EVS Securities Corporation (Stock Code: EVS, HNX) has announced the resignation of Mr. Nguyen Dinh Tuan from his position as a Board Member. Born in 1980, Mr. Tuan submitted his resignation due to personal reasons, effective November 17, 2025.

It is highly likely that his resignation will be approved at the upcoming Extraordinary Shareholders’ Meeting scheduled for December. On November 12, 2025, EVS finalized the list of shareholders eligible to attend the meeting. The agenda for the meeting has not yet been disclosed.

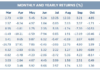

In terms of business performance, EVS reported an operating revenue of VND 209 billion in the first nine months of 2025, a 41% increase compared to the same period last year. Consequently, pre-tax profit reached over VND 11 billion, 2.3 times higher than the previous year.

As of September 30, 2025, EVS’s total assets stood at VND 2,323 billion, a 5.8% decrease year-over-year.

The financial assets at fair value through profit or loss (FVTPL) portfolio had an original value of over VND 723 billion, including VND 433 billion in listed stocks and VND 251 billion in unlisted stocks.

Outstanding loans amounted to more than VND 140 billion. Notably, receivables accounted for half of the total assets, reaching VND 1,255 billion. These receivables are likely associated with unrecovered bond debts.

This includes a VND 328.5 billion bond issued by Viet Media, as per the Bond Purchase Agreement No. 07/2024/HĐCHTP/EVS-VMA signed on December 25, 2024. Viet Media was scheduled to repay this amount to EVS by August 30, 2025, but the deadline has been extended to December 30, 2025, with EVS waiving interest during the extension period.

The remaining VND 737.5 billion is a bond issued by Tien Thanh Consulting Services Company. Tien Thanh was initially scheduled to repay this amount by December 22, 2025, but the deadline has been extended to January 22, 2026. EVS plans to seek shareholder approval during the extension period to take necessary actions or recover collateral to ensure the company’s financial safety indicators.

FLC Shares Expected to Resume Trading in Q1 2026 Following Leadership Overhaul

The extraordinary 2025 Shareholders’ Meeting (2nd session) of FLC Group Joint Stock Company (UPCoM: FLC), held on the morning of November 11th, commenced with a remarkable shareholder attendance rate of 35.682%.

Cumulative Loss Exceeds 3 Trillion, Negative Equity: Former Steel Industry Leader Unveils Restructuring Plan

Pomina’s Q3 2025 financial report reveals a net revenue of VND 203 billion, marking a 58% decline compared to the same period last year. The company incurred an after-tax loss of nearly VND 183 billion, an improvement from the VND 286 billion loss recorded in the corresponding quarter of the previous year. This marks Pomina’s 14th consecutive quarter of losses.