Illustrative image

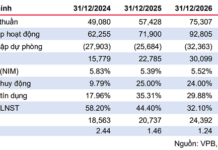

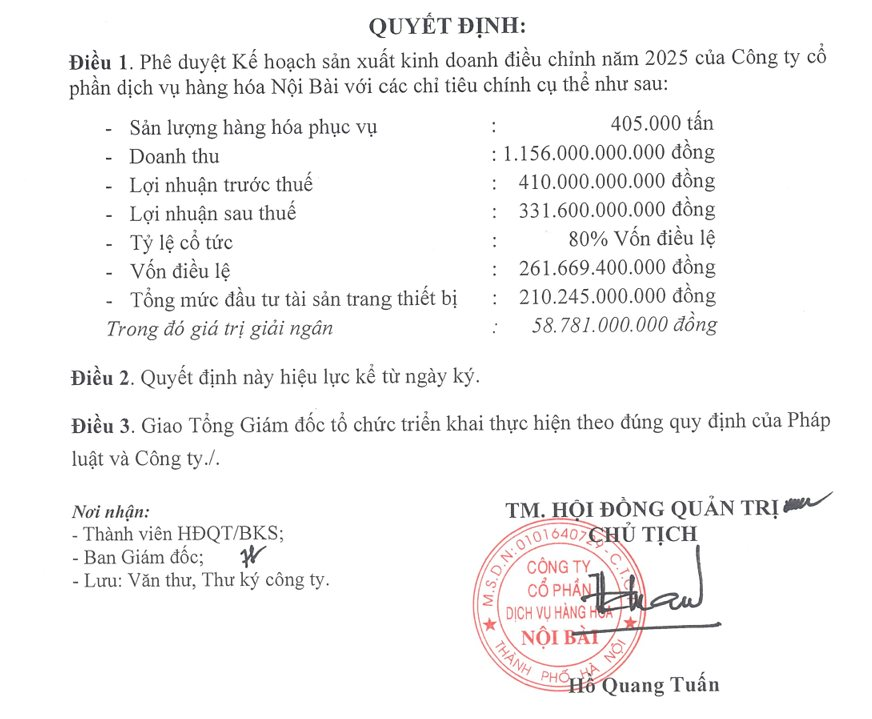

The Board of Directors of Noi Bai Cargo Services Joint Stock Company (NCT) has approved the adjustment of the 2025 business plan. Specifically, the total cargo volume served has been revised to 405,000 tons, a 6% increase from the 382,000 tons approved at the June 2025 Shareholders’ Meeting.

In line with the increased volume, financial targets have also been significantly adjusted. The 2025 revenue plan has been raised from 1.006 trillion VND to 1.156 trillion VND, reflecting a nearly 15% increase. Notably, the pre-tax profit target has been revised from 336.8 billion VND to 410 billion VND. Consequently, the post-tax profit has increased by over 60 billion VND (more than 22%) compared to the initial plan, reaching 331.6 billion VND.

Data source: Noi Bai Cargo Services Joint Stock Company (NCT)

This adjustment comes amidst NCT’s strong performance in the first nine months of 2025, with cumulative revenue reaching 839.3 billion VND and post-tax profit at 264.2 billion VND. Compared to the original plan, the company has achieved 97.4% of its annual profit target after just nine months.

However, with the newly approved plan, NCT’s completion rate as of Q3/2025 stands at 72.6% for revenue and 79.6% for post-tax profit. To meet these new targets, the company needs to achieve approximately 316.7 billion VND in revenue and 67.4 billion VND in net profit in Q4/2025.

Conversely, the investment plan for basic construction and equipment procurement has seen a significant reduction. While the total investment has been slightly adjusted from 217.2 billion VND to 210.2 billion VND, the projected disbursement for 2025 has decreased by over 50%, from 118.9 billion VND to 58.8 billion VND.

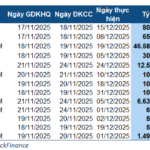

Regarding dividends, the 80% payout ratio remains unchanged. November 18th is the final registration date for the first dividend payment of 2024, scheduled for December 15th, totaling approximately 209 billion VND. Major shareholder Vietnam Airlines is expected to receive over 115 billion VND.

As of September 30, 2025, NCT’s total assets reached 1.0335 trillion VND, a 39.5% increase from the beginning of the year. The company maintains a substantial cash position, with short-term financial investments held to maturity (bank deposits) totaling 596.7 billion VND, accounting for 57.7% of total assets. Liabilities stand at 237.3 billion VND, a 30% increase from the start of the period, primarily consisting of short-term payables related to business operations.

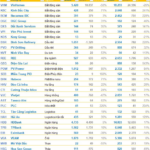

On the stock market, as of noon on November 19, 2025, NCT shares were trading around 96,000 VND per share, a slight 0.41% decrease from the reference price, with a trading volume of over 12,200 units. This follows a recent surge in early November, when the stock price reached a short-term peak of 103,000 – 104,000 VND per share before retreating to its current level.

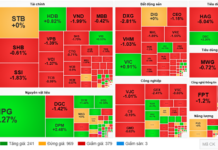

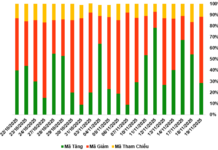

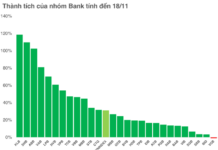

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.