I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON NOVEMBER 19, 2025

– Major indices universally declined during the November 19 trading session. The VN-Index dropped by 0.66%, closing at 1,649 points, while the HNX-Index fell by 0.87%, settling at 265.03 points.

– Trading volume on the HOSE increased by 5.1%, reaching nearly 742 million units. The HNX recorded 71 million matched units, a 7.7% rise compared to the previous session.

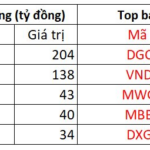

– Foreign investors continued to net sell, with a value of VND 651 billion on the HOSE and VND 8.2 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced widespread adjustments during the November 19 session. Although the VN-Index did not record a significant decline in the morning, the overall sentiment was negative, with a majority of stocks decreasing. In the afternoon session, buying interest emerged as the index retreated to around 1,650 points, briefly lifting the market. However, a sudden strong fluctuation occurred near the close, causing the VN-Index to plunge nearly 17 points before bottom-fishing buying helped narrow the loss, closing at 1,649 points, down nearly 11 points from the previous session.

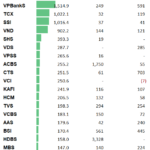

– Among the top stocks influencing the VN-Index, VPB had the most negative impact, reducing the index by 1.23 points. VCB, TCB, and FPT followed, collectively dragging the index down by an additional 2.56 points. Conversely, HDB and VIC were the top contributors, adding 1.2 points to the index.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index decreased by 11.87 points (-0.63%), closing at 1,886.2 points. Sellers dominated, with 23 stocks declining, 5 advancing, and 2 unchanged. Notably, TPB, SSI, VPB, BCM, VRE, and DGC all adjusted by more than 2%. In contrast, HDB was the standout performer, rising by 2.8%, while HPG, PLX, VNM, and VIC maintained slight gains.

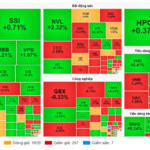

All sectors were dominated by red. The communication services sector performed the worst, declining by 3.6%, influenced by deep adjustments in VGI (-4.66%), YEG (-1.64%), SGT (-2.7%), and ICT (-3.4%).

The financial, industrial, and real estate sectors significantly pressured the overall index, with numerous stocks falling over 1%, including VIX, SSI, VPB, TCB, VCI, SHS, VND, MBS, TPB, GEX, GEE, HAH, VSC, CTD, PC1, VGC, VTP, DXG, NVL, VRE, CEO, KDH, and NLG.

The materials sector, despite some bright spots like DCM (+1.58%), DPM (+1.24%), NTP (+1.27%), TVN (+1.27%), and KSB (+1.32%), remained in the red as GVR (-0.88%), DGC (-2.23%), CSV (-1.54%), DDV (-2.71%), PAT (-1.05%), and others faced adjustment pressures.

The VN-Index paused its upward trend, testing the Middle line of the Bollinger Bands. This support level is crucial for maintaining short-term recovery momentum. The Stochastic Oscillator and MACD indicators continue to signal buying, with liquidity gradually improving. If trading volume exceeds the 20-day average in upcoming sessions, the index’s outlook will become more positive.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Testing the Middle Line of Bollinger Bands

The VN-Index paused its upward trend, testing the Middle line of the Bollinger Bands. This support level is crucial for maintaining short-term recovery momentum.

The Stochastic Oscillator and MACD indicators continue to signal buying, with liquidity gradually improving. If trading volume exceeds the 20-day average in upcoming sessions, the index’s outlook will become more positive.

HNX-Index – Testing the August 2025 Low

The HNX-Index continued to adjust, testing the August 2025 low (around 265-268 points).

Currently, the Stochastic Oscillator remains upward after signaling a buy. If the index can accumulate above the Middle line of the Bollinger Bands in the coming sessions, recovery potential remains.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) may increase.

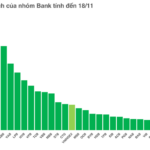

Foreign Investor Flow: Foreign investors continued to net sell in the November 19, 2025 session. If foreign investors maintain this action in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS ON NOVEMBER 19, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:22 November 19, 2025

Foreign Investors Continue Net Selling Over 700 Billion VND in Session 19/11, Blue-Chip Stocks Hit Hard by Heavy Selling

Foreign investors continued their net selling streak across all three exchanges, marking another session of net outflows.

How Record-Breaking Stock Markets Have Fueled Bank Performance

The third quarter of 2025 marks a historic milestone as the VN-Index surpasses its peak, with the banking sector playing an irreplaceable leading role. Interestingly, the vibrant stock market has also delivered a powerful boost to the business operations of banks, particularly those owning securities companies.

Bond and Deposit Certificate Strategies Dominate Brokerage Proprietary Trading

Most leading securities firms with substantial proprietary trading portfolios tend to favor holding safe, fixed-income assets such as certificates of deposit and bonds.