND 9 billion, leaving around VND 824 billion unpaid.

Previously, on May 23rd, Novaland was required to pay nearly VND 833 billion in principal and over VND 72 billion in interest for the NVLH2123011 bonds but only managed to pay VND 202 million in principal and nearly VND 19 million in interest through other assets.

As of November 14th, Novaland owes nearly VND 816 billion in principal and almost VND 72 billion in interest for the NVLH2123011 bond series.

The NVLH2123011 bond series was issued on September 1, 2021, with a total value of VND 1,000 billion and a 2-year term. The proceeds from this bond issuance were used by Novaland to invest in the Cu Lao Phuoc Hung Urban Area project in Dong Nai Province (commercially known as Phoenix Island) and other company projects.

Additionally, Novaland has announced a solicitation of bondholder opinions regarding an international convertible bond package with a 5.25% annual interest rate, maturing in 2027.

NVL proposes that bondholders approve a waiver of any default or breach related to the company’s inability to fully pay the accrued interest. The proposal also includes a waiver of any compensation, late payment penalties, or other charges arising from this incomplete payment.

NVL attributes its inability to pay the full interest amount to short-term cash flow challenges and market volatility. This bond series, issued by Novaland in 2021, raised USD 300 million with 1,500 bonds (USD 200,000 per bond). It is an unsecured bond with semi-annual interest payments.

Novaland completed the restructuring of this bond package on July 30th. Under the new terms, the outstanding principal was reset to over USD 335 million. The maturity date was extended from July 16, 2026, to June 30, 2027, with the interest rate remaining at 5.25% per annum.

Notably, one of the most significant adjustments in the restructuring was the conversion price, which was reduced from the initial VND 135,700 per share to just VND 36,000 per share. The new conversion ratio is equivalent to 156,018 NVL shares per bond.

In Q3 of this year, NVL reported net revenue of VND 1,683 billion and a post-tax loss of VND 1,153 billion, compared to a profit of VND 2,950 billion in the same period last year. For the first nine months, consolidated net revenue reached nearly VND 5,398 billion. However, consolidated post-tax profit recorded a loss of VND 1,820 billion, primarily due to a decline in financial activity revenue.

As of September 30th, Novaland’s total debt stood at over VND 64,000 billion, with short-term debt totaling approximately VND 32,000 billion.

Gia Phú Real Estate Delays Bond Principal and Interest Payments

By November 13, 2025, Gia Phu Real Estate failed to settle a principal payment of VND 125 billion and nearly VND 32.6 billion in interest for the GPRCH2123001 bond tranche, citing inability to secure sufficient funds.

Exclusive Acquisition: Phát Đạt Secures Billion-Dollar Project in the Heart of Ho Chi Minh City

Through its acquisition of a 50% stake in AKYN, Phat Dat Real Estate has announced plans to develop a multi-billion-dollar project.