Mekong Capital and Gene Solutions Founders

According to Reuters, Gene Solutions is advancing a substantial capital-raising plan through two phases: a pre-IPO funding round and an initial public offering (IPO), slated for as early as 2026.

PROJECTED REVENUE OF $100 MILLION

Detailing the financial structure, CFO Keng Hsu revealed the company aims to secure $50 million in the pre-IPO round and an additional $50 million upon listing.

The Vietnamese startup targets listing on one of Asia’s premier exchanges: Hong Kong or Singapore. Currently, CICC (China International Capital Corp) is advising on the pre-IPO funding.

Specializing in prenatal screening and cancer detection solutions powered by next-gen sequencing and AI, Gene Solutions is strategically timing its IPO to capitalize on growing international investor interest in genetic diagnostics.

Chris Freund, Founder and CEO of Mekong Capital—Gene Solutions’ primary investor—hinted that the two funding rounds could be flexibly combined. The company is also considering a dual listing in both Singapore and Hong Kong.

This approach maximizes access to foreign capital and leverages favorable legal frameworks in these financial hubs for biotech firms.

Source: Gene Solutions

IS THE VIETNAMESE STARTUP PROFITABLE IN ITS HOME MARKET?

A key highlight, as emphasized by Freund, is Gene Solutions’ profitability in Vietnam, having reached breakeven domestically.

Thus, the IPO proceeds will primarily fuel market expansion across Asia rather than defensive measures.

Mekong Capital initially invested $15 million in Gene Solutions in 2021 via its Mekong Enterprise Fund IV, followed by an additional $21 million in the 2023 Series B round.

While Mekong Capital declined to disclose Gene Solutions’ current valuation, Freund drew a notable parallel with MiRXES, a Singapore-based early-diagnosis firm using miRNA technology.

MiRXES, listed in Hong Kong earlier this year with a secondary listing in Singapore, boasts a market cap of HK$16.4 billion ($2.11 billion). Notably, Gene Solutions’ revenue surpasses MiRXES’ $21.34 million from last year.

Source: Mekong Capital

DEMOCRATIZING PRENATAL AND CANCER GENETIC TESTING

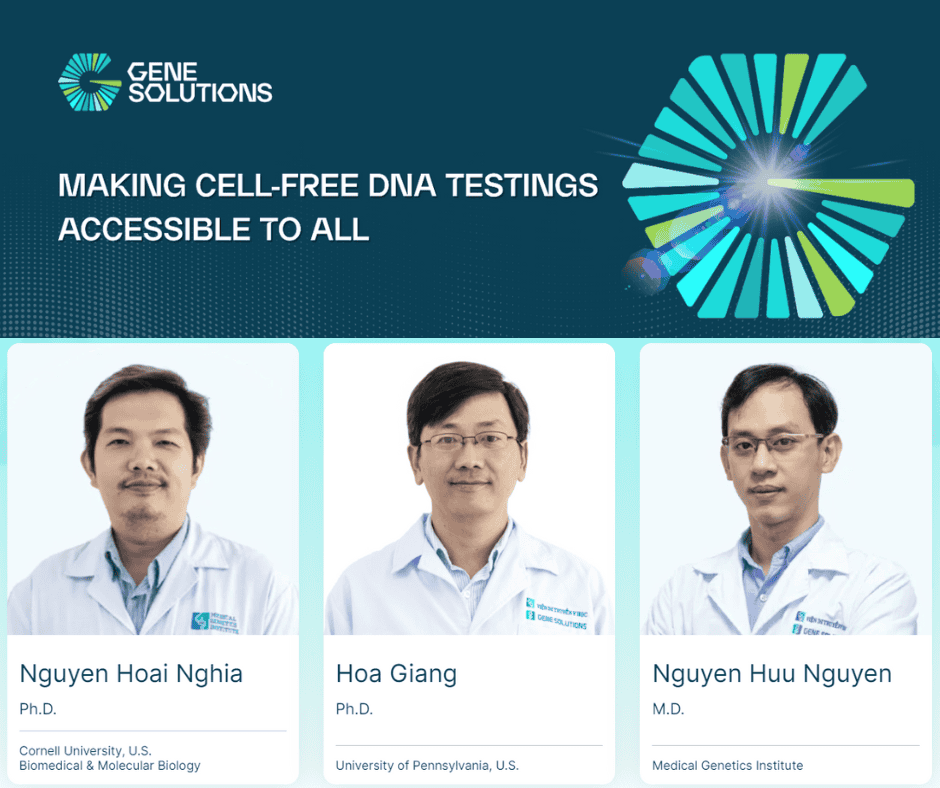

Founded in 2017 by Dr. Nguyễn Hoài Nghĩa (CEO), Dr. Giang Hoa, and Dr. Nguyễn Hữu Nguyên, Gene Solutions aims to make genetic testing affordable and accessible across Vietnam and Southeast Asia.

In prior interviews, leadership highlighted the demand for genetic testing in developed nations, particularly in prenatal and cancer care.

Since 2016, prenatal genetic testing (NIPT) has been global, but high costs limited accessibility in Vietnam. Gene Solutions pioneered NIPT in Vietnam, offering tests under $70 (previously $2,000), capturing 90% market share.

Following prenatal testing, Gene Solutions focuses on early cancer screening. Dr. Nguyên emphasized the need for early detection to improve treatment outcomes and reduce costs.

Their ctDNA cancer screening costs $300, compared to $1,000 abroad, with plans to reduce it to $120–150 within two years.

With over 2,000 hospital and clinic partnerships and international-standard labs, Gene Solutions dominates domestically and is expanding in Thailand, the Philippines, and Indonesia.

Gene Solutions Partners with Hoàn Mỹ

On October 15, Gene Solutions strengthened its domestic position by partnering with Hoàn Mỹ Medical Corporation.

This collaboration integrates Gene Solutions’ international-standard genetic tests (NIPT, ctDNA cancer screening, rare genetic diseases) into Hoàn Mỹ’s hospital network.

VPS Securities Continues Distribution of Remaining Shares in IPO

VPS Securities has successfully allocated the remaining 690,285 shares from its IPO to investor Vũ Cao Hoàng Hải Linh. Additionally, 12,859 fractional shares have been distributed to investor Nguyễn Trường Giang.

Global Brokerages Caught in the Capital Increase Vortex

Amidst a market correction marked by liquidity tightening and index fluctuations, the race to raise capital within the securities sector has entered a new phase of heightened tension. After a period of relative inactivity, foreign investors are now re-emerging as key players in this competitive landscape. This resurgence signals a notable shift, particularly as the IPO trend is poised to extend its reach to foreign direct investment (FDI) enterprises, warranting close attention from market observers.

MWG Aims to Transform Indonesian Electronics Chain into Southeast Asia’s New Retail Icon

In the 2026–2030 strategic cycle, EraBlue aims to achieve sustainable growth, expand its regional footprint, and go public before 2030, solidifying its position as Southeast Asia’s emerging retail icon.